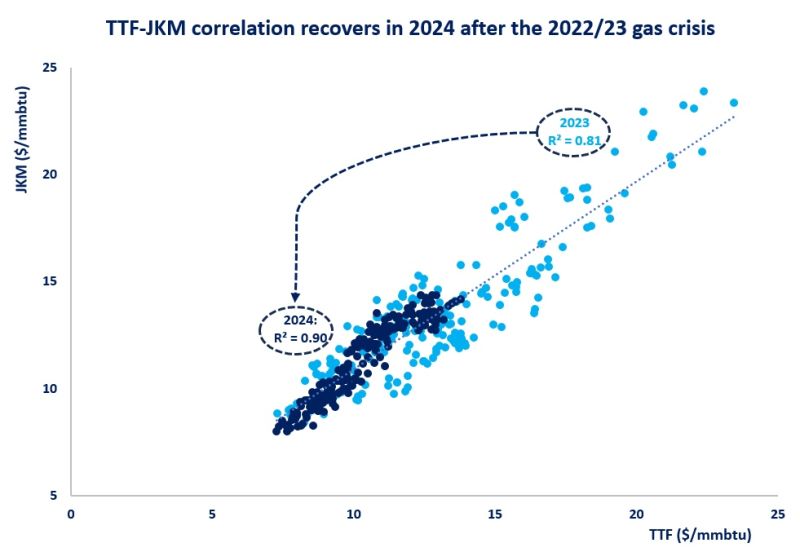

The correlation between TTF and JKM recovered in 2024, after the 2022/23 gas supply shock which temporarily distorted the interplay between Asian and European prices.

The correlation between TTF and JKM increased steadily since 2016, with the advent of flexible US LNG, which allowed for a greater interconnectivity between Asian and European gas markets. The correlation between TTF and JKM hit an all-time high of 0.9 in 2020 -exacerbated by the oversupply during the covid year.

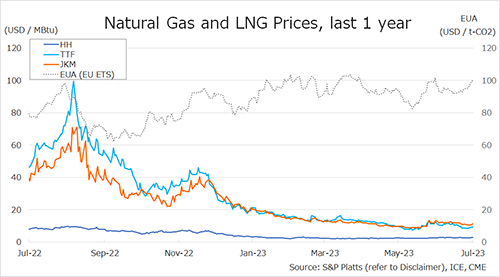

This strong interplay was somewhat distorted with the 2022/23 gas crisis, which had an asymmetric supply shock effect on the European market and fuelled unprecedented price volatility.

Consequently, the correlation between TTF and JKM prices dropped to just 0.8 in 2023 -its lowest level since 2019.

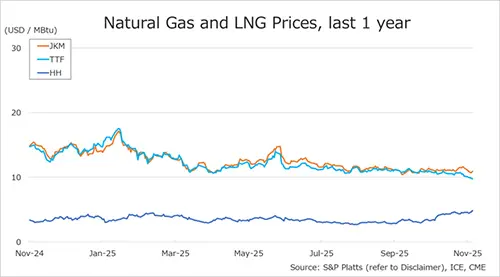

The correlation between TTF and JKM recovered to 0.9 in the first 10M of 2024, close to its all-time high record in 2020. This is reflective of natural gas markets gradually rebalancing and returning to their typical modus operandi.

The strong increase in LNG carrier capacity (up by 8% yoy) and consequent collapse of spot LNG charter rates further facilitated market integration and drove up correlation.

Temporary market tightness through the upcoming winter season and in H1 2025 could eventually weaken the TTF-JKM correlation.

This being said, the strong growth in LNG liquefaction capacity (around 270 bcm/y by 2030) will further support market integration and the globalisation of gas markets.

The TTF-JKM interplay is here to stay and their correlation is likely to further increase over the medium-term.

What is your view? How will global gas market dynamics evolve in the coming years? Could a truly global gas market emerge?

Source: Greg MOLNAR