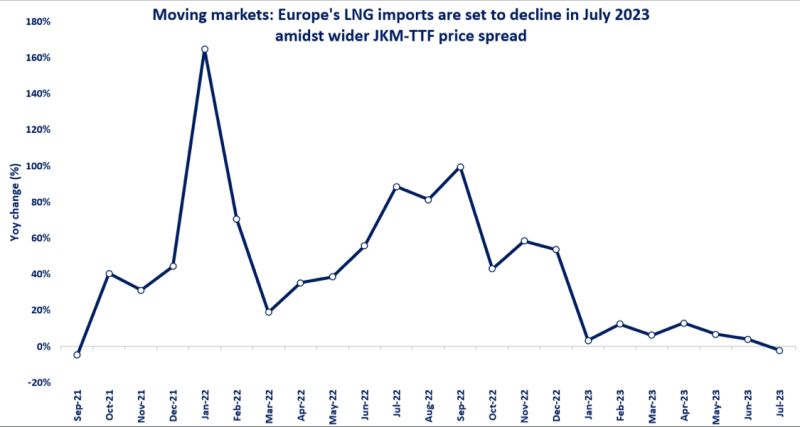

European LNG imports are set to decline in July for the first time since Sep21, when Russia started to put pressure on the European market by reducing piped gas deliveries.

According to preliminary shipping data European LNG imports dropped yoy in July, reflecting rapidly changing market conditions.

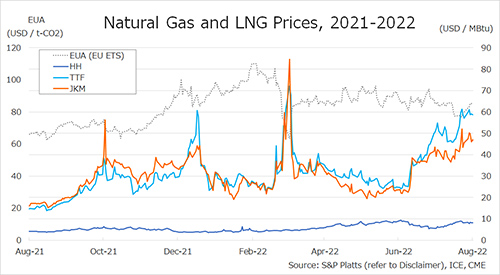

The steep decline in European gas demand (primarily due to lower gas burn in the power sector) together with high storage levels (almost 85% full) put downward pressure on TTF.

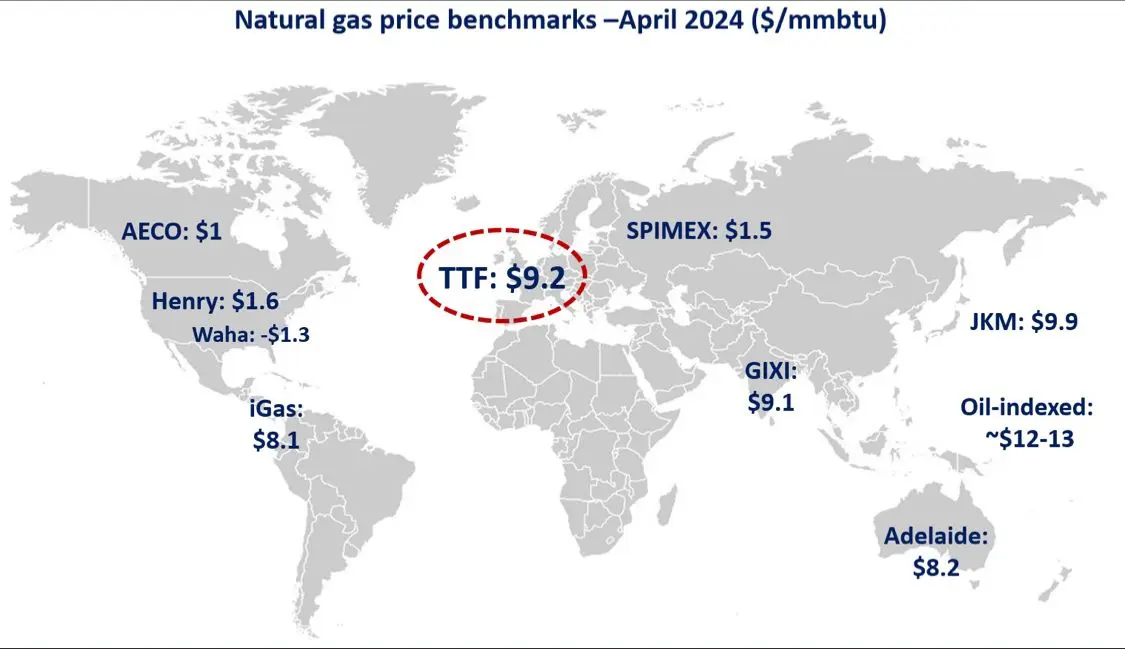

This in turn widened the JKM-TTF price spread from -$0.35/mmbtu in May, to $1.65/mmbtu by July -sufficient to pull cargos from Europe towards the Asian markets.

This trend is set to continue over the rest of Q3 as European storage sites are getting full and injection rates are naturally slowing down.

These dynamics are well-reflective of the growing liquidity of the global gas market and its ability to balance out changing regional supply-demand fundamentals.

Of course a colder Q4 could easily renew Europe’s appetite for LNG and spice up price volatility…

What is your view? How will LNG markets evolve through the rest of summer? Do you see any upside for European LNG imports?

Source: Greg Molnar (LinkedIn)