After the hefty gains of September, gas benchmarks continued their bull ride in October, climbing to above last year’s price levels.

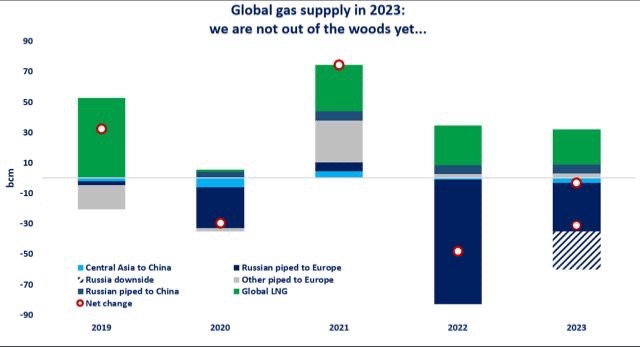

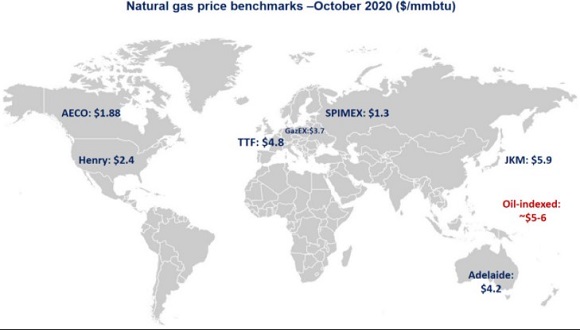

In Europe, TTF was up by 40% year-on-year, averaging at 4.8/mmbtu as demand continued to recover (+3%), whilst LNG imports plummeted by over 25% yoy.

In Asia, JKM closed the month at $7/mmbtu, about 12% above last year’s, amidst a particularly strong buying interest from China (32% yoy), India (28%) and Korea (27%). This also means, that spot prices are now trading above oil-indexed LNG prices, estimated to be in a range of $5-6/mmbtu.

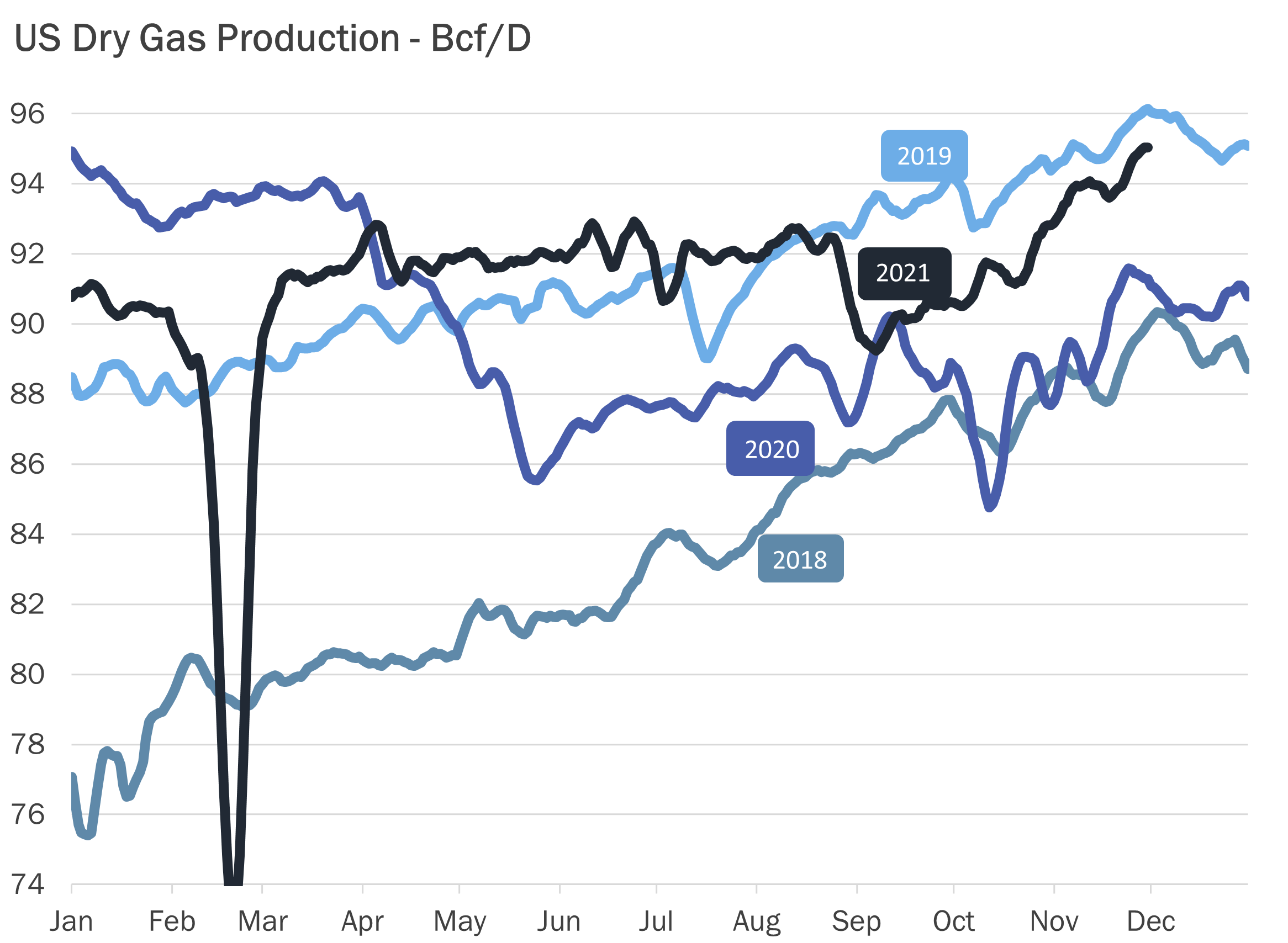

In the US, Henry Hub was up by 25% month-on-month amidst steep decline in domestic production (-8% yoy), stable demand and rapidly recovering LNG exports (+25 yoy).

What is your view? Will the bull ride continue, or we are reaching our limits here? Could European lockdowns will put a cap? How will Asian demand evolve this winter? Could La Niña push further prices?

Source: Greg Molnar

See original post by Greg on LinkedIn.