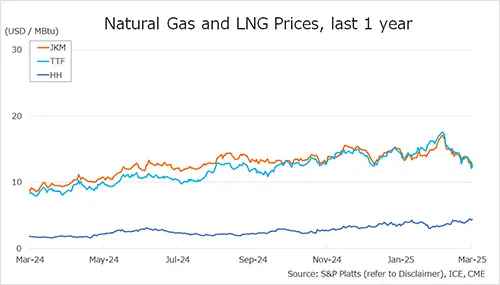

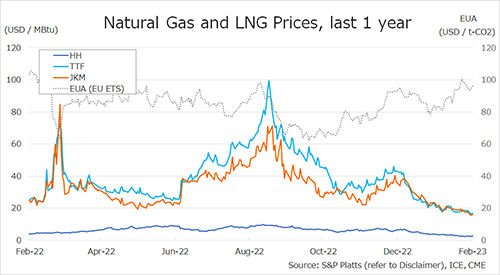

European and Asian gas prices fell below last year’s levels in December, amidst unseasonably mild weather and high storage levels.

In Europe, TTF month-ahead prices averaged at $36/mmbtu -5% below last year’s levels, despite the steep cut in Russian gas supplies.

Demand was down by around 12%, as unseasonably mild weather in the second half of the month weighed on residential and commercial gas consumption.

Strong winds and gradually improving nuclear and hydro availability depressed gas burn in the power sector.

Very high storage levels (83% full) and near-record LNG inflows further depressed gas prices.

By the end of Dec, TTF prices fell to their lowest level since mid-Feb.

In Asia, JKM followed suite, down by 12% yoy to an average of $32/mmbtu.

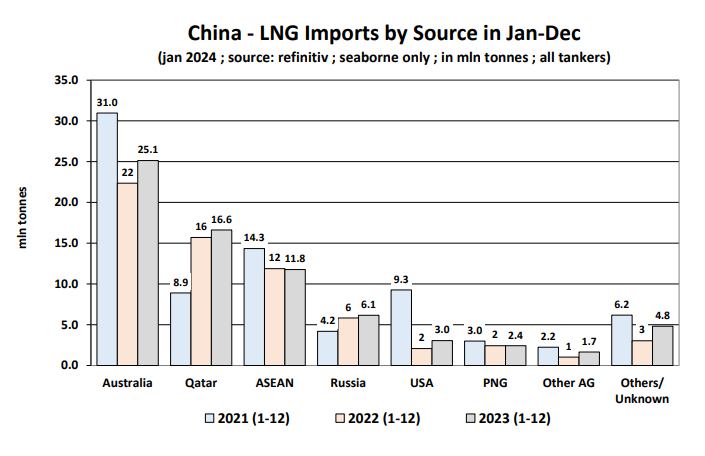

In China, overall gas demand remains depressed, with growth around 1% in Dec, and this is despite the cold spells in the first half of Dec.

In the US, Henry Hub prices are up by 50% compared to last year, averaging close to $6/mmbtu. Gas demand was up by a strong 10% yoy in the first three weeks of Dec, primarily supported by space higher heating requirements amidst violent cold spells across the country.

What is your view? How will gas prices evolve in 2023? Will it be a rabbit run, with a lot of volatility? Or the bears are out of the bushes for good? Will the European market rebalance?

Source: Greg MOLNAR