China’s LNG imports increased for the seventh month in a row in August. The Asian country received 6.3 million tons of LNG, 34.1% higher compared to the same month last year, data released by China’s General Administration of Customs showed.

August’s growth rate was exceptionally high given that last year’s imports hit rock bottom due to Beijing‘s strict measures to control COVID-19. This figure is also higher than LNG imports in July, which stood at 5.86 million tons. It could be the result of fear of supply shortages because of the labor strike in Australia, which ended last week.

In 2022, China’s LNG imports significantly dropped by 20% year-on-year, reaching 63.44 million tons. This came after China surpassed Japan as the world’s top LNG importer in 2021, with imports reaching an all-time high of 79.3 million tons, representing 21.2% of the global LNG trade.

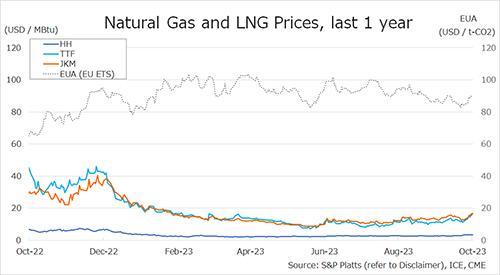

Last year’s sharp decline was the result of weak demand in China’s industrial sector amid COVID-19 control measures, and high spot LNG prices due to European appetite for LNG.

However, since the start of 2023, China’s economy has shown some early signs of demand growth for natural gas in the power generation, commercial and residential sectors. In February, China’s LNG imports saw the first monthly growth of 8.2% compared to the same period last year.

Lower LNG prices compared to the historical record highs of last year, and the recovery in industrial activity sustained a double-digit growth rate of LNG imports in the following months.

According to ship tracking data compiled by the EOA, China imported a total of 45.7 million tons of LNG from spot and long-term markets during the first eight months of this year, an uptick of 12.1% compared to the same period in 2022 (see chart).

The EOA’s early estimates match those of China’s customs data which showed that LNG imports totalled 45.5 million tons during this period. LNG imports so far in 2023, however, are still lower compared to the same period in 2021 when China imported 51.81 million tons of LNG (higher by 12%).