Valuing LNG contracts used to be a one-dimensional exercise. Intrinsic value was the focus. Extrinsic value from contract flexibility terms was either ignored or heavily discounted for valuation purposes. It was nice to have when it turned up, but nothing to ‘pay up’ for when signing a contract.

This focus on intrinsic value meant for years that embedded flexibility in LNG contracts worth millions of dollars, changed hands for close to nothing. This was particularly the case with large & complex long term contracts signed directly between producers and end users.

This is no longer the case. The rapid growth in mid-market trading entities over the last 3 to 5 years is driving an evolution in the pricing of LNG contract flexibility.

In this article we look at how LNG contracts are being valued, defining 5 categories of contract flexibility that drive value. We also set out a practical case study that quantifies the build-up of contract value by key flexibility terms.

LNG contract flex value is becoming much more important

As the LNG market matures, participants are taking a more structured approach to valuing supply contracts and flex terms. While this is being driven by traders, more physically focused producers & end-users are responding fast, in order to prevent giving away unnecessary value to intermediaries.

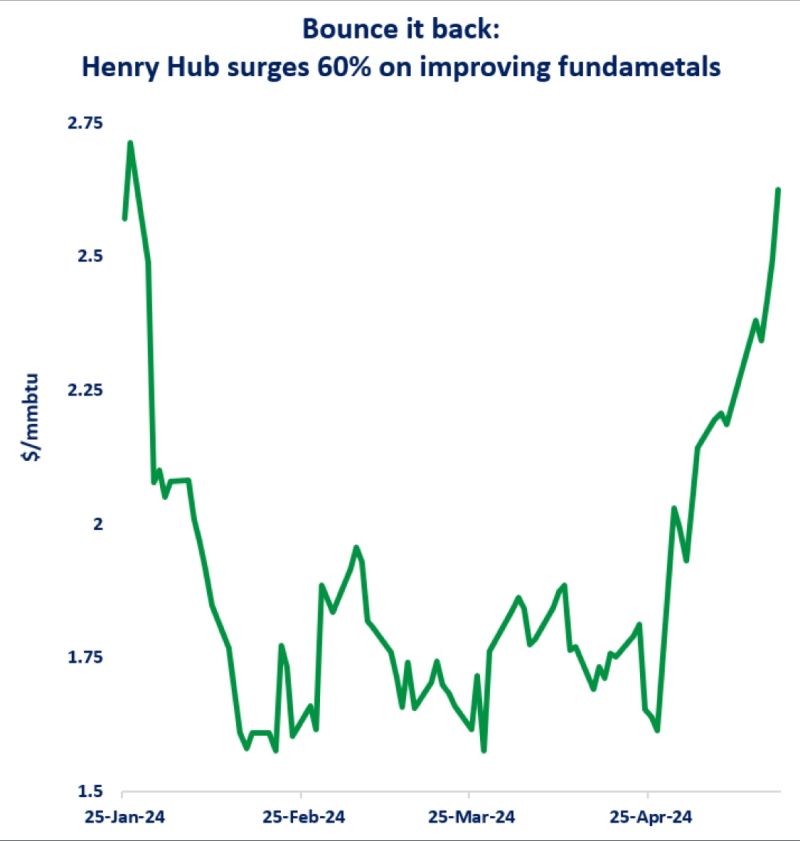

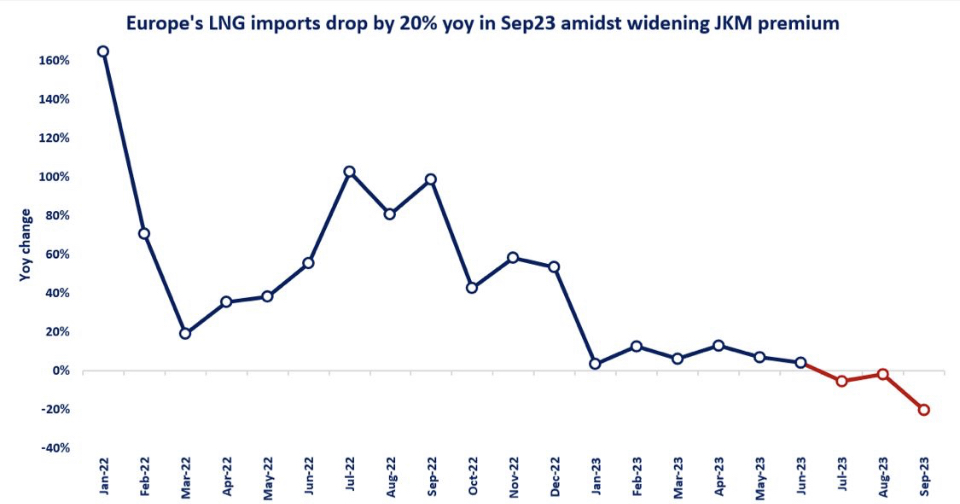

Low market prices across 2019-20 have also increased commercial focus on extracting extrinsic value, in what has been a low intrinsic margin environment.

The upshot is that valuing flexibility in LNG contracts is becoming much more important as a source of value capture and competitive advantage. It impacts for example for:

Portfolio investment decisions e.g. in monetising the value of production & midstream assets

Traders & originators e.g. in accurately pricing contracts & creating value

Risk managers e.g. in quantifying contract mark to market and measuring associated risk.

The challenge in tackling LNG contract flexibility is defining a structured & transparent approach to quantifying value.

Deconstructing LNG contract flexibility

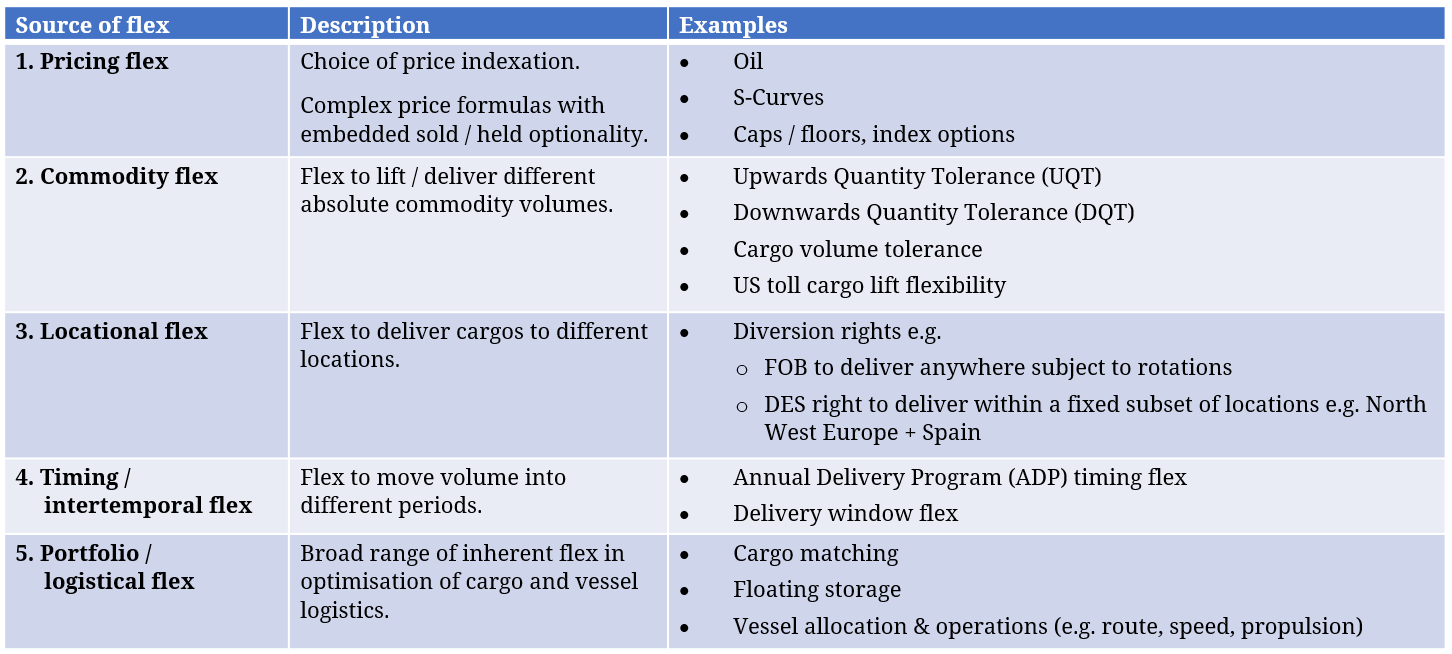

It is not straightforward deconstructing and valuing LNG contract flexibility, given the complex nature of physical supply deals. An important place to start is a structured definition of the sources of flexibility that underpin contract valuation.

In Table 1 we define 5 key types of flexibility that underpin a range of LNG contract structures.

Table 1: 5 key categories of LNG contract flexibility

An important feature of LNG contracts is that flexibility is often held by both buyer & seller and it needs to be valued accordingly. This differs from conventional gas swing contracts where flex is typically held by the buyer.

Many LNG contract terms also implicitly grant flexibility to one party. As a simple example, a Free on Board (FOB) deal grants the buyer the right to deliver the cargo to the highest priced market (subject to logistical constraints).

The best way to illustrate how these categories of flex interact in practice is to to quantify value via a case study.

To read the complete article, please visit the Timera Energy website.

Source: Timera Energy

Follow on Twitter:

[tfws username=”TimeraEnergy” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]