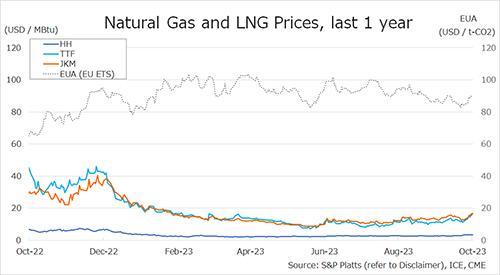

Domestic natural gas prices shot up nearly 4%, easily breaking through the $7 barrier once again. Similarly, international prices also surged; the TTF is currently noted to be trading at $34, 6% higher than its close yesterday.

While Russia’s decision to close off flows to Poland and Bulgaria certainly tightens European markets somewhat, Europe will be able to source gas through existing LNG terminals, and given that it is currently the shoulder season, Europe no longer needs large quantities of gas to use in the near term. Instead, their focus will be primarily to prepare storage for winter next year.

While domestic prices may have been pulled up slightly alongside European ones, other reasons also exist for the Henry Hub’s venture upwards today.

Production weakness continues to persist, with daily domestic volumes falling once again. On the demand side of the market, domestic weather forecasts strengthened and the latest models have added a marginal degree of cold.

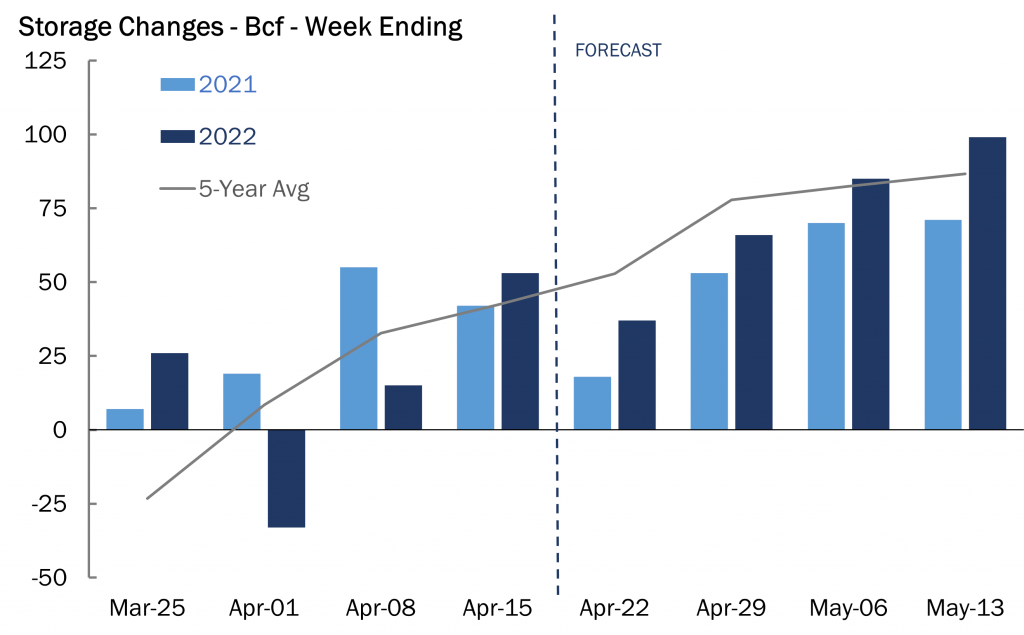

Tomorrow’s storage report is forecasted to come in at 37 Bcf, nearly 16 Bcf below the five-year average. Storage injections will continue to under perform the five-year average through the remainder of April, contributing to the widening deficit between 2022 storage and the five-year average and adding upward pressure on price in the extreme near term.

It should also be noted that today is the last day of trading for the May contract; the morning market indicates that today’s move will likely be to the upside. With lower trading volumes and high volatility, the May contract will not need much push to rise even higher before its settle in the afternoon.

Source: Gelber and Associates