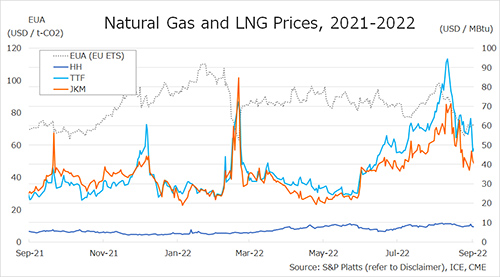

The Northeast Asian assessed spot LNG price JKM for the previous week (12-16 September) fell from USD 44/MBtu the previous week to USD 37/MBtu on 13 September due to continued weak buying interest and a switch from gas to coal due to high LNG prices and a prolonged lockdown in China.

JKM then turned higher on rising Indian spot demand and soaring European gas prices, reaching USD 47/MBtu on 15 September. On 16 September, JKM fell again to USD 42/MBtu due to weak buying interest in spot cargo.

The European gas price TTF fell to USD 55.5/MBtu on 12 September from USD 56.8/MBtu the previous week as steady natural gas underground storage buildup in Europe.

TTF subsequently rose, reaching USD 63.7/MBtu on 14 September, due to reports that gas price caps may not be included in the gas demand supply measures in Europe, and uncertainty over European gas supply.

On 15 September, TTF fell slightly to USD 62.7/MBtu on oversupply of prompt cargo delivery and lower trading orders, and fell further to USD 46.8/MBtu on 16 September due to strong UK wind power output.

On 14 September, the European Commission released a proposal for measures to deal with soaring energy prices. It will cap the profits that energy-related companies can earn and collect a total of 140 billion euros, which will be returned to consumers and used to support companies.

On the same day, two FSRUs (totaling 8 Bcm/y) started operation at Eemshaven in the Netherlands to supply the gas grid.

The U.S. gas price HH rose from USD 8.0/MBtu the previous week to USD 9.1/MBtu on 14 September. HH then turned downward to USD 8.3/MBtu on 15 September and USD 7.8/MBtu on 16 September.

According to the EIA Natural Gas Storage Report released on 15 September, U.S. natural gas inventories for the week ended 9 September totaled 2,771 Bcf, up 77 Bcf from the previous week, but still lower than usual, down 7.4% from the same period last year and 11.3% from the five-year average.

Updated 20 September 2022

Source: JOGMEC