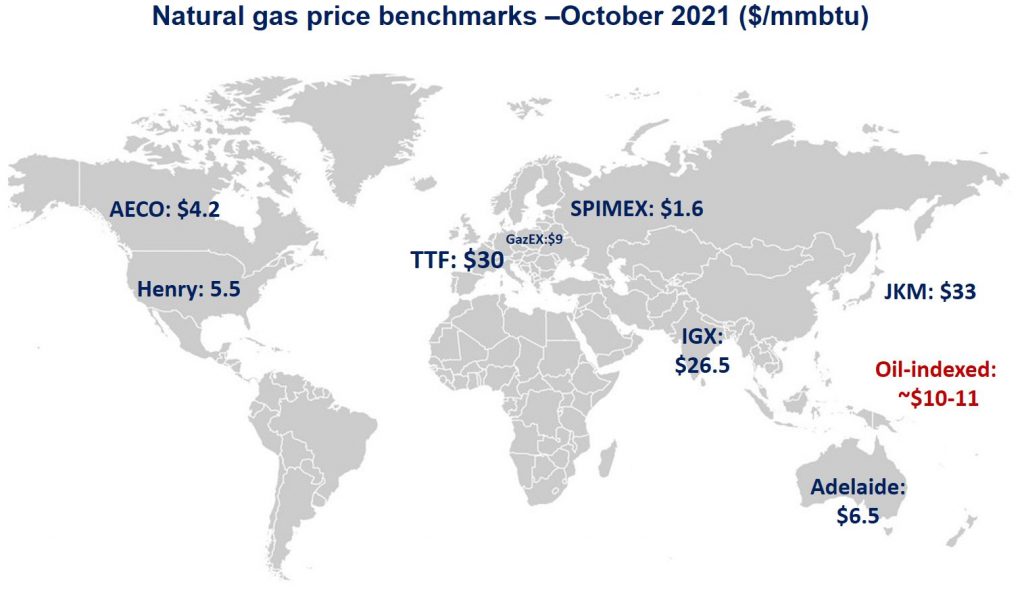

Play hard, party hard: gas benchmarks embarked on a wild volatility ride this October, hitting all-time highs both in Europe and Asia.

In Europe, TTF prices exploded hitting an historic intra-day high of $54/mmbtu in the beginning of the month, while averaging at $30/mmbtu over the month -up by 40% compared to its September levels.

This has been largely driven by two factors: (1) Russia’s pipeline flows to the EU plummeting by 25% yoy; (2) decade low storage levels: standing at 77% vs 90% ten-year average.

In Asia, JKM prices average at a record of $33/mmbtu, driven up by strong competition from Europe and supported by China’s buying spree (up by 10%, mainly on restocking demand). This higher spot environment is well reflected in India’s IGX standing at $23/mmbtu.

Meanwhile, oil-indexed LNG prices are moving into a range of $10-11/mmbtu -less than a third of spot prices.

In the US, Henry averaged at $5.5/mmbtu, its highest October price level since 2008. Strong storage injection demand, together with a surge in LNG exports (up by 43% yoy) supported the benchmark. Canada’s AECO climbed above the $4/mmbtu mark for the first time since 2014 -largely driven by higher pipeline exports to the US, up by 40% yoy.

What is your view? Markets seem to have somewhat calmed down compared the first weeks of October… but the deep gas winter hasn’t started yet, pipelines are complicated and storage is low, so we might still have some surprises…

Greg MOLNAR (LinkedIn)