Australian LNG export revenue surges in 2021 but close to peak with increasing competition and a declining major gas field

Record LNG export volumes and revenue

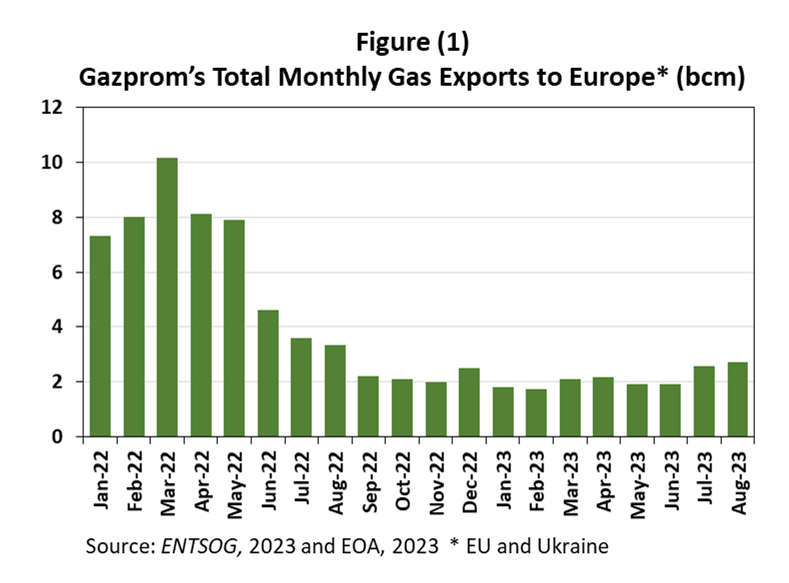

Based on shipping data, EnergyQuest estimates that Australian exports of liquefied natural

gas (LNG) reached a new record of 80.9 million tonnes (Mt) in 2021. Exports were up by

3.7% on the 78.0 Mt exported in 2020, and also higher than the 77.6 Mt exported in 2019,

before the pandemic. In the current world of supply chain and shipping challenges, the

steady increase in Australian LNG exports is a significant achievement.

Reflecting higher exports and stronger international energy prices, EnergyQuest estimates

that total 2021 LNG export revenue reached A$48 billion, up 25% from only A$36 billion in

2020. The massive increase in export revenue takes Australia back to the record level

achieved in 2019 prior to the pandemic.

Figure 1 Australian LNG exports 2017-2021

In 2021 Australia is again likely to rank as the world’s largest LNG exporter. Australia’s 10

LNG projects have total production capacity of 89 million tonnes per annum (Mtpa), the

world’s largest. The other major global producer, Qatar, which does not release timely

export statistics, currently has lower total capacity of 77 Mtpa.

However, Australia’s ranking is under threat from Qatar and also the USA. Qatar plans to

expand its capacity to 110 Mtpa by 2026. New LNG expansion in the USA, is likely to see

Australia lose its top producer ranking in 2022, according to the US Energy Information

Agency (EIA). This will be an increasing challenge for Australian LNG producers wanting to

contract new projects, or extend existing operations.

Most Australian LNG projects produced more in 2021 than in 2020. One highlight was that

the Shell-operated Prelude floating LNG project recommenced regular production from

early on the year and produced 2.2 Mt. However, it was shut-down by the National Offshore

Petroleum Safety and Environmental Management Authority (NOPSEMA) in late November

due to safety concerns.

The only LNG projects with lower production in 2021 than 2020 were the Woodside operated

North West Shelf (NWS) (down 12.0%) and the Inpex operated Ichthys project

(down 8.6%).

Lower Ichthys production was temporary but the continuing fall in NWS production due to

ageing gas fields represents another challenge for Australian exports.

Share prices ignore surging revenue.

While 2021 has seen a surge in LNG revenue, this has not been reflected in the share

prices of the three Australian companies most leveraged to LNG revenue: Woodside,

Santos and Origin Energy. Woodside’s share price on 31 December was 3.6% lower than

at the end of 2020 and the Santos share price was flat. The Origin Energy share price is up

but only by 10.1%.

Globally the 2021 share price performance for companies leveraged to LNG was much

better. The share prices of Shell and Chevron (Australia’s two largest LNG producers) were

up by over 30% in 2021 and the share price of US LNG developer Cheniere was up by

69%.

For the year the S&P 500 Energy Index was up by 48%, outperforming the S&P Clean

Energy Index which was down by 24%.

Investment in traditional energy is far from dead globally, but it appears to be in the

Australian share market.

China replaces Japan as the biggest LNG market

EnergyQuest estimates that Australian LNG projects delivered a total 80.0 Mt to customers

in 2021. China replaced Japan as Australia’s largest LNG market in 2021, with estimated

deliveries of 32 Mt, up by 7.1% on 2020.

Growing LNG sales to China reflect the rapid growth in Chinese natural gas demand as the

economy has recovered from the pandemic and also the push to reduce air pollution in

major cities.

All Australian projects except Prelude delivered LNG cargoes to China. The two biggest

suppliers to China were the Conoco Phillips/Origin Energy APLNG project and the Shell operated

QCLNG project.

LNG deliveries also grew to Korea and Taiwan. However, deliveries to Japan were down

9.3% on 2020, largely due to the expiry of Japanese contracts with the North West Shelf

and Darwin LNG.

The lost Japanese sales were effectively replaced by higher-price spot sales.

Peak Australian LNG?

It is likely that 2021 is close to the peak of Australian LNG production. The biggest threats

are not only increasing competition but also the natural decline in the gas fields feeding

existing projects and the limited number of new projects.

Two new LNG projects were announced in 2021: the Santos Barossa project to back fill

Darwin LNG and the Woodside Scarborough project. These projects are likely to produce

first LNG in 2025 and 2026 respectively. In the meantime, gas from the Bayu-Undan field

supplying Darwin LNG is expected to be exhausted by around 2023, depending on the

results of the current drilling program. At full capacity Scarborough will produce 8 Mtpa but

by the time it is in full production, production from the NWS is likely to have declined by a

similar amount.

The best-case scenario would be that these two new projects bring Australian production

back up to around current production levels. They are unlikely to take it up to new levels.

Reaching new levels would require new sources of gas to turn around the decline in the

North West Shelf, Australia’s largest LNG project.

Source: EnergyQuest