New analysis by Timera Energy explores how rising US gas price volatility is reshaping LNG portfolio value and risk as global LNG markets move into a new phase of price convergence.

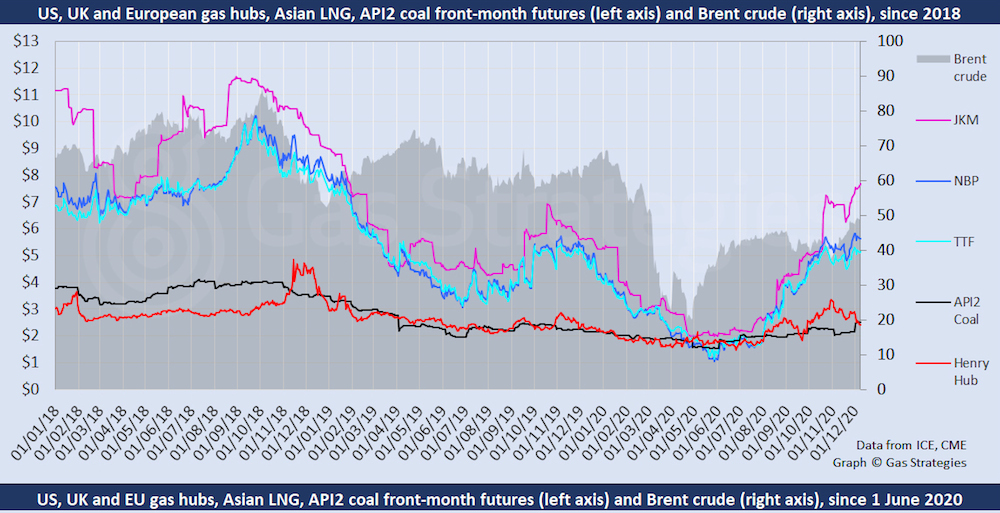

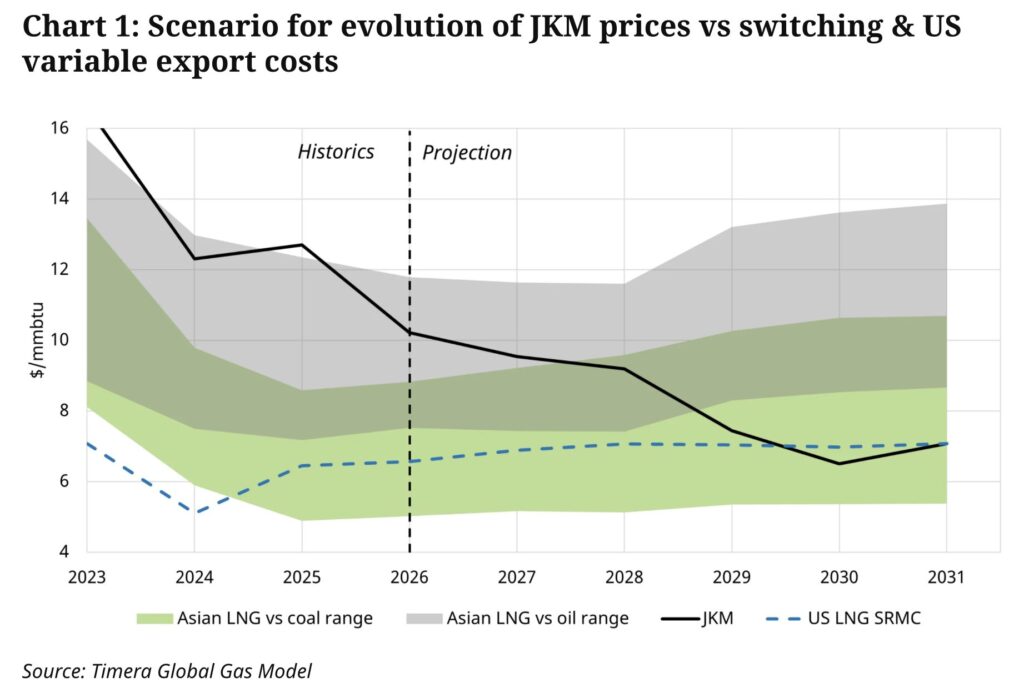

The report argues that the rapid expansion of US LNG export capacity through 2026–2030 will increasingly link Henry Hub dynamics with global LNG benchmarks such as JKM and TTF, reducing the structural separation that has historically insulated international prices from US gas volatility.

Using stochastic modelling, Timera shows that price volatility — rather than average price levels — is becoming the dominant driver of LNG portfolio value.

As global prices converge, volatility in the US gas market is increasingly transmitted into Asian and European markets, raising expected LNG prices while also widening the distribution of potential outcomes.

This asymmetric response means traditional deterministic modelling approaches risk understating both portfolio risk and the value of flexible LNG assets.

The analysis also highlights growing commercial challenges for US LNG export contracts, where margin variability driven by Henry Hub volatility coincides with longer-term margin compression as global prices converge toward US variable export costs.

As a result, active risk management, portfolio optionality and benchmark exposure are becoming central to LNG value creation.

To view the full analysis and underlying modelling, read the full article on the Timera Energy website.