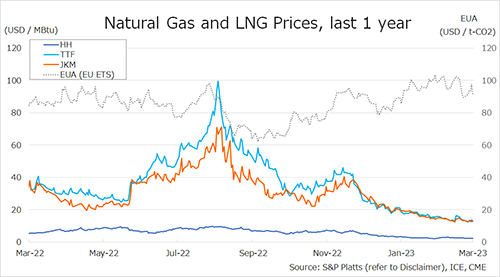

The Northeast Asian assessed spot LNG price JKM for the previous week (20 March – 24 March) fell to late USD 12s on 20 March from USD 13/MBtu the previous week as a French LNG terminal resumed operations, easing supply concerns in Europe, and European gas spot prices declined.

JKM then rose for two consecutive business days to USD 13/MBtu on 22 March after steady buying bids from China and Thailand and Angola LNG’s cancellation of future bidding plans due to technical problems that reduced its utilization rate.

On 23 March, JKM fell again to the late USD 12s as market participants remained quiet, keeping a close eye on inventory levels in various countries, but demand from India and Thailand supported the price, which rose slightly the next day and remained in the upper USD 12s range.

According to METI, Japan’s LNG inventories for power generation totaled 2.56 million tonnes as of 19 March, up 0.17 million tonnes from the previous week, up 0.93 million tonnes from the end of the same month last year and up 0.49 million tonnes from the average of the past five years.

The European gas price TTF fell to USD 12.4/MBtu on 20 March from USD 13.3/MBtu the previous week as the French Dunkerque LNG resumed operations after a strike and the European underground gas storage rate increased for the second consecutive day.

On 21 March, the price rebounded to USD 13.4/MBtu on the back of the decision to extend strikes at several French LNG terminals, but the following day, the price dropped to USD 12.6/MBtu as the market was balanced as Algerian cargoes diverted from France were supplied to other regions in Europe.

On 23 March, the price rose to USD 13.8/MBtu following another strike at French Dunkerque LNG, but dropped to USD 12.9/MBtu the next day. On 20 March, the European Commission proposed to extend the existing target of a 15% reduction in gas consumption in EU member states until March 2024.

ACER published the 24 March spot LNG assessment price for delivery in the EU at EUR 36.39/MWh (equivalent to USD 11.46/MBtu).

According to AGSI+, the European underground gas storage rate as of 24 March was 55.8%, up from 55.7% the previous week.

The U.S. gas price HH fluctuated but maintained in the low USD 2s from USD 2.3/MBtu the previous week, reflecting changes in temperature and demand forecasts in the U.S. and was USD 2.2/MBtu on 24 March.

On 20 March, Sempra Infrastructure announced the FID for Port Arthur LNG Phase 1 (13MTPA) in Texas.

According to the EIA Weekly Natural Gas Storage Report released on 23 March, the U.S. natural gas underground storage on 17 March was 1,900 Bcf, down 72 Bcf from the previous week, up 36.1% from the same period last year, and up 22.7% from the historical five-year average.

Updated 27 March 2023

Source: JOGMEC