Henry Hub cash increased nearly 60 cents yesterday as it exploded away from depressed weekend trading near yearly lows.

Corresponding surges were seen in the November and other winter gas contracts on NYMEX, although to a lesser extent. Although it is a positive sign to see spot prices begin to strengthen, they will have farther to go to support the front month’s higher trading levels.

Today, the November contract is taking a breather from the wild swings and trading sideways near $2.61/MMBtu, while other winter contracts continue to lift quietly.

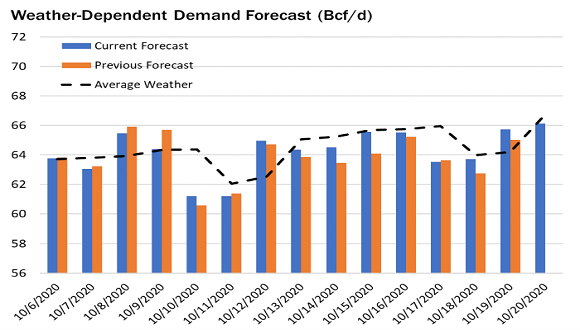

Uncertainty persists this morning with large shifts in both production and LNG demand possible over the next few days. The current forecast for Hurricane Delta now anticipates that it will reach major status as it breezes through the Gulf of Mexico towards eastern Louisiana on Friday.

Nearly all offshore Gulf production could be caught up in this path and forced to shut-in, while disruptions to LNG shipping is likely to cause export terminals to throttle down capacity utilization in the near-term.

Source: Gelber & Associates

[tfws username=”GelberCorp” height=”GelberCorp” width=”GelberCorp” theme=”GelberCorp” color=”GelberCorp” tweets=”GelberCorp” header=”GelberCorp” footer=”GelberCorp” borders=”GelberCorp” scrollbar=”GelberCorp” background=”GelberCorp”]