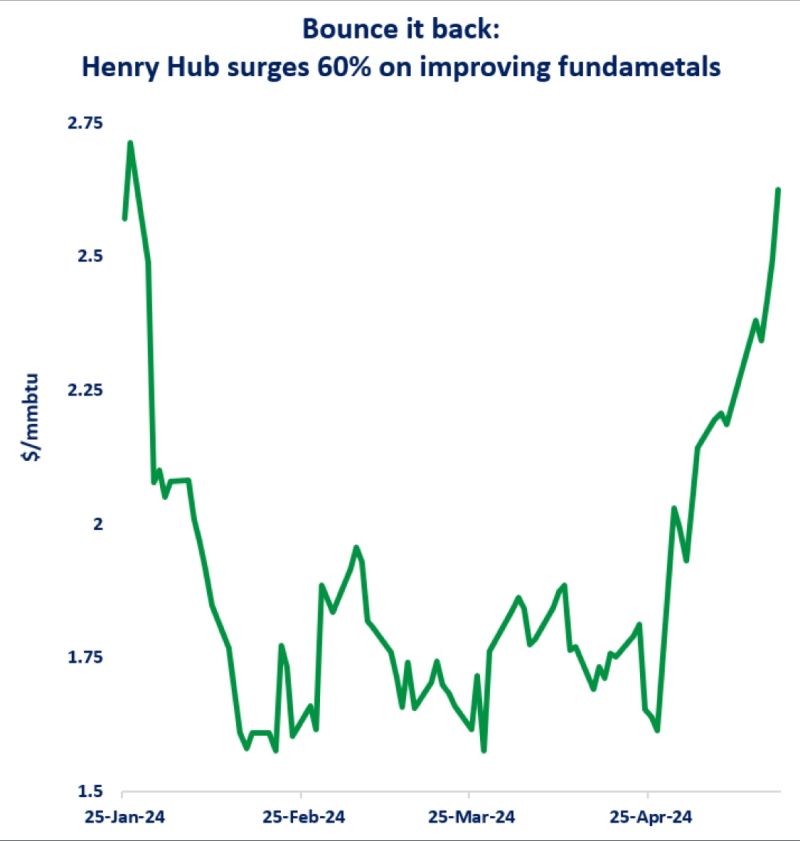

After plummeting to decade lows in March and April, Henry Hub prices surged by 60% since end of April amidst tighter supply fundamentals.

The key drivers behind this strong growth are:

(1) Production cuts: Appalachia dray gas suppliers started reducing their output when Henry Hub dipped below $2/mmbtu. overall US gas production drooped by 1% yoy since March;

(2) Stronger gas burn: gas-fired power generation rose by 6% yoy since the start of the year, providing a key outlet for surplus gas;

(3) Mexico’s gas thirst: exports to Mexico rose by a strong 10% yoy since the start of the year, primarily supported by higher gas-fired powgen and the continued decline in domestic production;

(4) Rising LNG feedgas flows: Freeport LNG is back at full speed with all three trains up and running after several months of maintenance and outages;

(5) Getting hotter: latest forecasts indicate more cooling demand over the summer months, which adds to the overall bullish mix.

Source: Greg Molnar