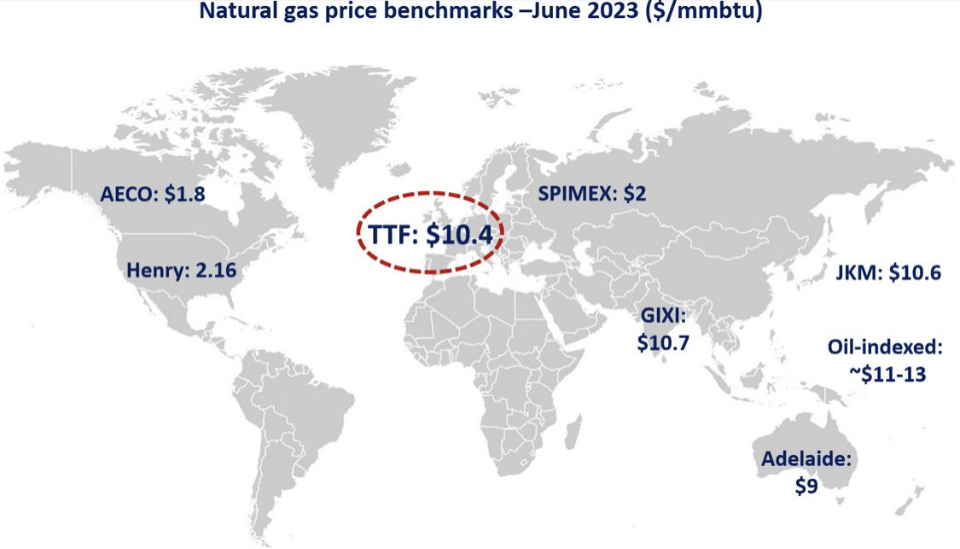

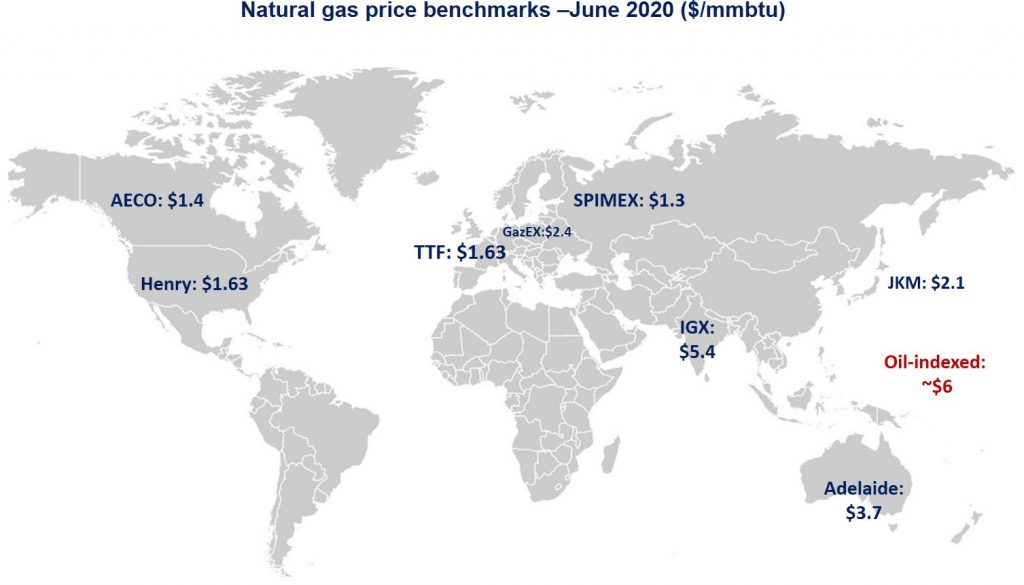

(Greg Molnar) Gas prices were all over the place this June.

In the US, Henry Hub fell to 1.63/mmbtu, a 25-year low. and this was not primarily driven by domestic supply-demand conditions but rather by plummeting LNG exports, falling by almost 40% compared to May.

In Europe, TTF gained 10% month-on-month. this has been driven by some recovery in demand (up by 0.5% yoy) on the back of gas-fired powgen, and by a decreasing LNG influx (down by 10% yoy), primarily from the US.

in Asia, #JKM held steady, as the growth in LNG imports from China and India has been counterbalanced by steeply falling imports from Korea (down by 30%), probably due to storage tank-top concerns.

And we have a newcomer: IGX, India’s Gas Exchange. first trades averaged at $5.4/mmbtu, much higher thank JKM. Two main reasons for that: (1) IGX includes costs related to infrastructure access, and (2) reflects the fact that the majority of India’s LNG imports is still oil-indexed.

Oil-indexed LNG prices are estimated to be ~$6/mmbtu, about 30% vs last year, as the oil price collapse in March/April filters through the contractual formulae. it is still almost 3 times higher than the spot!

What is your view? Where are we heading? Will TTF continue to recover? What about storage, are we reaching limits soon?

Source: Greg Molnar

Connect & discuss further with Greg Molnar on LinkedIn