European imports are forecast to be lower in 2021 than in 2020 as the region rebalances following two years of acting as a sink for excess LNG.

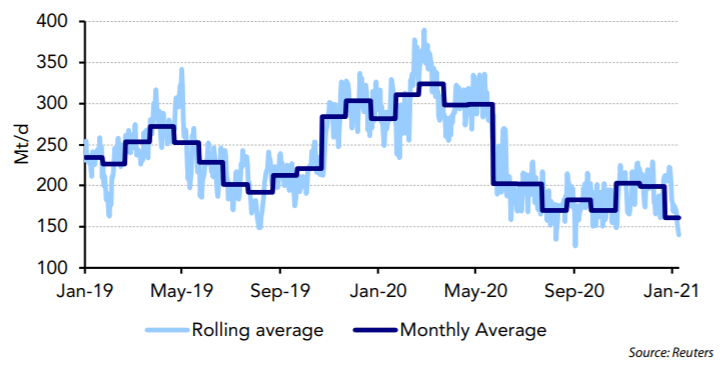

European imports have fallen further from December, averaging at around 4.5 MMt for the month as of January 25.

Last January, the region imported 8.6 MMt, about 50% more than this year. This marks the continuation of an extremely weak winter as far as LNG imports go. At this level, regional imports are far below original expectations.

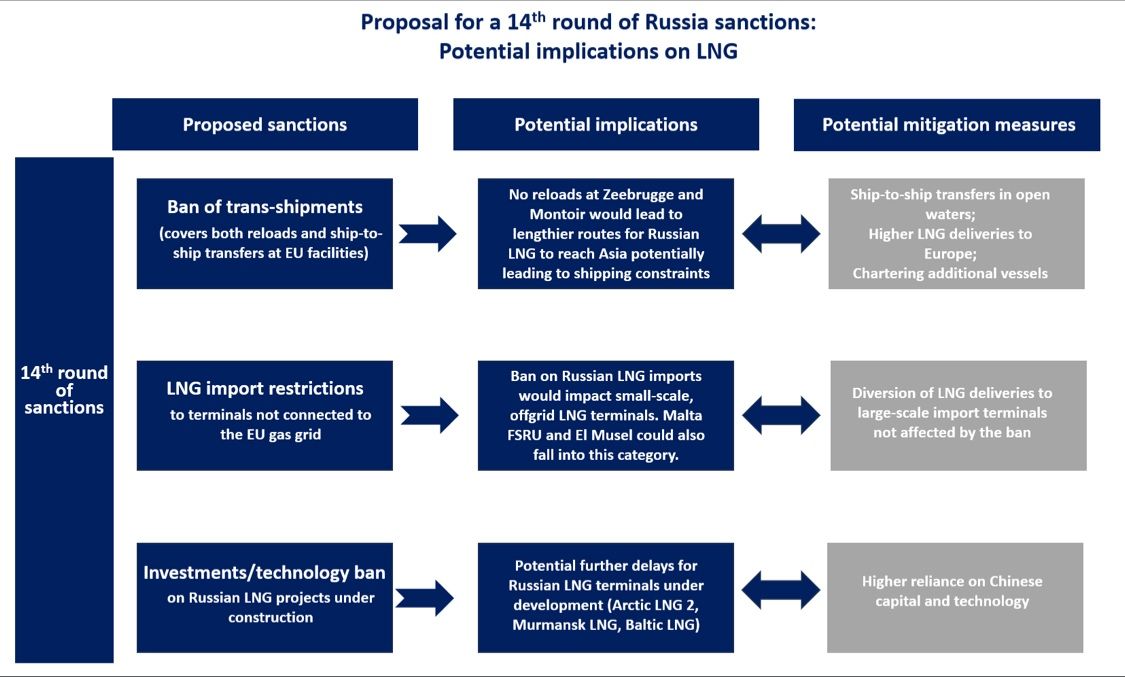

European LNG imports – 10-day rolling average vs monthly average

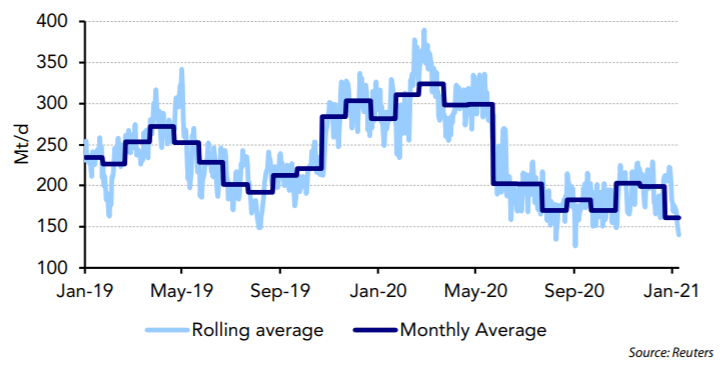

Demand for natural gas, on the other hand, has not been lower this year as the winter is more normal. With pipeline flows from Russia and Norway at or slightly lower than previous years, natural gas storage levels in the region have dropped precipitously. The middle graph shows the progress so far for 2021 in the dark blue line on the left. For the first 20 days of January, storage levels fell 19% in 2021 compared to 9% in 2020 and 12% in 2019. In fact, overall natural gas storage is nearing the typical seasonal level; however, the rate of withdrawals is not sustainable.

European natural gas storage

Additional LNG is forecast to head to the region in the coming months as Asia’s appetite for high-priced LNG starts to wane. As these new cargoes arrive, the rate of withdrawals should be curtailed somewhat. It remains to be seen if and when Russia turns the pipeline flows back on as it appears they have been waiting to use inventory rather than continuing to send natural gas into a low price market.

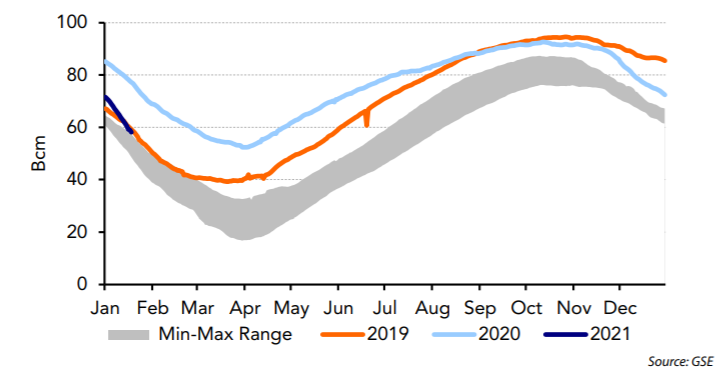

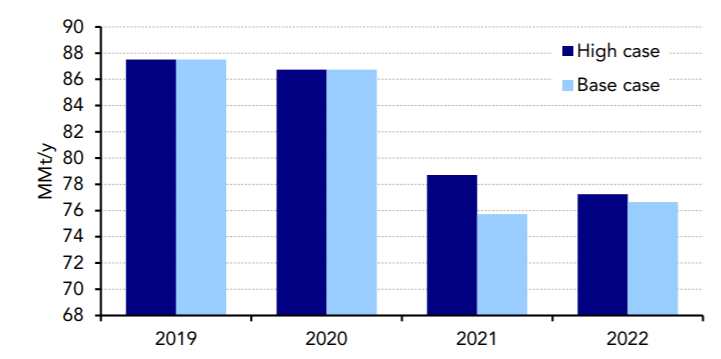

European LNG import forecast

The current rate of storage withdrawal has added a wrinkle to the forecast for the year. Specifically, with storage levels so low currently, will regional demand be higher than expected in the summer months in order to replenish inventory levels back to historical norms? The bottom graph highlights a scenario with higher overall import levels than currently forecast. The increased volume will serve to rebalance the market.

The low storage levels also mean that there is room, where there was not last year, to take additional cargoes should the global summer market become long again. This may mean that there will be fewer cancellations this summer than last summer.

The forward market certainly seems to point to this direction with imports from the US to Europe in the money for the duration of the forward curve.

Source: Poten & Partners

Follow on Twitter:

[tfws username=”PotenPartners” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]