Europe’s October LNG imports have recovered to the level not seen since May. US plants accounted for most of the increase, with a twofold rise in their loadings to the European terminals compared to the previous month. However, the inflows from the US could have been even greater if spot cargoes had not been in such strong demand from Brazil.

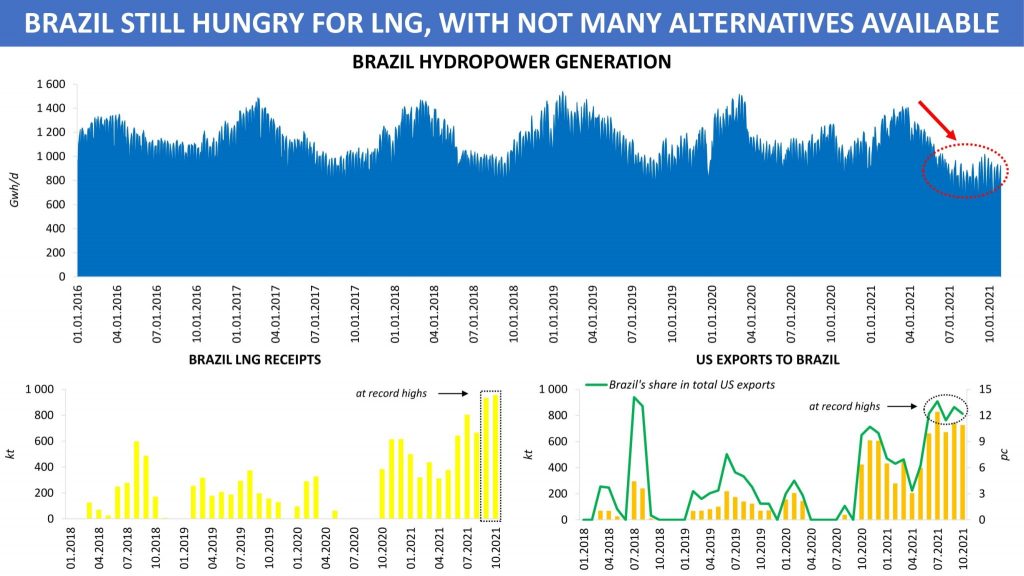

While other major Latin American buyers – Argentina and Chile – substantially restricted LNG imports in recent months, Brazil did not only reduce its purchases of liquefied gas but received a record number of deliveries in late Q3 and early Q4. In September, more than 900 kt were delivered to the country’s terminals, an increase of 40pc over the figure for August. Later in October, LNG imports has showed no signs of slowing down, with Petrobras bringing in 950 kt, according to #Kpler. The total volume supplied in these two months is 65pc higher than in the period from January to October 2020.

Much has been said about the reason for this year’s unprecedentedly high appetite for LNG in Brazil. To feel the full impact that Brazil’s worst drought of the past century has had on the national energy system, you should learn just two facts. First is that Brazilian hydropower facilities produced on average 850 GWh/d between June and October 2021 versus 1000 GWh/d in the same period in 2016-2020. Second, hydropower makes up more than 70pc of the country’s electricity mix, as compared to around 30pc for Argentina and Chile.

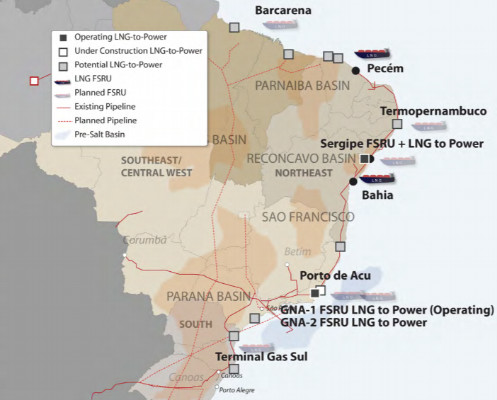

Amid rainfall shortages, it is LNG that has become the first and primary substitute for Brazil’s hydroelectric power. The lion’s share of cargoes arrive into the country’s ports from the Gulf Coast, given low transportation costs and the lack of long-term agreements between Petrobras and LNG producers/suppliers from outside the region. If in the second half of 2021, US LNG imports to Brazil had stood at the same level as in the period from June to October 2019, adjusted for the volumes arrived at the recently launched terminal in the Port of Acu, this would have freed up spot cargoes of some 800 kt. These volumes would have been a nice addition to any region, let alone Europe.

This winter, players active in the European market should carefully track weather forecasts not only for Europe itself and Asia-Pacific, but also for Latin America.

Source: Yakov Grabar