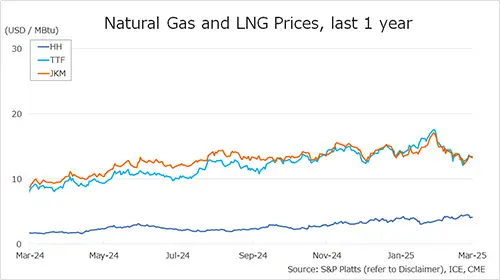

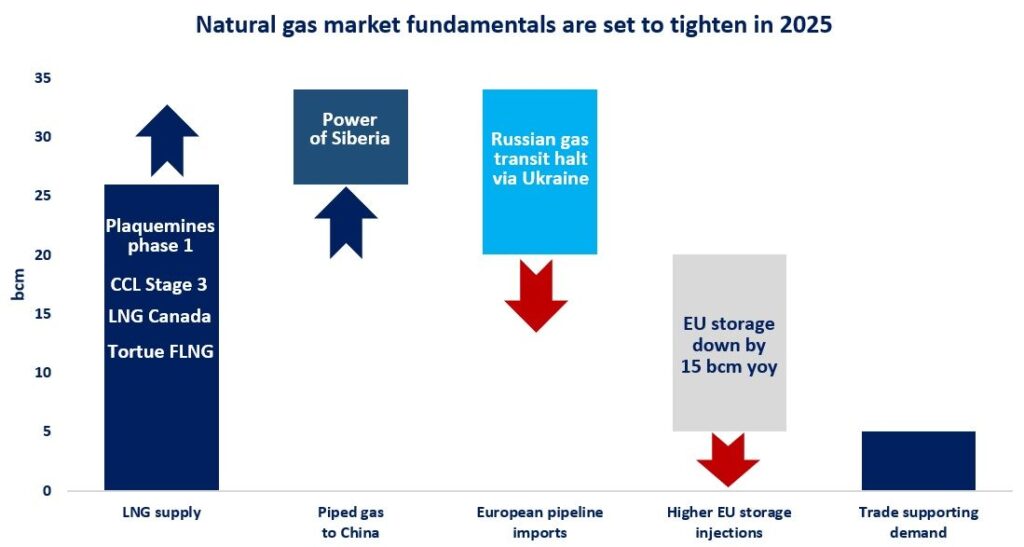

Global gas market fundamentals are set to tighten in 2025 amid limited supply growth and higher storage injection needs through the summer. Tighter market conditions could support higher price levels and weigh on gas demand growth.

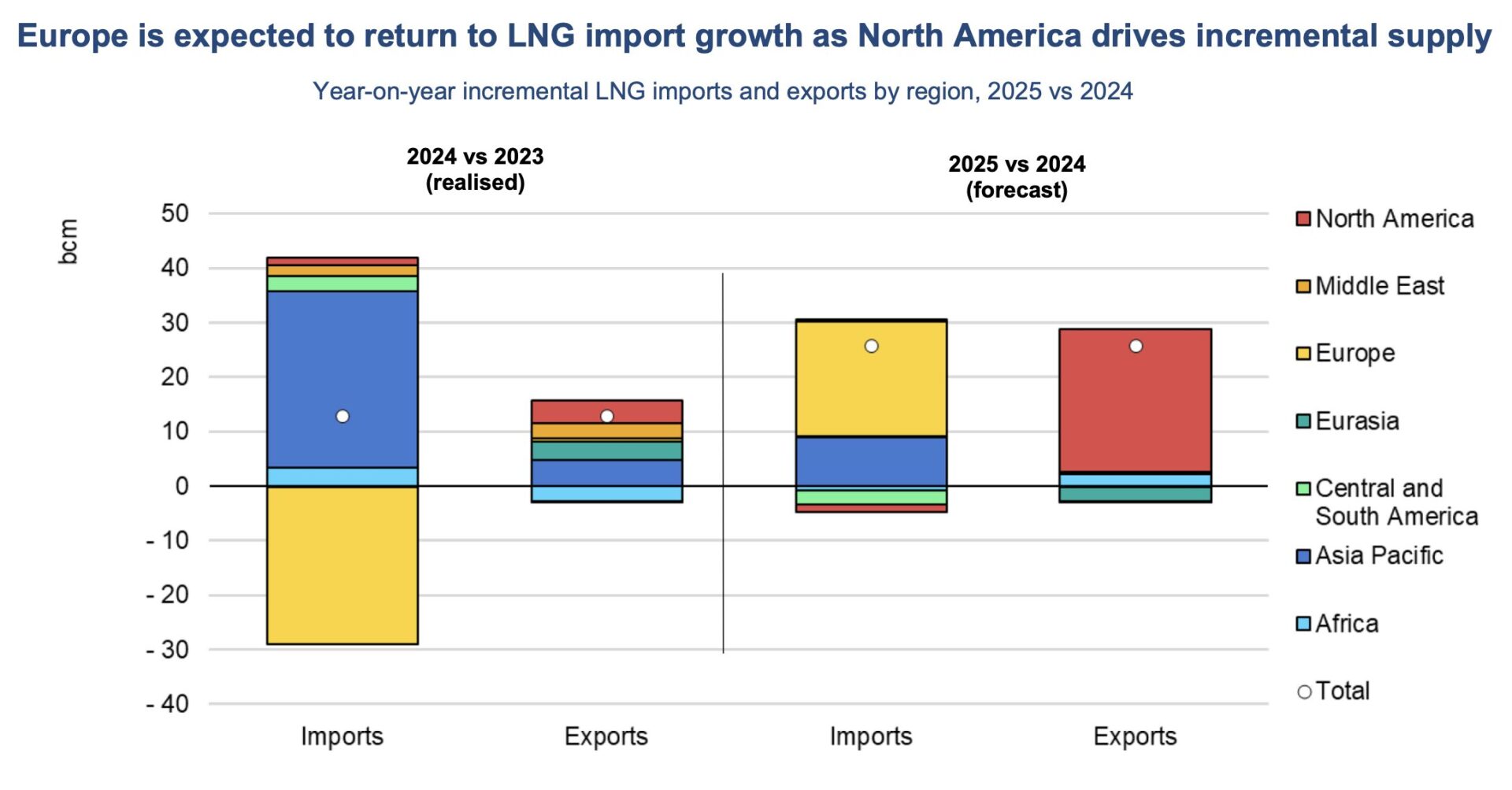

After the dry years of 2021-23, global LNG supply is expected to expand by more than 25 bcm in 2025 -double of the volumes added in 2024. This relatively strong growth is primarily driven by large North American projects, including Plaquemines LNG, Corpus Christi stage 3 expansion and LNG Canada.

In addition, Russia will continue to ramp-up its gas deliveries to China via the Power of Siberia pipeline system, with around 8 bcm of incremental gas supply compared to 2024.

However, this growth is expected to be partially offset by lower Russian piped gas deliveries to Europe, following the halt of gas transit via Ukraine, which could reduce supplies to Europe by around 15 bcm.

In addition, EU storage sites are rapidly depleting, with fill levels now below 60% and inventories standing 15 bcm below their last year’s levels. this will naturally support stronger injections through the summer of 2025, potentially standing 10-15 bcm above their last year’s levels.

Geopolitical tensions and increasingly extreme weather patterns are unfortunately here to stay, further fuelling price volatility and exacerbating market tensions.

What is your view? How will gas markets evolve in 2025? What are the key risks ahead? Stay tuned: our next Quarterly Gas Report is out tomorrow, with a focus on the short-term outlook.

Source: Greg MOLNAR