Natural gas prices fell today, sinking by 2% – the equivalent of 18 cents – in the early morning as production managed to sustain 94+ Bcf levels and LNG exports fell by ~ 1 Bcf/D over the Memorial Day weekend.

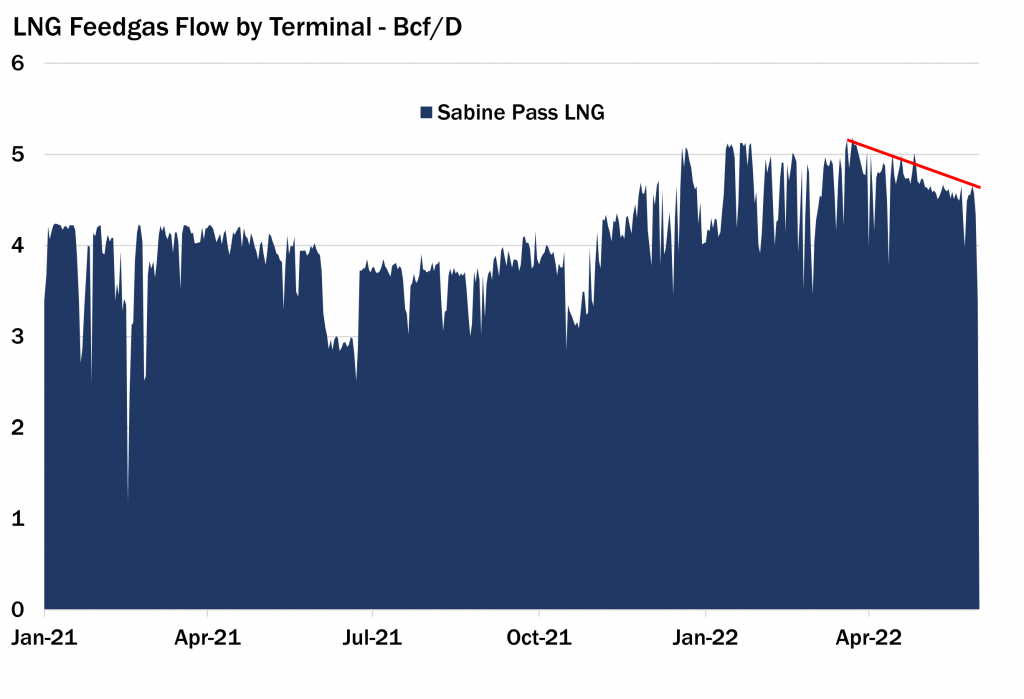

Weekly production averages are currently settled at 94.5 Bcf/D – the highest observed value since the beginning of the year, when production averages spiked past 95 Bcf/D. On the other hand, LNG exports continued to show weakness as maintenance lowered volumes to Sabine Pass (displayed below).

Work on the compressor station at Gillis is suspected to have contributed to the sustained drop in flows today. LNG exports, as a whole, are no longer at their mid-winter 13+ Bcf highs due to the routine intervention of maintenance.

Seasonal maintenance is normal and the drop in volumes through much of April and May to 12 Bcf/D was expected; LNG facilities were running at capacity utilizations near 100% midwinter and midseason maintenance is a necessary feature of the market as LNG facilities prepare for the same high octane performance next winter.

Price action today largely followed the fundamentals today, and the loosening of the market in the form of a sustained, high supply base accompanied with declining export demand allowed prices to put some distance in between themselves and the decade-high $9+ intraday pricing observed last week.

Source: Gelber and Associates