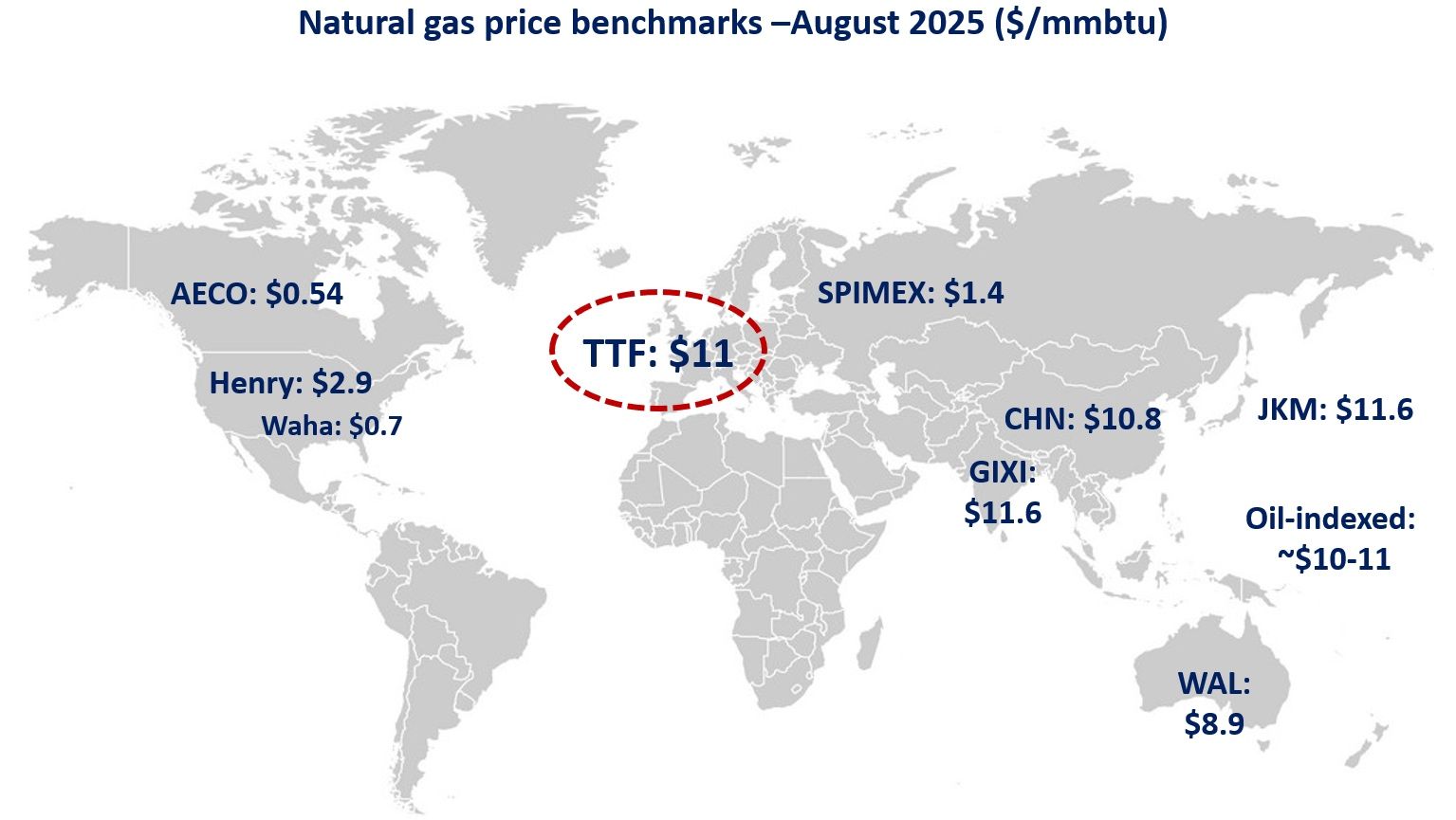

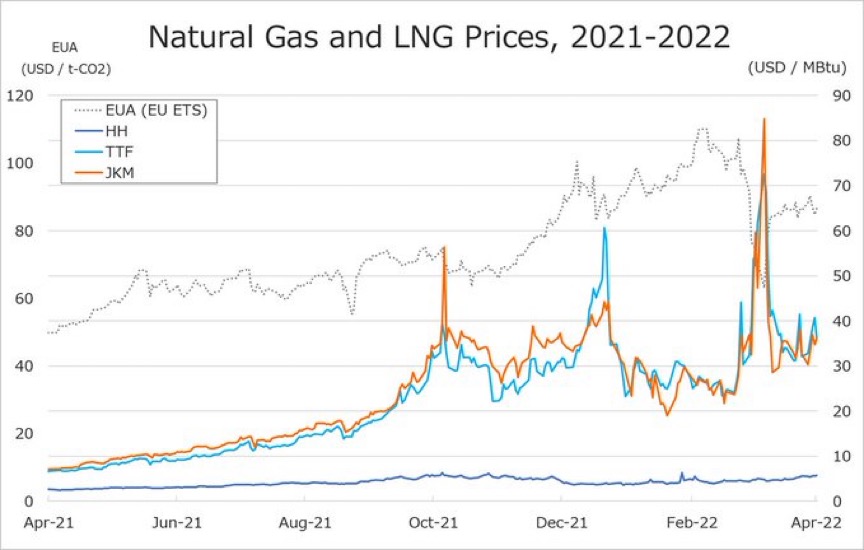

The Northeast Asian assessed spot LNG price JKM (November delivery) for last week (23 September – 4 October) was almost unchanged at low-USD 13s on 4 October from low-USD 13s the previous weekend (27 September).

The previous week, the price fell to high-USD 12s on Thursday due to weak buying interest in the Asian region as China did not participate in the market due to the National holidays and sufficient supply, but prices rose on 4 October due to concerns that Israel would target Iran’s energy infrastructure in retaliation for Iranian missile attacks, and the price returned to the low-USD 13s.

METI announced on 2 October that Japan’s LNG inventories for power generation as of 29 September stood at 1.99 million tonnes, up 0.36 million tonnes from the previous week.

The European gas price TTF for last week (30 September – 4 October) rose to USD 13.3/MBtu (November delivery) on 4 October from USD 12.5/MBtu (October delivery) the previous weekend (27 September). TTF rose, particularly in the second half of the week, to low-USD 13s, influenced by heightened geopolitical tensions, despite settled maintenance at the Norwegian gas field and strong fundamentals.

The delivery month changed to November on 30 September. According to AGSI+, the EU-wide underground gas storage increased to 94.4% as of 4 October from 94.1% the previous weekend.

The U.S. gas price HH for last week (27 September – 4 October) was almost unchanged at USD 2.9/MBtu (November delivery) on 4 October from USD 2.9/MBtu the previous weekend (27 September).

The EIA Weekly Natural Gas Storage Report released on 3 October showed U.S. natural gas inventories as of 27 September at 3,547 Bcf, up 55 Bcf from the previous week, up 3.7% from the same period last year, and 5.7% increase over the five-year average.

Updated: Octoberber 7

Source: JOGMEC