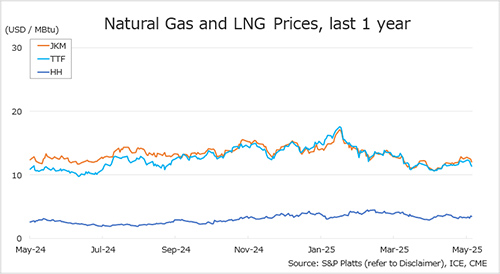

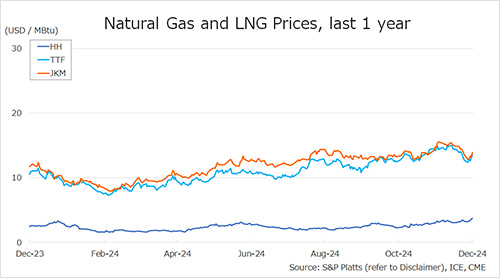

The Northeast Asian assessed spot LNG price JKM for last week (16 – 20 December) rose to high-USD 13s on 20 December (February delivery) from mid-USD 13s the previous weekend (13 December, January delivery).

JKM rose in line with rising gas prices in Europe, with high inventories and weak demand in Northeast Asia unchanged.

METI announced on 18 December that Japan’s LNG inventories for power generation as of 15 December stood at 2.24 million tonnes, up 0.12 million tonnes from the previous week.

The European gas price TTF (January delivery) for last week (16 – 20 December) rose to USD 13.4/MBtu on 20 December from USD 12.7/MBtu the previous weekend (13 December). TTF rose due to uncertainty over future gas flows from Russia, including President Putin’s statement that there is no possibility of extending the gas transportation agreement with Ukraine.

Supplies remained relatively stable despite the announcement of an unplanned extension of the maintenance at the Norwegian gas field. According to AGSI+, the EU-wide underground gas storage was 76.1% on 20 December, down from 78.8% at the end of the previous weekend.

The US gas price HH (January delivery) for last week (16 – 20 December) rose to USD 3.8/MBtu on 20 December from USD 3.3/MBtu the previous weekend (13 December). Venture Global started the operation of Plaquemines LNG.

EIA Weekly Natural Gas Storage Report released on 18 December showed US natural gas inventories as of 13 December at 3,622 Bcf, down 125 Bcf from the previous week, up 0.6% from the same period last year, and 3.8% increase over the five-year average.

Updated: December 23

Source: JOGMEC