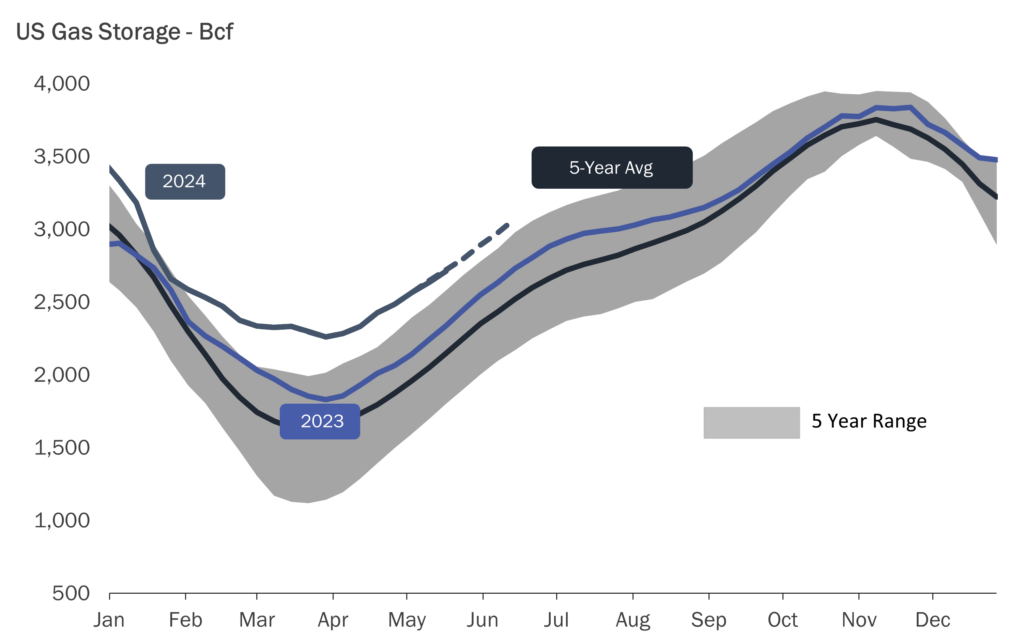

NYMEX natural gas futures are down -$0.07, last trading at $2.60. With today’s decline, the July contract has now retraced over 50% of its move up from the year’s low in February. The EIA’s storage report release for the week of May 23rd showed an injection of 84 Bcf, on the higher side relative to most participants’ expectations.

The release has seen a more muted price response and even some limited upwards movement, likely helped by some short-covering from positions opened ahead of the report’s release this morning. As expected, the impact of the injection left the current surplus to the 5-year and year-ago averages lower than last week.

Working gas in storage is now 380 Bcf higher than this time last year and 586 Bcf higher than the 5-year average.

Aiming to maintain a quorum, the Senate Energy and Natural Resources Committee is set to vote on three nominees to FERC next Tuesday. President Biden nominated two Democrats, Judy Chang and David Rosner, and one Republican, Lindsay See, to fill two open slots and an impending vacancy. With limited legislative days before the general election, the June committee action increases the chances of Senate floor time for confirmations.

Senate Republicans will need to weigh the risk that FERC remains majority-Democrat well after Biden’s term has ended. That said, the bipartisan support hinted by the committee’s actions suggests a smoother confirmation process, despite those concerns. FERC requires a quorum of three members to vote on key issues, including natural gas infrastructure projects.