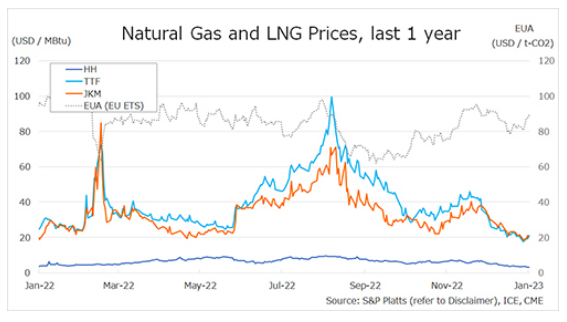

European gas prices rebounded strongly yesterday, supported by President Putin’s announcement that Russia will seek payment in roubles for gas sold to “unfriendly” countries (these countries include among others the United States, European Union member states, Britain, Japan, South Korea).

On its side, the European Commission published yesterday its final proposal on stock level requirements. For this year, the proposal is less stringent than the previously leaked draft versions: the 2022 target for filling gas storages is set to 80% by 1 November. From 2023 forwards, the target will be 90%.

On the spot pipeline supply side, Norwegian flows rebounded slightly yesterday to 308 mm cm/day on average, compared to 303 mm cm/day on Tuesday. Russian flows were also slightly up, averaging 231 mm cm/day, compared to 227 mm cm/day on Tuesday.

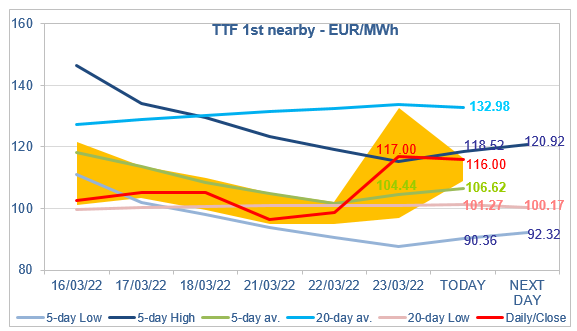

At the close, NBP ICE April 2022 prices increased by 43.900 p/th day-on-day (+18.79%), to 277.500 p/th. TTF ICE April 2022 prices were up by €18.25 (+18.49%), closing at €117.001/MWh. On the far curve, TTF ICE Cal 2023 prices were up by €6.48 (+9.95%), closing at €71.635/MWh.

In Asia, JKM spot prices increased by 7.09%, to €105.975/MWh; May 2022 prices increased by 0.05%, to €105.800/MWh.

Source: EnergyScan