Global seaborne LNG trade has continued to increase last year, helped also by the events in Ukraine which forced Europe to diversify away from Russian pipeline gas, but slowed down somewhat compared to previous years.

In the full 12 months of 2023, global shipments of LNG increased by +1.7% y-o-y to 409.9 mln t, based on Refinitiv vessel tracking data.

This followed an even stronger +4.7% y-o-y increase in volumes during 2022, and a +7.3% y-o-y increase during 2021.

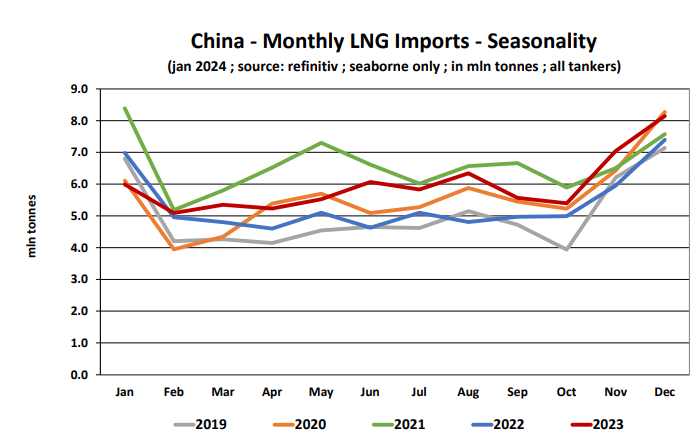

In 2023, things started very strongly in the first quarter, but then slowed down somewhat over the spring and summer.

The largest exporter of LNG is now the USA, which accounted for 21.7% of shipments in the full 12 months of 2023, followed by Australia with 19.7% and Qatar with 19.2%.

In 2023, the USA exported 88.9 mln tonnes of LNG, which represented a +12.0% y-o-y increase from the 79.4 mln tonnes shipped in 2022.

This is also a significant increase from the 72.5 mln t exported by the USA in 2021 and 48.2 mln t in 2020. Australia shipped 80.8 mln tonnes in Jan-Dec 2023, -0.6% y-o-y.

Qatar exported 78.6 mln tonnes in Jan-Dec 2023, -1.6% y-o-y.

Russia shipped 30.9 mln tonnes in 2023, down -6.1% y-o-y from a record 32.9 mln t in 2022, but still above the 30.3 mln t in 2021.

The European Union remains the world’s largest importer of LNG.

In 2023, the EU imported 102.0 mln tonnes of LNG, up +1.9% y-o-y, accounting for 25.0% of global LNG imports.

Mainland China imported 71.6 mln tonnes of LNG in 2023, +11.4% y-o-y from 64.3 mln t in 2022, but below the 79.0 mln t in 2021.

Japan imported 66.9 mln t in 2023, down -9.2% y-o-y. South Korea imported 45.5 mln t in 2023, down – 3.5% y-o-y. India imported 21.1 mln t in 2023, up +10.3% y-o-y. The United Kingdom imported 14.9 mln t in 2023, down -22.9% y-o-y.

In 2021, Mainland China emerged briefly as the largest importer of LNG in the world, with a 20.7% share. In 2021, China’s imports jumped by +17.8% y-o-y to 79.1 mln tonnes. It overtook Japan, which in 2021 recorded a more modest +2.8% y-o-y increase to 76.5 mln tonnes.

In 2022, however, there was a dramatic turnaround, as high gas prices and weak manufacturing due to COVID-19 lockdowns reduced demand for the fuel, whilst Western Europe rushed to replace pipeline gas supply from Russia.

In 2022, China’s LNG imports declined by -18.7% y-o-y to 64.3 mln t, from 79.0 mln tonnes in 2021. As such, it was again overtaken by a more stable Japan, which recorded a modest -3.8% y-o-y decline to 73.6 mln t, from 76.5 mln t in 2021.

Also, both China and Japan got leapfrogged in 2022 by the European Union, whose LNG imports surged by +67.6% y-o-y to 100.1 mln tonnes, from 59.7 mln t in 2021.

In 2023, Chinese imports rebounded strongly by +11.4% y-o-y to 71.6 mln t as Zero-Covid got shelved, but it was not enough to overtake EU imports.

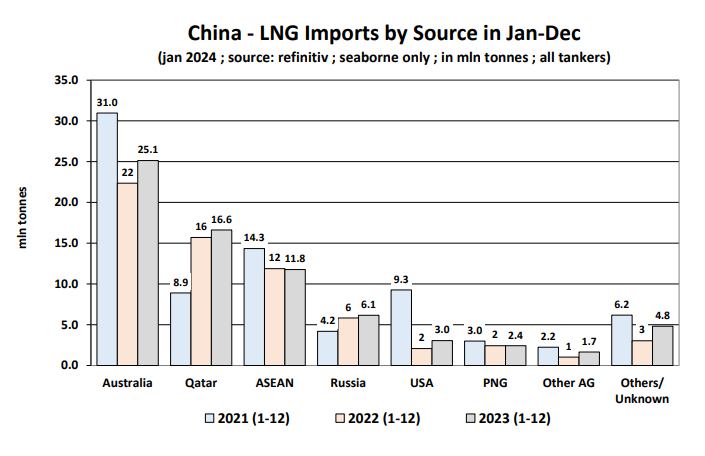

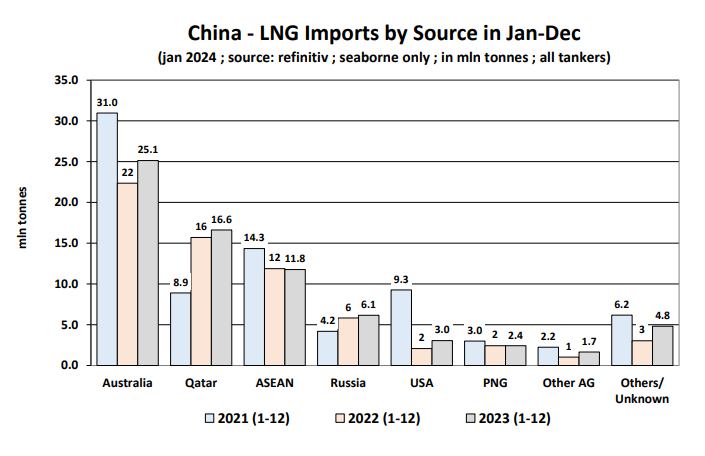

In terms of sources for LNG shipments into China, there has also been a big reshuffle, largely driven by geopolitical factors.

In Jan-Dec 2023, China imported 25.1 mln tonnes of LNG from Australia, up +12.5% y-o-y from 22.4 mln tonnes in 2022.

This was still well below the 31.0 mln t imported from Australia in 2021, and follows a dramatic -27.8% y-o-y decline in 2022.

Australia remains the top supplier to China, with a 35.1% in 2023.

Shipments from Qatar to China increased +5.9% y-o-y in 2023 to 16.6 mln t, building on the +76.4% yo-y surge recorded in 2022.

Qatar now accounts for 23.2% of China’s total LNG imports in 2023.

Imports to China from ASEAN (Malaysia and Indonesia) declined by -0.9% y-o-y in 2023 to 11.8 mln t.

Volumes from Russia to China increased last year by +5.5% y-o-y to 6.1 mln t from 5.8 mln t in 2022.

Finally, shipments from the USA to China rebounded by +46.8% y-o-y to 3.0 mln t in 2023.