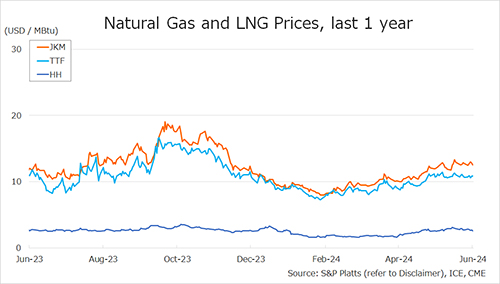

Henry Hub prices have just experienced one of their most violent intramonth sell-offs on record.

After surging by almost 65% since mid-January, the Henry Hub March contract plummeted by more than 25% yesterday — the steepest within-month decline for any futures contract since 1995.

There are several factors contributing to this near-record decline:

(1) Milder weather: After the big freeze in the second half of January, weather models suggest a return to milder temperatures which would moderate gas demand in the residential and commercial sectors;

(2) Freezing out: US dry gas production is recovering fast after the freeze-offs, with output up by nearly 20% since 26 January and now trending at near pre-storm levels of just over 110 bcf/d;

(3) Cross-commodity: The crash in silver and gold prices is transmitting to commodity markets, further amplifying price moves;

(4) Profit-taking: Similarly to TTF, it seems to be a good moment to dwindle down positions and cash in some hefty profits, especially when considering the bearish turn in physical fundamentals.

The next big market-moving event for Henry Hub prices will be the weekly EIA storage report, which is likely to show record storage withdrawals for last week… this could provide some temporary upside to prices, especially if the draws turn out to be above consensus levels. But any significant trend revision would now very much depend on weather.

What is your view? How will Henry move through the remainder of the heating season? Is it all about livin’ la vida loca now?

Source: Greg MOLNAR