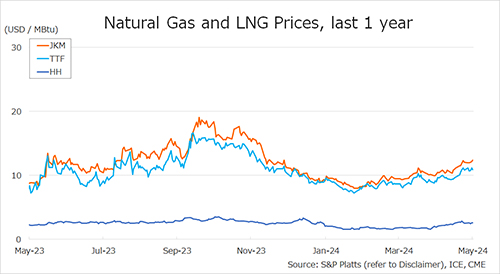

The Northeast Asian assessed spot LNG price JKM for last week (27 May – 31 May) increased to low-USD 12s on 24 May from mid-USD 12s the previous weekend (24 May). The price continued its upward trend due to increased demand in Asia for the summer season and increased electricity demand due to the heat wave in India, as well as continued supply uncertainties such as troubles at Gorgon PJ.

METI announced on 29 May that Japan’s LNG inventories for power generation as of 26 May stood at 2.06 million tonnes, down 0.20 million tonnes from the previous week.

The European gas price TTF for last week almost unchanged at USD 10.9/MBtu on 31 May from USD 10.8/MBtu the previous weekend (24 May).

The price rose to low-USD 11s on 27 May due to high demand in the Asian region, but finally settled in high-USD 10s due to the end of maintenance on gas production facilities in Norway and steady wind power in France and Germany.

According to AGSI+, the EU-wide underground gas storage increased to 70.0% as of 31 May from 68.2% the previous weekend.

The U.S. gas price HH for this week slightly increased to USD 2.6/MBtu on 31 May from USD 2.5/MBtu the previous weekend. The EIA Weekly Natural Gas Storage Report released on 30 May showed U.S. natural gas inventories as of 24 May at 2,795 Bcf, up 84 Bcf from the previous week, up 15.7% from the same period last year, and 26.5% increase over the five-year average.

The contract month for TTF and HH switched from June to July on May 31.

Updated: June 3

Source: JOGMEC