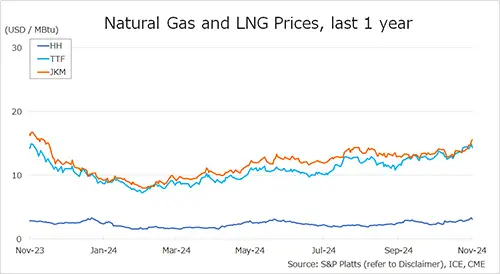

The Northeast Asian assessed spot LNG price JKM for last week (18 – 22 November) rose to mid-USD 15s on 22 November (January delivery) from high-USD 13s the previous weekend (December delivery, 15 November).

In the beginning of the week, JKM rose due to falling temperatures mainly. Then rising tensions between Russia and Ukraine in the middle of the week made the price its highest level since December 2023.

METI announced on 20 November that Japan’s LNG inventories for power generation as of 17 November stood at 2.28 million tonnes, up 0.07 million tonnes from the previous week.

The European gas price TTF (December delivery) for last week (18 – 22 November) was almost unchanged at USD 14.4/MBtu on 22 November from USD 14.4/MBtu the previous weekend (8 November).

TTF fell in the middle of the week due to eased supply concern as pipeline gas flow from Russia to Austria continued. Then cold weather pushed it up to the USD 15s range. After that the price fall due to the forecasts of warmer temperatures in the weekend.

According to AGSI+, the EU-wide underground gas storage was 88.3% on 22 November, down from 91.3% at the end of the previous weekend.

The U.S. gas price HH (December delivery) for last week (18 – 22 November) rose to USD 3.3/MBtu on 22 November from USD 2.8/MBtu the previous weekend (15 November). HH was in USD 3s range as heating demand increased due to falling U.S. temperatures.

The EIA Weekly Natural Gas Storage Report released on 21 November showed U.S. natural gas inventories as of 15 November at 3,969 Bcf, down 3 Bcf from the previous week, up 3.7% from the same period last year, and 6.4% increase over the five-year average.

Updated: November 25

Source: JOGMEC