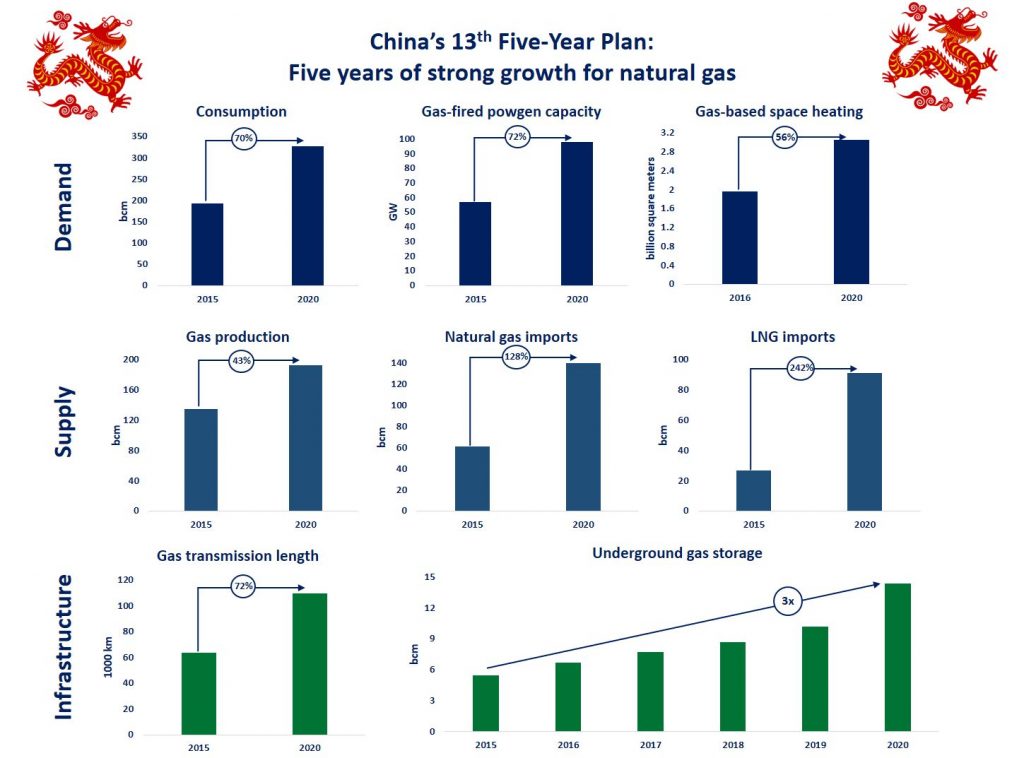

China’s 13th FYP brought an unprecedented growth to the country’s gas industry. The recently published Natural Gas Development Report gives a good overview of some of those market trends.

China’s gas consumption grew by close to 70% between 2015 and 2020, accounting for over 30% of global demand growth during that period.

This has been largely driven by an impressive coal-to-gas switching programme, converting close to 20 million users in 5 years, while the gas-fired powgen fleet expended by over 70% to reach almost 100 GW.

Gas production grew by an impressive 43% although not sufficient to keep up with the more rapidly rising gas demand. as such, imports more than doubled and today China is on the verge to become the world’s largest LNG importer. meanwhile, China’s gas import reliance grew from 32% in 2015 to 43% in 2020.

The high pressure transmission system continued to grow, including through the building of additional interconnectors, with its length expanding by over 70% or an impressive 46,000 km.

In terms of underground gas storage, China almost tripled its working capacity from just above 5 bcm back in 2015 to 14.5 bcm in 2020.

Although this is still only about 5% of the country’s annual gas consumption (vs ~20% in the EU). China’s storage capacity will need to build-up more aggressively in the coming years, to keep up with the rapidly rising peak demand during winter (expected to reach 1.5 bcm/d this heating season).

What is your view? What is next for China’s gas market under the 14th FYP? Does the Dragon need more gas?

Source: Greg MOLNAR (LinkedIn)