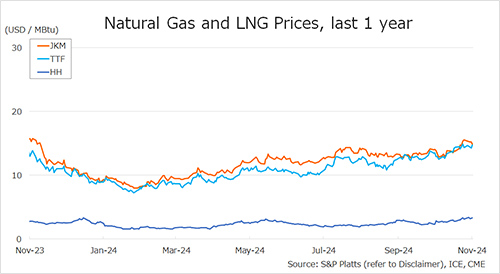

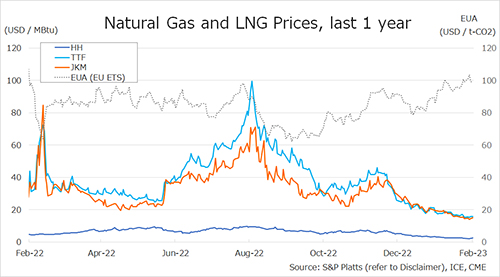

The Northeast Asian assessed spot LNG price JKM for the previous week (20 February – 24 February) rose to USD 15/MBtu on 20 February from USD 14/MBtu the previous week due to several tenders for prompt delivery cargoes issued by major Indian buyers, but fell to USD 14/MBtu on the next day due to lower purchasing interest from JKTC. JKM then rose for three consecutive business days to USD 15/MBtu on 24 February as demand for prompt delivery cargoes in South and Northeast Asia emerged.

According to METI, Japan’s LNG inventories for power generation totaled 2.63 million tonnes as of 19 February, up 0.06 million tonnes from the previous week, up 0.94 million tonnes from the end of the same month last year and up 0.65 million tonnes from the average of the past five years.

The European gas price TTF slightly rose to USD 15.5/MBtu on 20 February from USD 15.3/MBtu the previous week, despite warm weather, strong UK wind output, high gas inventories, and the resumption of US Freeport LNG operation.

TTF fell to USD 15.2/MBtu the next day, but rose for three consecutive business days to USD 15.8/MBtu on 24 February due to lower capacity at a Norwegian gas processing plant, annual maintenance at a gas field, and forecasts of below-normal temperatures across Europe over the next two weeks.

ACER published the 24 February spot LNG assessment price for delivery in Northwest Europe at EUR 44.80/MWh (equivalent to USD 13.88/MBtu), down EUR 3.08/MWh from the previous week. According to AGSI+, the average European underground gas storage rate as of 24 February was 62.67%, down from 64.28% the previous week.

The U.S. gas price HH fell to USD 2.1/MBtu on 21 February from USD 2.3/MBtu the previous week due to mild weather and limited inventory withdrawals.

HH then rose for two consecutive business days to USD 2.3/MBtu on 23 February, following an announcement by Chesapeake Energy that it would slightly reduce production in 2023. The next day, HH rose further to USD 2.5/MBtu, despite sluggish demand and stable supply.

On 21 February, Freeport LNG announced that it has received regulatory approval to resume commercial production of trains 1 and 2. According to the EIA Weekly Natural Gas Storage Report released on 23 February, the U.S. natural gas underground storage on 17 February was 2,195 Bcf, down 71 Bcf from the previous week, up 21.9% from the same period last year, and up 15.2% from the historical five-year average.

Updated 27 February 2023

Source: JOGMEC