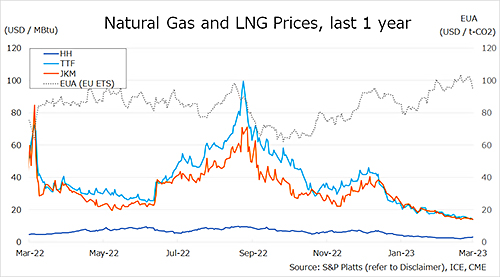

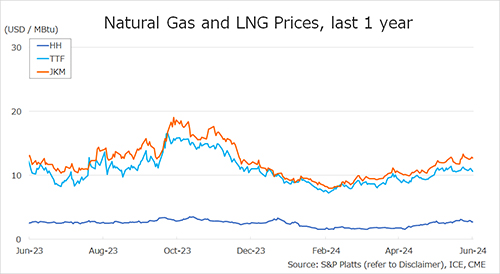

The Northeast Asian assessed spot LNG price JKM for last week (17 June – 21 June) fell to mid-USD 12s on 21 June from high-USD 12s the previous weekend (14 June).

After falling to mid-USD 12s at the beginning of the week, due to the sentiment by high prices of the previous week and a slowdown in buying interest along with Hari Raya Haji, demand for August cargoes arose and the price went up modestly. METI announced on 19 June that Japan’s LNG inventories for power generation as of 16 June stood at 2.14 million tonnes, up 0.04 million tonnes from the previous week.

The European gas price TTF for last week fell to USD 10.6/MBtu on 21 June from USD 11.1/MBtu the previous weekend (14 June). After falling at the beginning of the previous week due to weak demand and a recovery in supply from the Norwegian continental shelf, the price rose to USD 11.4/MBtu in mid-week on unplanned maintenance to the Skarv gas field and an extended shutdown period at the Visund gas field in Norway.

Then it fell again on forecasts of below-normal temperatures and firm nominations from the Norwegian continental shelf. According to AGSI+, the EU-wide underground gas storage increased to 74.8% as of 21 June from 72.9% the previous weekend.

The U.S. gas price HH for last week fell to USD 2.7/MBtu on 21 June from USD 2.9/MBtu the previous weekend (14 June). At the beginning of the week, the price rose to USD 2.9/MBtu on expectations of growing demand for the natural gas in U.S. due to record heat observed across the country.

Later in the week, the price fell on lower feed gas supplies to major liquefaction facilities and strong production and inventories. The EIA Weekly Natural Gas Storage Report released on 21 June showed U.S. natural gas inventories as of 14 June at 3,045 Bcf, up 71 Bcf from the previous week, up 12.7% from the same period last year, and 22.6% increase over the five-year average.

Updated: June 24

Source: JOGMEC