A new supply wave of more than 200 mtpa of LNG is set to ramp up from 2025. North American LNG will play a key role, particularly US exports. Global LNG market share of North American supply is set to rise from 22% in 2023 to 34% by 2030 (volume growth of 116 mtpa).

The variable production cost of most of this North American liquefaction capacity is closely linked to the benchmark US Henry Hub price. This means a strong increase in the influence of the Henry Hub price signal on the global LNG market across the next 5 years.

What would the impact be on the LNG market if Henry Hub prices increased substantially?

Aside from a brief surge during the 2022 energy crisis, Henry Hub (HH) prices have been stubbornly stuck in a 1 – 4 $/mmbtu range. The driver of this is relatively simple: price responsive, short investment cycle shale production.

Prices could remain in this range for a long time to come. Production response across the last 10 years has been impressive in dampening any attempts at a structural increase in price levels.

However extended periods of low market volatility can breed complacency. There are 3 key supply side risks that could cause HH prices to break out of this range and materially increase across the next 5 -10 years:

There is also the risk of a material increase in US gas demand, e.g. from datacenter load growth which draws on gas-fired power.

If the US sneezes does the world catch a cold?

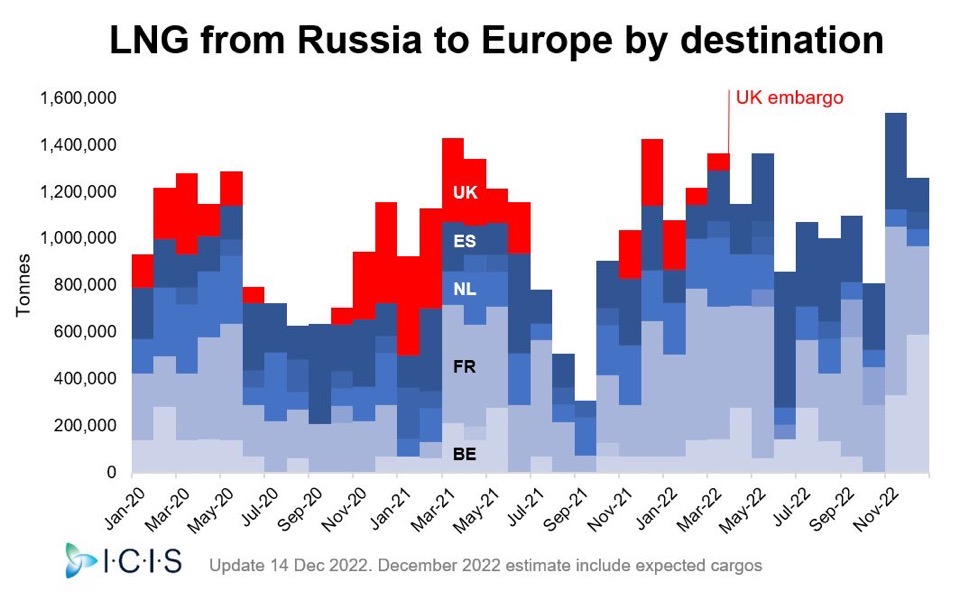

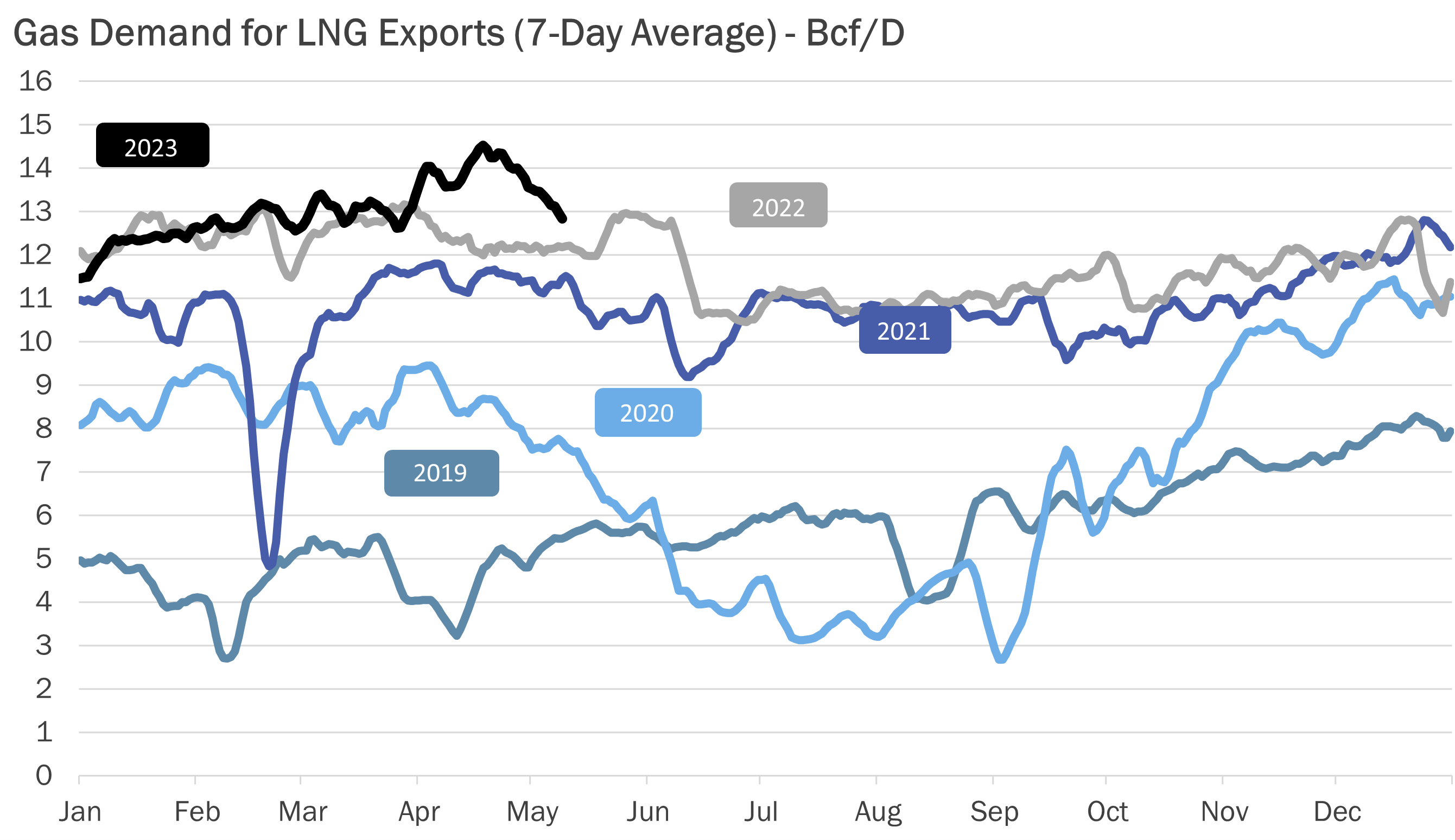

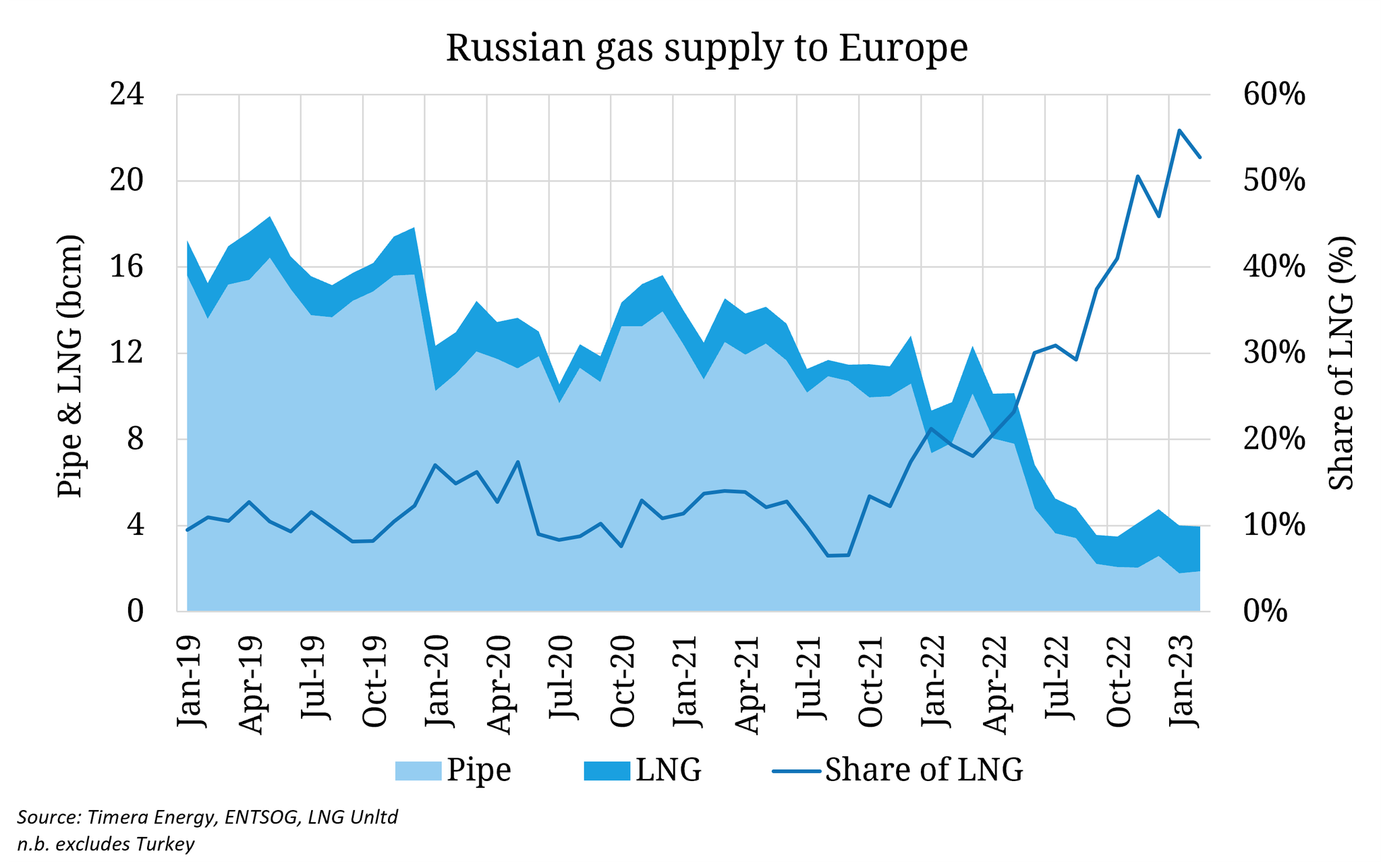

LNG market prices in Europe & Asia have diverged from US HH prices since 2020, given a tight LNG market regime resulting from Russian supply cuts and a resulting surge in European LNG demand.

That is set to change from 2026 as the new supply wave ramps up in earnest, with European and Asian prices likely to converge towards US HH levels. As the LNG market shifts towards an oversupplied regime, HH prices play a key ‘soft floor’ support role.

If US netback LNG prices decline below the variable production cost of export terminals, there are huge volumes of cargo cancellation potential (as liquefaction capacity is ‘shut in’ and export gas volumes sold back into the domestic market).

Chart 1 is based on results from our global LNG market fundamental model. It shows global LNG supply & demand curves (including the European gas market). The large volumes of US cargo cancellation flex are represented by the long blue section of the LNG market supply curve in the chart.

Chart 1: Impact of HH price rise on global LNG market pricing. Source: Timera global gas market model

The grey dashed line shows a sensitivity where HH prices rise. This is part of a detailed case study we analyse in our Q2 Global Gas Report (part of our quarterly gas subscription service – reach out for a free sample copy if you’re interested).

Here are 5 key takeaways on pricing dynamics that come from our modelling of the impact of a rise in HH prices:

The most immediate commercial impact of the new supply wave is a sharp increase in LNG portfolio exposures to HH prices. This happens in two main ways:

From an LNG market perspective, the US gas market has been a sideshow for most of the last decade. Over the next two years it is going to transition to centre stage.

Source: Timera Energy