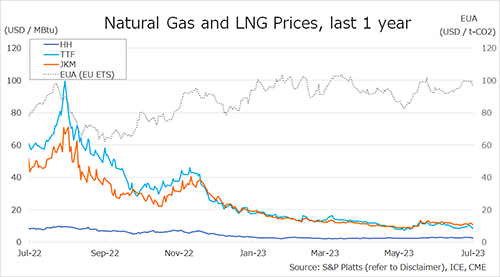

Queensland gas prices moved to over $15/GJ in April and have spiked in May, to over $30/GJ. Wholesale electricity prices have reached stratospheric levels.

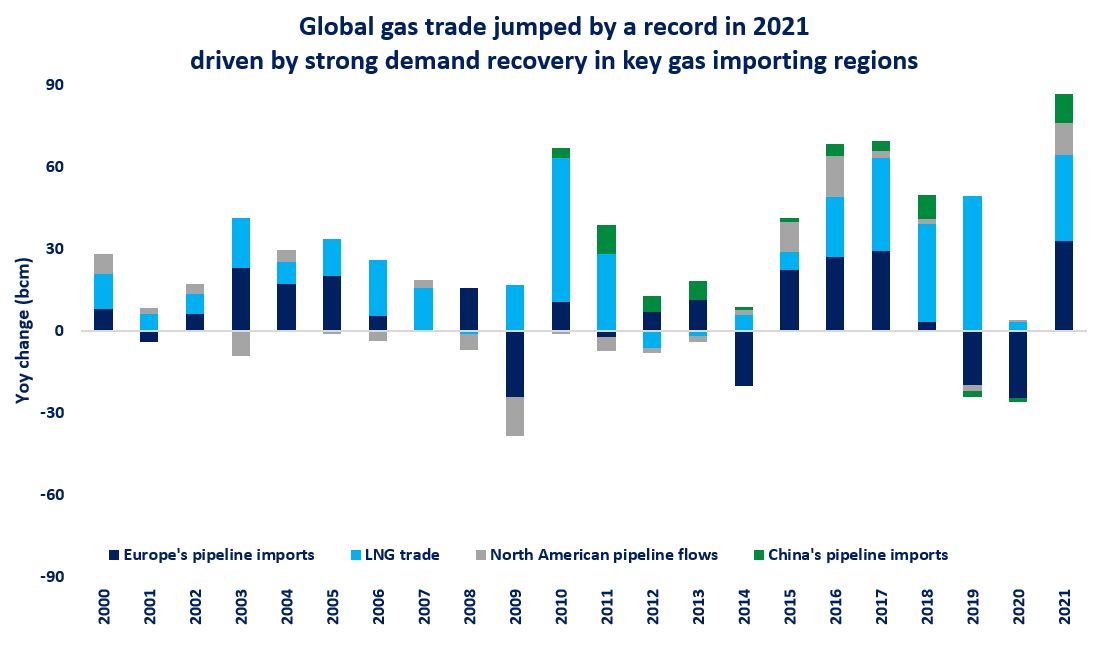

The report outlines some of the demand and supply factors behind these spikes. For gas there is continuing strong demand for LNG at high international prices (strengthened further by the fall in the A$).

For electricity, coal-fired generation and renewables were well down in April, meaning gas had to step up to fill the gap, even though overall power demand was seasonally down compared with March.

We also have short pieces on North Asian Russian LNG imports, the current ranking of LNG producing countries and comments on Woodside’s long stranded Browse and Sunrise LNG projects.

Some of the other highlights of the report are:

In April Australian projects shipped 6.38 million tonnes (Mt) (92 cargoes), slightly less than the 6.41 Mt (94 cargoes) in March, accounted for by the slightly shorter month.

EnergyQuest estimates that Australian LNG export revenue decreased slightly in April to $5.52 billion, down from $6.02 billion in March but up by 95% on April 2021.

Compared with March, Australian projects delivered 3 additional cargoes to China in March, but 15 fewer cargoes to Korea and Japan. There were no cargoes delivered to Europe.

West Coast shipments decreased to 4.3 Mt in April (4.6 Mt in March), with 61 cargoes in April compared to 66 in March. West coast projects operated at 84% of nameplate capacity during April.

East coast shipments increased to 2.1 Mt in April (1.8 Mt in March), with 31 cargoes compared to 28 in March, and 31 cargoes of 2.1 Mt a year ago. The east coast projects operated at 96% of nameplate capacity during April.

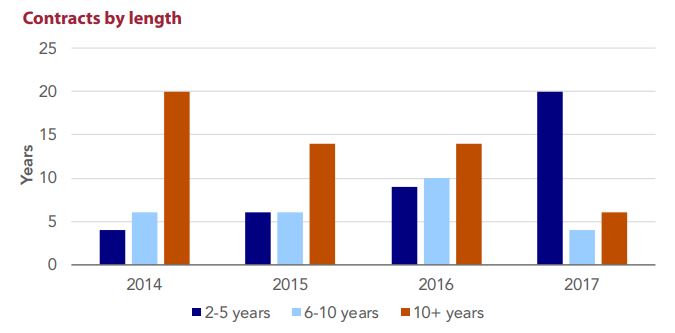

Notwithstanding high LNG spot prices there were only two spot cargoes reported for shipping from Australian projects in April, one spot cargo from the east coast and one spot cargo from the west coast (2% of total shipments). There were three spot cargoes in March.

Source : EnergyQuest