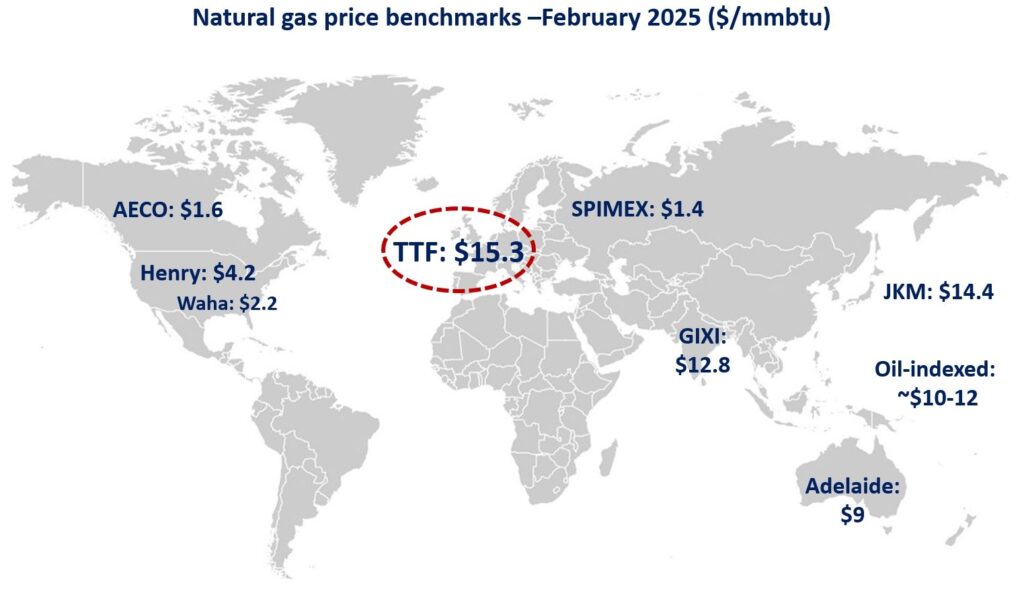

In Europe, TTF month-ahead prices rose 90% yoy to an average of $15/mmbtu -their highest monthly level since Feb23. European gas demand was up by 20% compared to last year, with low wind speeds boosting gas-fired powgen by 60% and colder temperatures drivinb up space heating demand by over 15%.

Meanwhile Russian and Norwegian piped flows stood well-below last year’s levels and gas storage levels dropped to below 40% -standing 25 bcm lower than last year.

In Asia, JKM prices grew by 60% yoy to an average of $14.5/mmbtu -standing at a discount of $0.9/mmbtu compared to TTF.

This allowed for stronger LNG flows to Europe, which surged by almost 20% yoy. in contrast, China’s LNG imports dropped by near 20% yoy amid weaker domestic demand, stronger Russian piped gas and relatively healthy storage levels.

In the US, Henry Hub prices more than doubled compared their Feb24 levels and averaged at $4.2/mmbtu. cold weather boosted space heating demand by more than 20%, while gas-fired powgen was up by around 6%.

Meanwhile, domestic production is still trending somewhat below its 2024 levels (due to earlier production cuts, which take time to recover).

Source: Greg MOLNAR