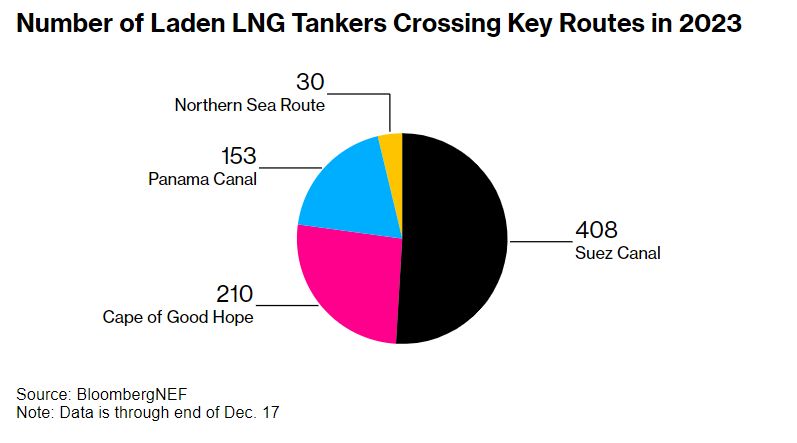

In 2023, 8% of global LNG exports were delivered via the Suez Canal and 2.5% via the Panama Canal. The disruption of these “chokepoints” affects just over 10% of global LNG trade, but does not prevent navigation between the Atlantic and Pacific basins.

After accounting for diversions, rerouting of cargoes via longer routes, and the consequent reduction in LNG transport capacity, the global LNG supply (which was 400 million tons in 2023) could decrease by 5.4 million tons (1.35%) year-on-year. This reduction drops to 0.9% when considering new supplies from West Africa, which will increase in the second half of 2024.

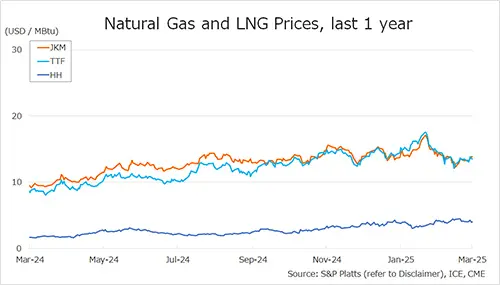

This minor reduction in global supply is relatively limited compared to fluctuations in global LNG demand and could explain the limited reaction of benchmark LNG prices in Europe and Asia.

Indeed, the global LNG market has become more fragile than before, with price increases more likely in case of changes in the supply-demand balance. To date, this fragmentation is a reality. Qatari LNG is now primarily destined for Asia, while Russian LNG is destined for Europe. American LNG is shipped to both locations, but some forecasters now warn that a supply disruption anywhere would affect the market more severely than before February.

Ships are forced to navigate around Africa to transport fuel between the Atlantic and Pacific basins, leaving buyers with a limited pool of suppliers unless they are willing to pay higher transportation fees. The result is an increasingly fragmented global LNG market.

Longer routes involve higher transportation costs and a lower volume of LNG that can be delivered by each ship over a given period.

These increased operational costs represent an “inter-basin LNG transport premium” that will be borne by exporters. These additional costs will only be recovered through higher sales prices if the disruption leads to increased LNG import prices in Europe and Asia.

These efforts will likely intensify as fuel demand rises approaching next winter, when transportation costs generally also increase.

This fragmentation will make it more difficult to divert supply between regions in the event of a breakdown at an export facility or a sudden increase in demand. This could lead to higher prices or a widening of the spread between Europe and Asia.

The simultaneous reduction in LNG transport via the Panama Canal and the Red Sea could test the extent of this flexibility, but current ship rental rates and price indices suggest that the challenge is being met.

It appears, then, that the LNG market will remain in its current fragmented, or perhaps segmented, state at least for a few more months or even more should the Israel-Hamas war extend beyond 2024. Yet supply security may become a bit more challenging for key import markets. In this situation, all it would take to disrupt the market would be a production outage of the sort that appears to be quite frequent in large LNG projects.

Source: Vincent Barret