Global gas prices showed mixed movements last week, with Asian LNG strengthening to its highest level since early August, European prices whipsawing around weather and storage signals, and US Henry Hub surging mid-week before falling sharply on contract rollover.

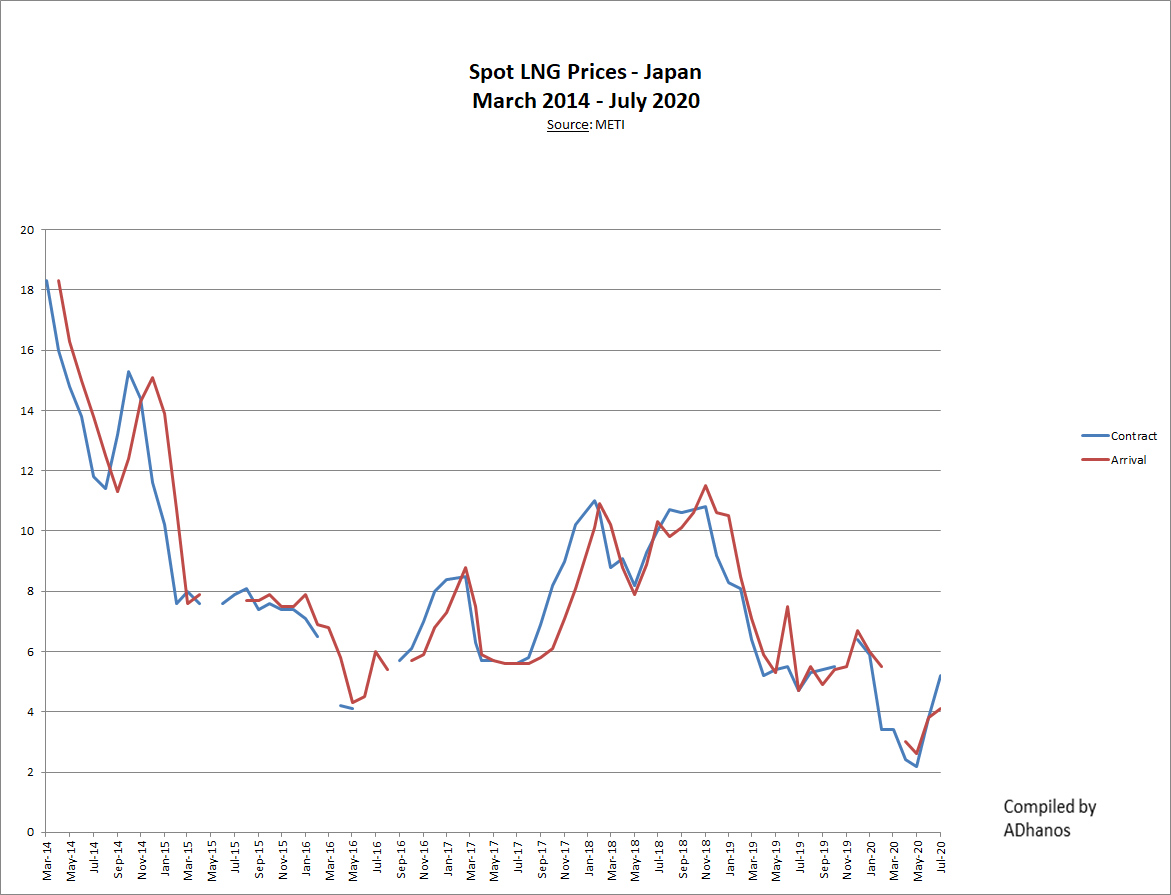

The Northeast Asian spot LNG benchmark JKM (March delivery) rose to the low-USD 12s/MMBtu on 30 January, up from the low-USD 11s/MMBtu the previous weekend (23 January). Prices initially climbed to the high-USD 11s/MMBtu on 26 January, supported by a surge in European and US gas prices during a cold snap. Although JKM softened on 27–28 January amid persistently weak Asian spot demand, sentiment turned bullish again as expectations grew that Asia-Pacific cargoes could be resold to Europe, tightening available supply. JKM subsequently strengthened to the high-USD 11s/MMBtu on 29 January and reached the low-USD 12s/MMBtu on 30 January — its highest level since early August — amid intensifying competition for cargoes destined for Europe. METI reported that Japan’s LNG inventories for power generation stood at 2.26 million tonnes as of 25 January, down 0.03 million tonnes week-on-week.

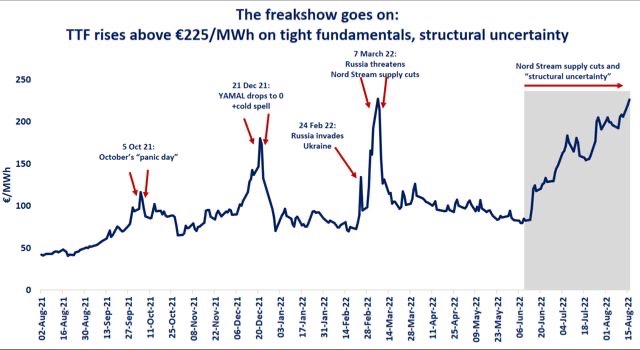

European TTF prices (March delivery) eased slightly to USD 13.7/MMBtu on 30 January from USD 13.8/MMBtu the previous weekend (23 January, February delivery). TTF initially fell to USD 13.6/MMBtu on 27 January on milder weather forecasts and slower storage withdrawals. Prices then rebounded on 28–29 January to USD 14.1/MMBtu as colder conditions were expected across Central and Eastern Europe and wind power generation in Germany and the UK was forecast to weaken. On 30 January, prices slipped back to USD 13.7/MMBtu as the contract rolled from February to March delivery. According to AGSI+, EU-wide gas storage stood at 41.6% on 30 January — down from 46.1% the previous weekend, 23.5% below last year, and 26.8% below the five-year average.

US Henry Hub prices (March delivery) fell to USD 4.4/MMBtu on 30 January from USD 5.3/MMBtu the previous weekend (23 January, February delivery). In the first half of the week, prices surged sharply on the back of elevated heating demand during a severe cold snap and production disruptions from freeze-offs, peaking at USD 7.5/MMBtu on 27 January — the highest level since the Ukraine-related gas crisis in 2022. On 29 January, prices plunged to USD 3.9/MMBtu as the contract rolled to March delivery, which was less exposed to the immediate cold impact. Henry Hub then rebounded to USD 4.4/MMBtu on 30 January as forecasts suggested the cold spell could extend into mid-February. The EIA reported US gas inventories at 2,823 Bcf as of 23 January — down 242 Bcf week-on-week, but still 7.9% above last year and 5.3% above the five-year average.

Updated 2 February 2026

Source: JOGMEC