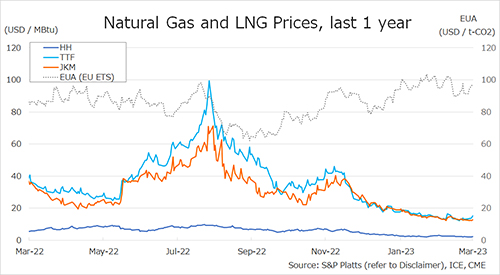

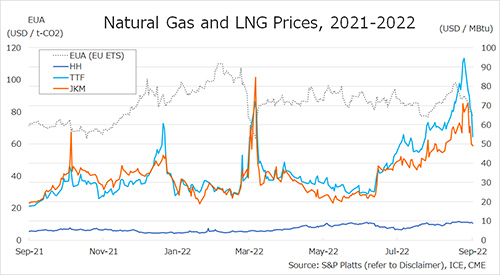

The Northeast Asian assessed spot LNG price JKM for the previous week (29 August-2 September) rose to USD 71/MBtu on 29 August, following a rise in European gas prices from USD 67/MBtu the previous week.

The price then dropped to USD 56/MBtu on 30 August due to lower TTF prices, but it rose to USD 59/MBtu on 31 August. On 2 September, JKM fell to USD 49/MBtu, citing limited prompt demand due to adequate inventory in Northeast Asia.

According to a 31 August METI release, LNG Inventories for power generation totaled 2.63 million tonnes, up 200 thousand tonnes from the same month last year and up 780 thousand tonnes from the average of the past five-year.

The European gas price TTF fell to USD 68.9/MBtu on 31 August from USD 94.4/MBtu the previous week as the market calmed down from last weekend’s unplanned maintenance announcement at the Norwegian gas fields and as high European underground gas storage levels eased winter supply concerns in the market.

The price also fell to USD 53.7/MBtu on 2 September as European underground gas storage as of 1 September reached 80.81%, two months ahead of the EU’s 1 November target of 80%.

Gazprom announced on 2 September that Nord Stream would not resume operations as originally planned due to an oil leak was detected in a gas turbine; Nord Stream was scheduled to resume operations early on September 3 after scheduled maintenance to the Portovaya’s turbine from August 31 to September 2.

The U.S. gas price HH rose to USD 9.4/MBtu on 29 August from USD 9.3/MBtu the previous week. It then fell to USD 9.0/MBtu on 30 August but rose to USD 9.3/MBtu on 1 September. HH fell again to USD 8.8/MBtu on 2 September.

According to the EIA Weekly Natural Gas Storage Report released on 1 September, U.S. natural gas underground storage inventories for the week of August 26 totaled 2,640 Bcf, up 61 Bcf from the previous week, down 7.9% from the same period last year, and still lower than usual at 11.3% of the five-year average.

Updated 05 September 2022

Source: JOGMEC