The Northeast Asian assessed spot LNG price JKM for the previous week (10-14 October) dropped to USD 27/MBtu on 10 October from USD 28/MBtu the previous week, as winter procurement in Japan, China and Korea was almost complete and inventory levels seemed adequate.

It then rose to USD 30/MBtu on 11 October due to supply concerns in Malaysia and demand from East Asian importers. It fell to USD 29/MBtu on 12 October amid modest demand in Northeast Asia, but rose to USD 30/Mbtu on 13 October.

On 14 October, it fell again to USD 29/MBtu due to declining demand for prompt cargoes in Northeast Asia. Meanwhile, according to a 12 October METI release, LNG inventories for power generation were 2.49 million tonnes as of 9 October, up 420 thousand tonnes from the end of the same month last year and up 650 thousand tonnes from the average of the past five years, showing steady growth.

The European gas price TTF fell from USD 45.8/MBtu the previous week to USD 44.7/MBtu on 11 October as underground gas storage in Europe exceeded 90% for the first time in two years.

TTF then rose to USD 45.6/MBtu on 12 October but fell to USD 41.6/MBtu on 14 October due to firm underground storage, tight regasification capacities, and declining demand. The German energy regulator announced on 13 October that gas consumption in Germany from 3 to 9 October was down 15% from the previous week and down 30% from the average weekly demand from 2018 to 2021.

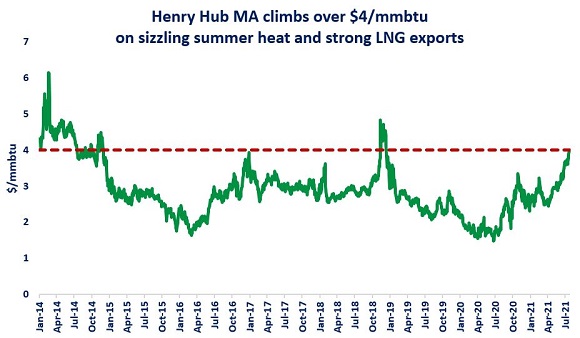

The U.S. gas price HH fell to USD 6.4/MBtu on 10 October from USD 6.7/MBtu the previous week. The price then rose to USD 6.6/MBtu on 11 October, but dropped again to USD 6.4/Mbtu on 12 October. 13 and 14 October showed similar price movements, at USD 6.7/MBtu and USD 6.5/MBtu, respectively.

Meanwhile, according to the EIA Weekly Natural Gas Storage Report released on 13 October, natural gas underground storage on 7 October totaled 3,231 Bcf, up 125 Bcf from the previous week, but still low, down 3.8% from the same period last year and 6.4% from the average of the past five years.

Updated 17 October 2022

Source: JOGMEC