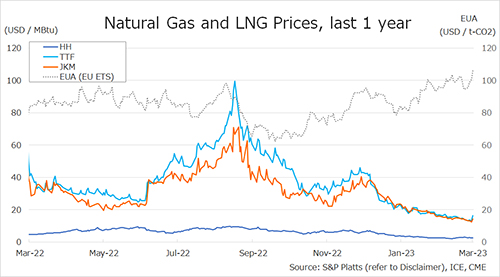

The Northeast Asian assessed spot LNG price JKM for the previous week (6 March – 10 March) fell for four consecutive business days to USD 12/MBtu on 9 March from USD 14/MBtu the previous week, as demand in Northeast Asia remained thin due to firm inventory levels from the mild winter.

The price rose to USD 14/MBtu on the following day, fueled by rising prices in Europe. According to METI, Japan’s LNG inventories for power generation totaled 2.23 million tonnes as of 5 March, down 0.11 million tonnes from the previous week, up 0.60 million tonnes from the end of the same month last year and up 0.16 million tonnes from the average of the past five years.

The European gas price TTF fell to USD 13.2/MBtu on 6 March from USD 14.0/MBtu the previous week due to the end of the cold snap in Spain.

TTF rebounded slightly and remained in the middle of USD 13/MBtu range in the first of the week, mainly due to forecast lower temperatures in Northwest Europe and the announcement of reduced supply due to unplanned maintenance at Norwegian gas fields, and rose sharply to USD 16.4/MBtu on 10 March due to concerns in French nuclear power plants operations, strikes at French LNG terminals, and reduced production at Norwegian gas fields.

ACER published the 10 March spot LNG assessment price for delivery in the EU at EUR 40.26/MWh (equivalent to USD 12.49/MBtu). According to AGSI+, the European underground gas storage rate as of 10 March was 56.9%, down from 59.7% the previous week.

The U.S. gas price HH fluctuated as gas demand forecasts were affected by changes in weather forecasts, first falling from USD 3.0/MBtu on the previous week to USD 2.6/MBtu on 6 March, rising slightly to USD 2.7/MBtu on 7 March, and then falling for three consecutive business days to USD 2.4/MBtu on 10 March.

On 8 March, Freeport LNG announced that it has received FERC and PHMSA approval to resume production of the remaining train.

According to the EIA Weekly Natural Gas Storage Report released on 9 March, the U.S. natural gas underground storage on 3 March was 2,030 Bcf, down 84 Bcf from the previous week, up 32.1% from the same period last year, and up 21.5% from the historical five-year average.

Updated 13 March 2023

Source: JOGMEC