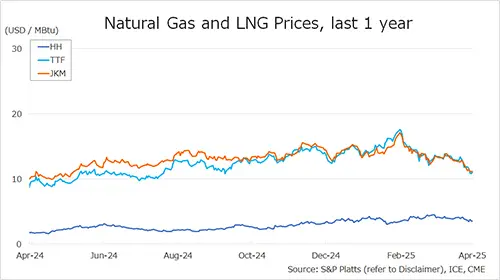

The Northeast Asian assessed spot LNG price JKM (May delivery) for last week (7 April – 11 April) fell to low-USD 11s on 11 April from low-USD 12s the previous weekend (4 April). JKM was on a downtrend throughout the week on concerns of trade friction and a worsening global economy due to the Trump administration’s introduction of retaliatory tariffs.

It rose slightly on 8 April, when a 10-month low price level attracted buyers from such as India, but continued to fall thereafter. METI announced on 9 April that Japan’s LNG inventories for power generation as of 6 April stood at 2.13 million tonnes, down 0.1 million tonnes from the previous week.

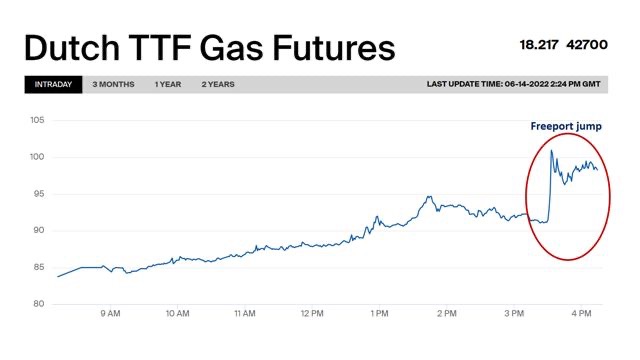

The European gas price TTF (May delivery) for last week (7 April – 11 April) fell to USD 11.1/MBtu on 11 April from USD 11.8/MBtu the previous weekend (4 April). TTF continued to decline throughout the week as fundamentals remained bearish until 10 April when it reached USD 10.8/MBtu.

Then on 11 April, the decline slowed, although fundamentals remained weak, and the price rose to USD 11.1/MBtu. According to AGSI+, the EU-wide underground gas storage was 35.1% on 11 April, up from 34.6% the previous weekend, down 42.7% from the same period last year, and down 23.7% over the five-year average.

The U.S. gas price HH (May delivery) for last week (7 April – 11 April) fell to USD 3.5/MBtu on 11 April from USD 3.8/MBtu the previous weekend (4 April). The HH generally continued to decline due to concerns of economic deterioration caused by retaliatory tariffs.

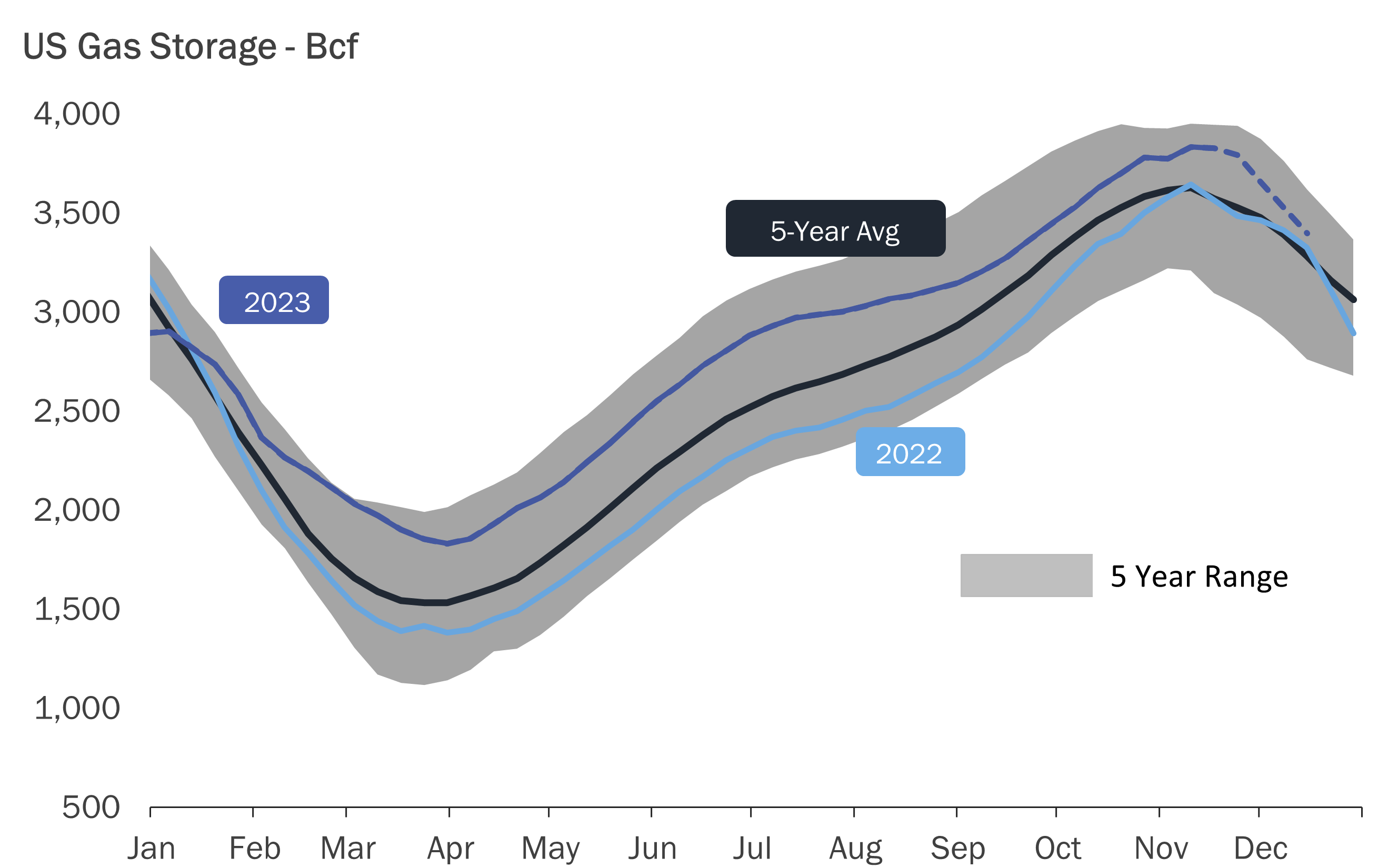

The EIA Weekly Natural Gas Storage Report released on 10 April showed U.S. natural gas inventories as of 4 April at 1,830 Bcf, up 57 Bcf from the previous week, down 19.7% from the same period last year, and 2.1% decrease over the five-year average.

Updated: April 14

Source: JOGMEC