The announcement of the FID for the Coral North FLNG project adds another 3.6 mtpa to global capacity under construction. While this is small in the context of the coming wave of new supply and will not materially move the needle of the global supply-demand balance, it still carries a few interesting consequences for the outlook for the market.

First, this announcement comes at the same time as TotalEnergies is reported to be close to announcing the restart of the construction of its Mozambique LNG project. Exxon was also this week still quoted as targeting FID for its much delayed Rovuma LNG in 2026. Despite not being the lowest cost and despite the security challenges that affect onshore developments, East African projects continue to move ahead, then. Somewhat against the odds, this region continues to represent one of the key regions carrying potential for future expansion in global production.

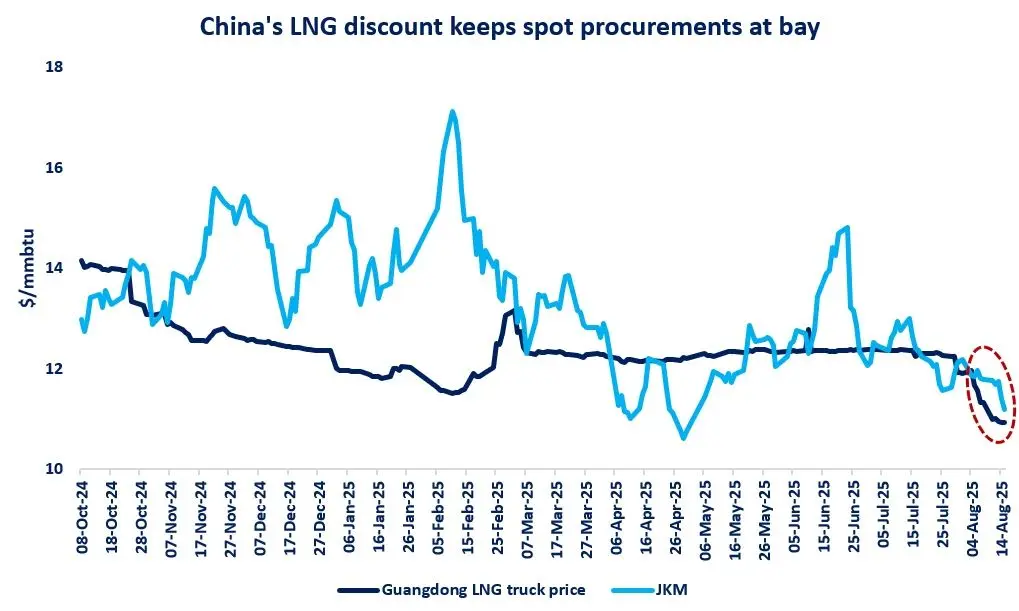

I have not seen any announcements related to the project’s offtake yet. It is likely that the volumes will be taken by one or more of the project’s sponsors, with also perhaps the potential for BP to expand its offtake from the sister project Coral South. Regardless of the outcome, this will likely result in an addition of up to 3.6 mtpa on the books of global portfolio players. This is in line with the trends seen in recent months and adds to the already large volumes of supply yet to find a demand sink.

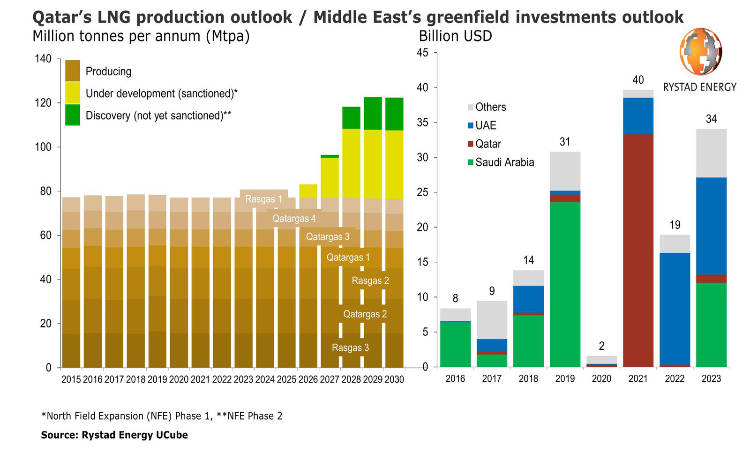

Finally, while the volume is relatively small, this represents another step in the expansion of the global portfolio of ADNOC (through its subsidiary XRG), with Middle Eastern NOCs continuing to find success in the expansion of their presence in the LNG industry.

Source: Giovanni Bettinelli