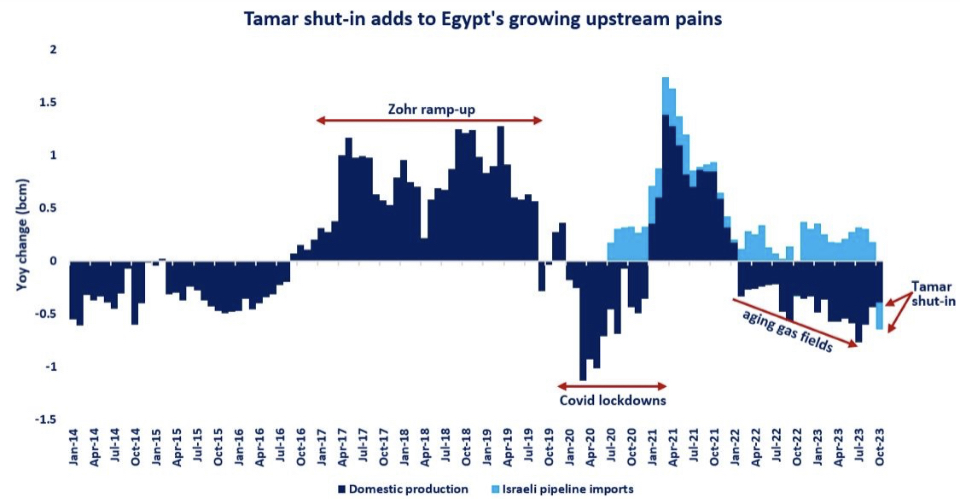

Egypt’s gas production dwindled by 10% yoy in the first 8 months of 2023, a decline of 4.5 bcm in absolute terms. this steep decline is reflective of the country’s aging gas fields and growing upstream issues.

The ramp-up of Israeli piped gas (up by 50%) partly compensated for the lost domestic production, adding just over 2 bcm to Egypt’s gas supply mix.

With the Tamar field now being shut for almost a month, Israel’s own gas production plummeted by an estimated 40% (or 0.8 bcm) in October, leading to lower piped gas exports to Egypt.

According to media reports, Israeli piped exports to Egypt dropped by 70-80% compared to the first eight months of 2023, translating into a decline of over 0.5 bcm month-on-month.

Lower Israeli piped gas deliveries will ultimately weigh on Egypt’s export capabilities this winter. Egypt exported around 4.5 bcm of LNG to Europe during the 2022/23 heating season.

Considering the upstream issues in the country and the reduced Israeli piped gas availability, Egypt’s LNG exports are most likely to dry up this winter, adding to a tighter winter gas balance in Europe.

What is your view?

How will Egypt’s gas and LNG production evolve this winter? How could be Tamar impacted by a prolonged shut-in?

Source: Greg Molnar