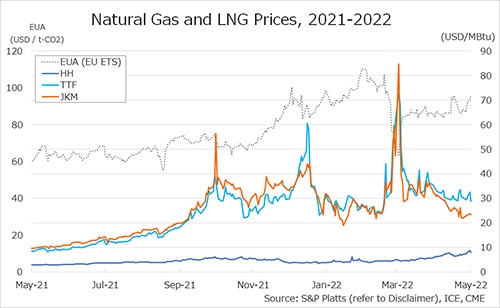

Henry Hub gas prices surged sharply during late January as Storm Fern drove extreme cold across the United States, triggering widespread freeze-offs, record local price spikes and a sharp rise in gas-fired power demand.

US local gas prices surged to their highest level since Storm Uri, shooting up to triple digits in the Northeast amid the violent coldblast brought by Storm Fern.

Freezing temperatures together with slower wind speeds boosted US gas demand by around 30% since mid-Jan. Gas use in the residential and commercial sectors surged by a whopping 30%, driven by higher space heating requirements.

In addition, wind power generation plummeted by around 30% since mid-Jan, further boosting gas burn in the power sector by almost 35%. This highlights once again the critical role of flexible gas-fired power plants in providing back-up, including during extreme weather events.

And of course, sub-zero temperatures brought back freeze-offs, with more than 15% of US dry gas production out of operation. Estimated dry gas output in the Permian was down by almost 40%, with further downside risk persisting in Appalachia.

Meanwhile, US LNG feedgas flows were also heavily impacted, down by 40% between 22–26 Jan, although first data suggests that recovery is already under way.

Most local gas hub prices reached their highest level on Monday, while Henry Hub prices surged to an all-time high of over $30/mmbtu last week.

Prices are now gradually retreating, although further short-term volatility can’t be excluded.

A key development to watch will be the weekly storage reports, which are likely to show near-record storage draws for the current week.

Lower inventory levels would translate into higher injection needs over the summer and hence support summer 2026 contracts, as most likely more gas production will be needed, including from the more pricey plays of Haynesville.

What is your view? What could be the impact of Storm Fern on the US balance this year? How do you see freeze-offs playing out?

Source: Greg MOLNAR