The globalisation of gas markets: global LNG trade more than quadrupled since the beginning of the century. This strong quantitative growth was accompanied by a qualitative transformation: the growing interconnectivity of regional gas markets.

LNG trade has become increasingly flexible through the last two decades, underpinned by destination-free LNG contracts and the growing share of spot LNG, which increased from just around 10% in the early 2000s to around 35-40% in the last few years.

Meanwhile, the role of oil-indexation has been gradually eroding, falling from over 80% at the beginning of the century to just around 50% of global LNG trade last year, and leaving more place to hub-indexation and more complex, hybrid pricing formulae.

These changes mean that LNG trade flows are becoming increasingly responsive to regional price dynamics and sensitive to price spreads.

Meanwhile, regional markets are becoming increasingly inter-linked with flexible LNG, meaning that one region’s supply-demand dynamics can transpire to other regions and influence their price developments.

The best example of this growing interconnectivity is correlation between TTF and JKM prices which rose from 60% in the 2010s to over 90% since 2020.

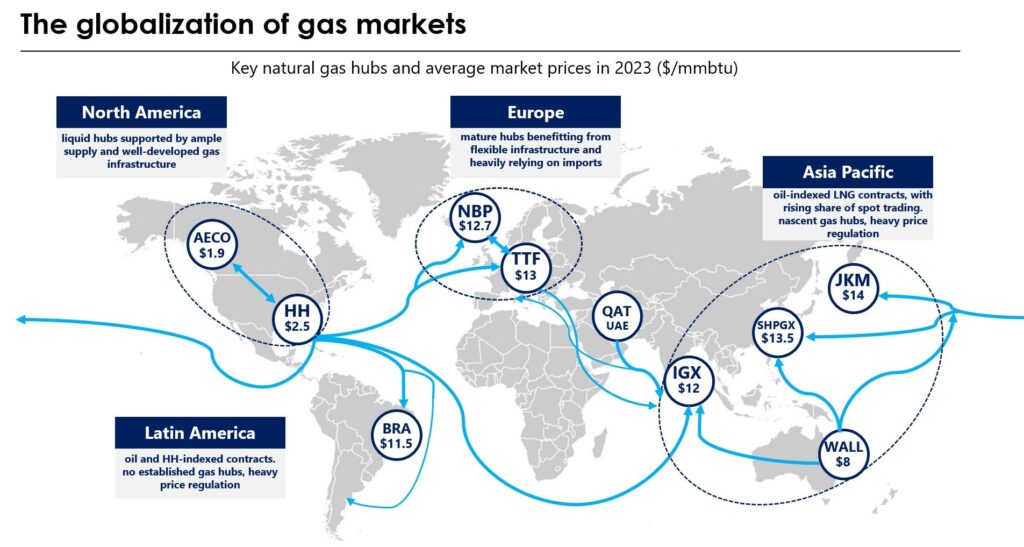

Of course, natural gas markets are by definition regional. Each region has its own particular supply-demand fundamentals, different regulatory frameworks and ultimately they are all at a different stage of market and hub development.

In North America we have liquid hubs, with over 50 pricing points supported by ample supply. In Europe, TTF gained maturity, benefitting from a highly flexible gas infrastructure. And in the Asia Pacific region, we see a rising share of spot trading and nascent gas hubs, although oil-indexation remain dominant.

We don’t have a global gas market, but the globalisation of regional markets is well on its way and seems to be unstoppable. The next LNG megawave, fuelled by Qatar and the United States is expected to deepen the liquidity and the flexibility of the global LNG market.

Source: Greg Molnar