The beginning of 2023 has shown some reversal in LNG import trends seen last year.

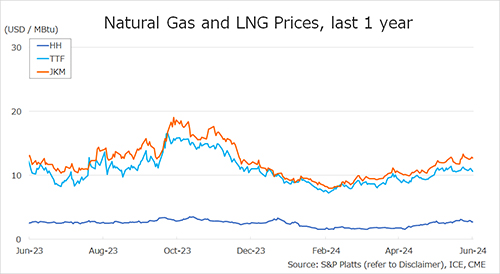

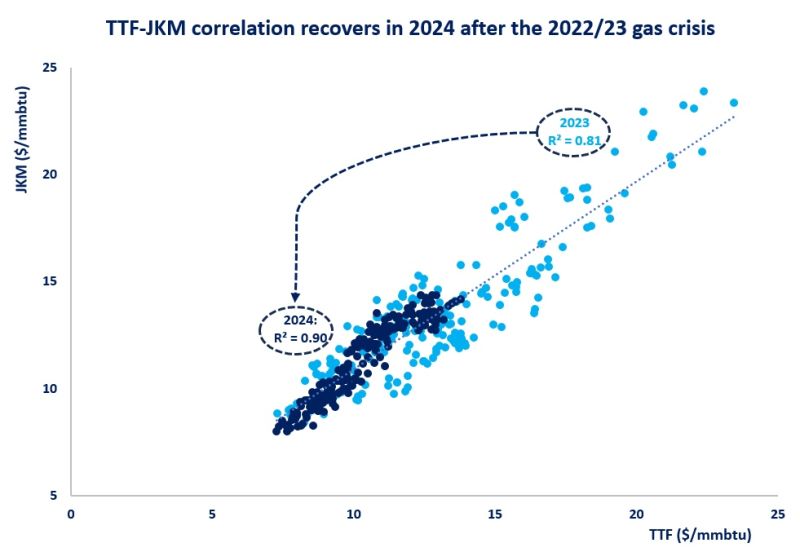

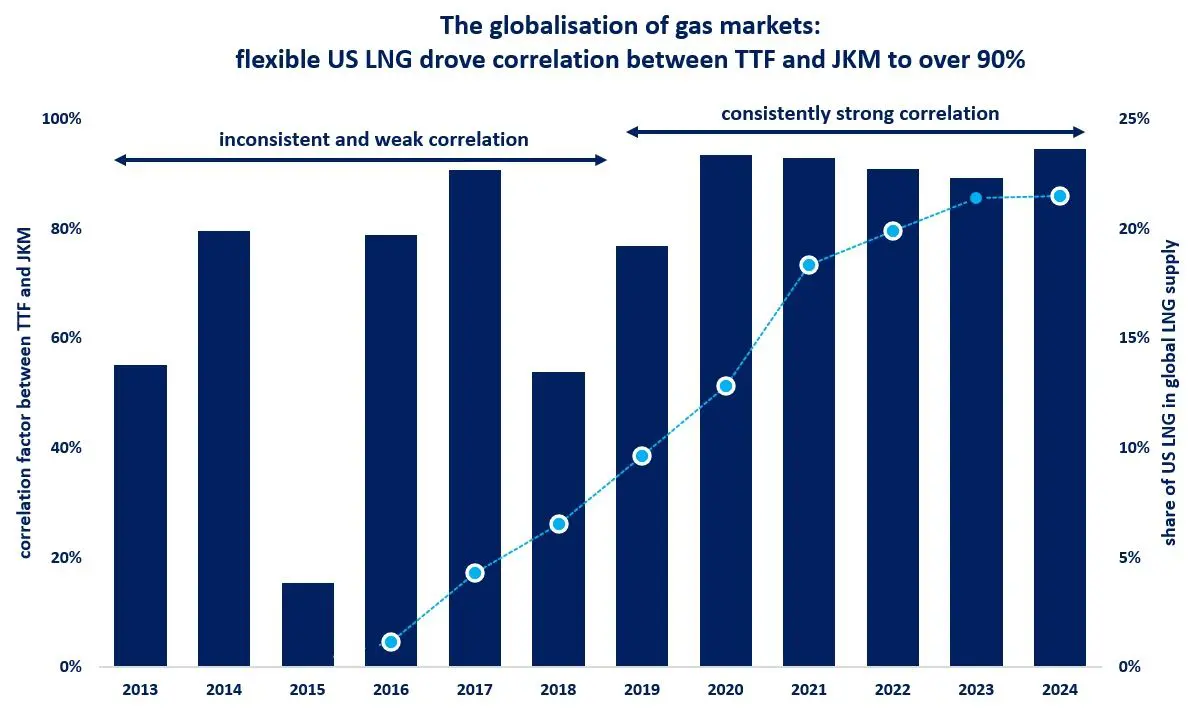

Weakness in European gas markets has led the Mar-23 JKM (Asian LNG benchmark) futures price down 34% since the start of the year (closing January at just over $19/mmbtu), following but to a lesser extent the downtrend in TTF.

Source: Timera Energy

JKM is now back trading flat to TTF in Q2 (e.g. from a 8.5 $/mmbtu discount in late Nov 2022), indicating increased competition for LNG to come between the European and Asian markets.

European LNG imports dropped 9% month-on-month this January versus December as European demand remains muted around economic demand reductions, mild winter temperatures and high gas inventory levels.

However, European LNG imports were still up 11% year-on-year in January 2023 given 4.9 bcm less Russian gas vs Jan 2022 levels.

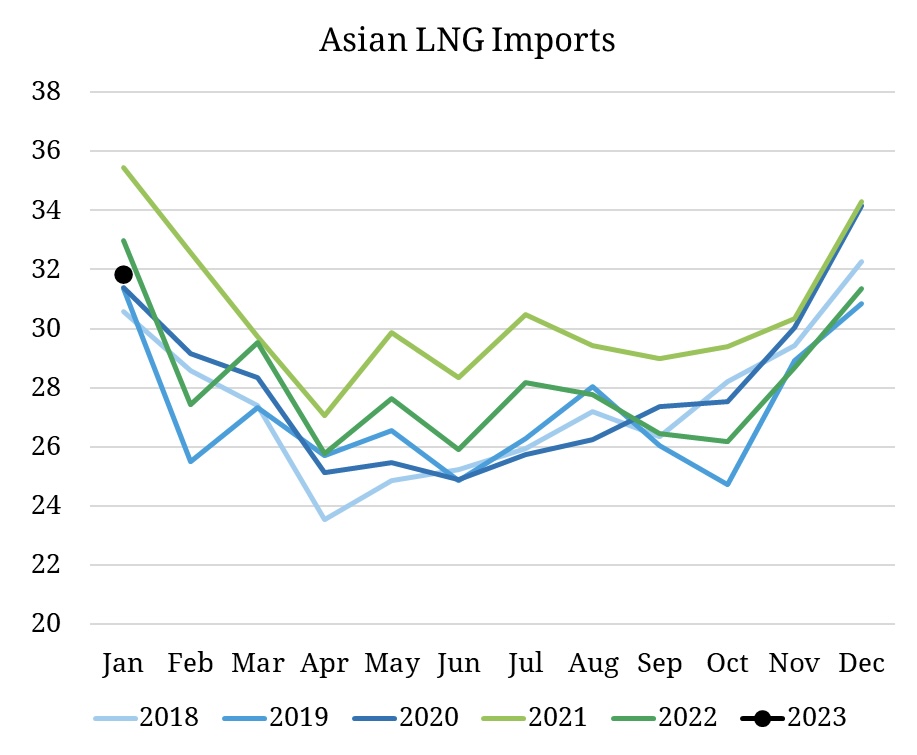

Asian LNG imports are on the rise meanwhile, reaching their highest level for a year in January 2023.

LNG flows into Asia increased by 0.5 bcm month-on-month, although this has not fully offset a monthly decline of 1.7 bcm in European imports.

Prompt JKM prices are at their lowest level since 2021, bringing back Asian buying interest.

The increase in Asian LNG imports has mostly been driven by more traditional LNG importers Japan and South Korea, collectively adding 1 bcm of imports month-on-month this January.

Declining Asian LNG prices has the potential to bring back price-sensitive buyers in South Asia (e.g. Bangladesh heard returning to the spot market for the first time since last July).

The wildcard of Chinese imports actually declined by over 1 bcm month-on-month, and remain 1.5 bcm below year-ago levels due to the lingering demand impact of its previous zero-COVID policy.

However, imports may well increase following the exit from zero-COVID, as Chinese buyers take contracted volumes seen being resold into the spot market last year.

Source: Timera Energy