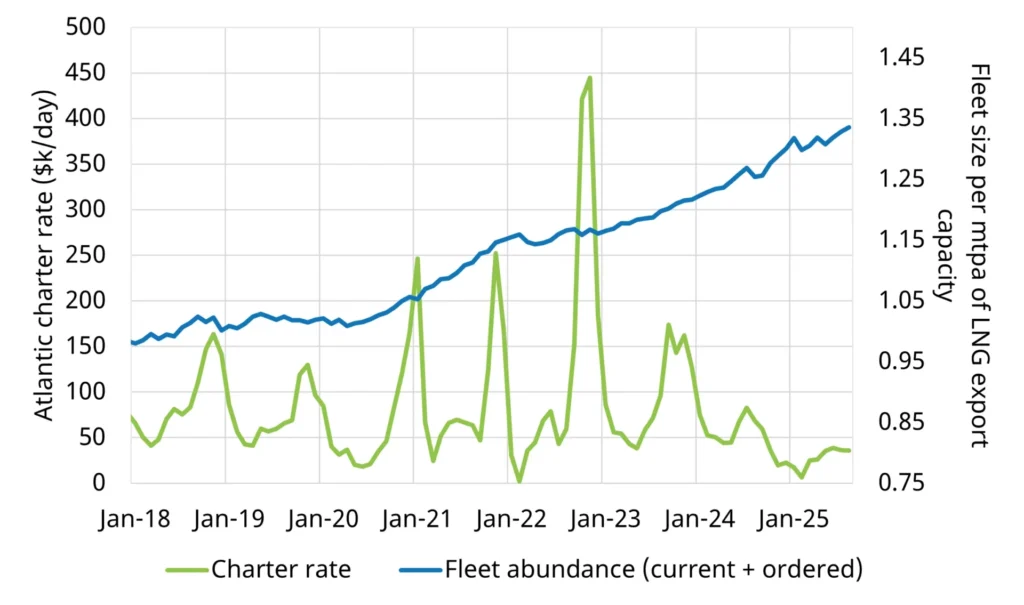

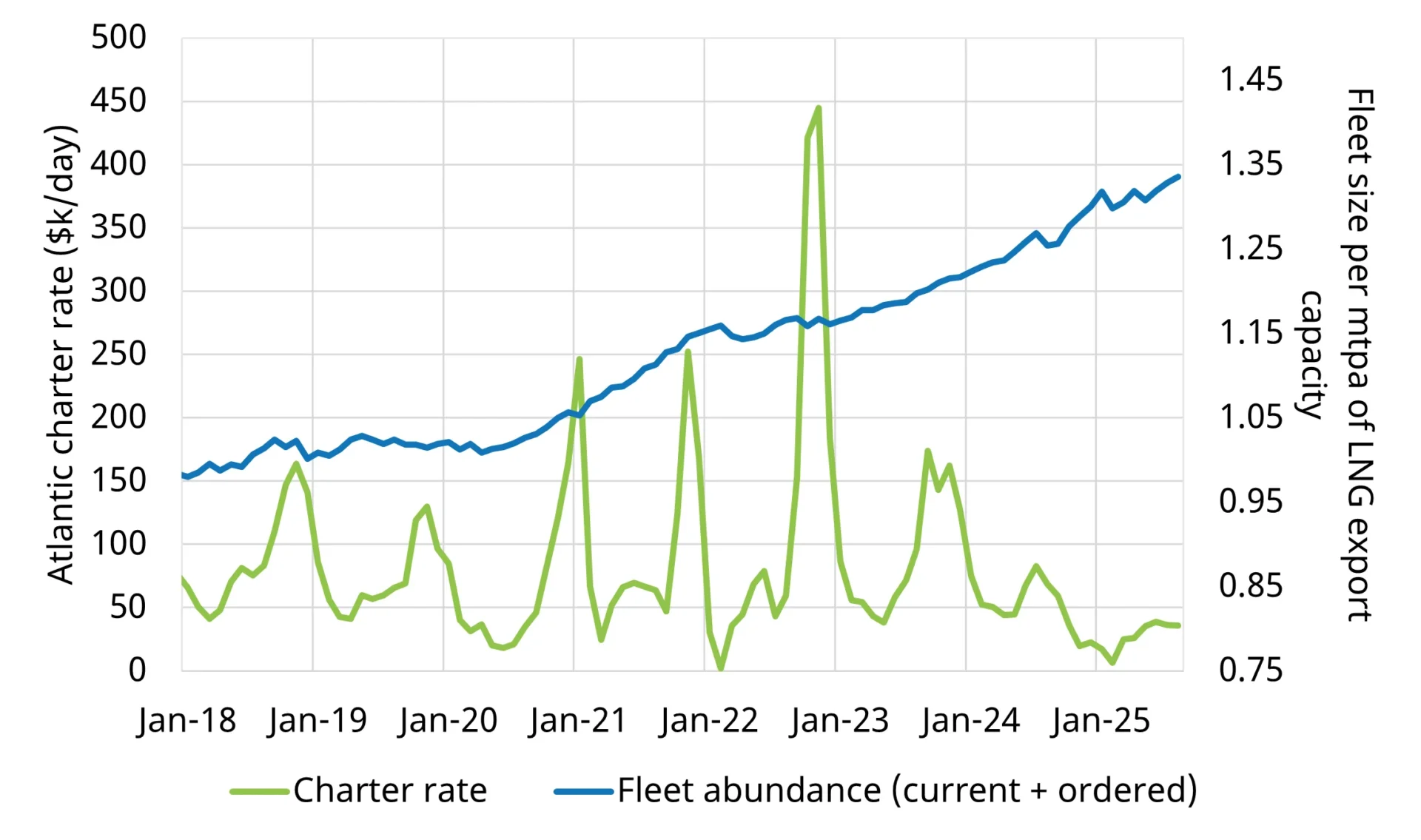

Timera explains why LNG charter rates collapsed to record lows in 2025—an overhang of newbuilds, project delays, and shorter average voyages—and how/when rates could recover as the supply wave ramps.

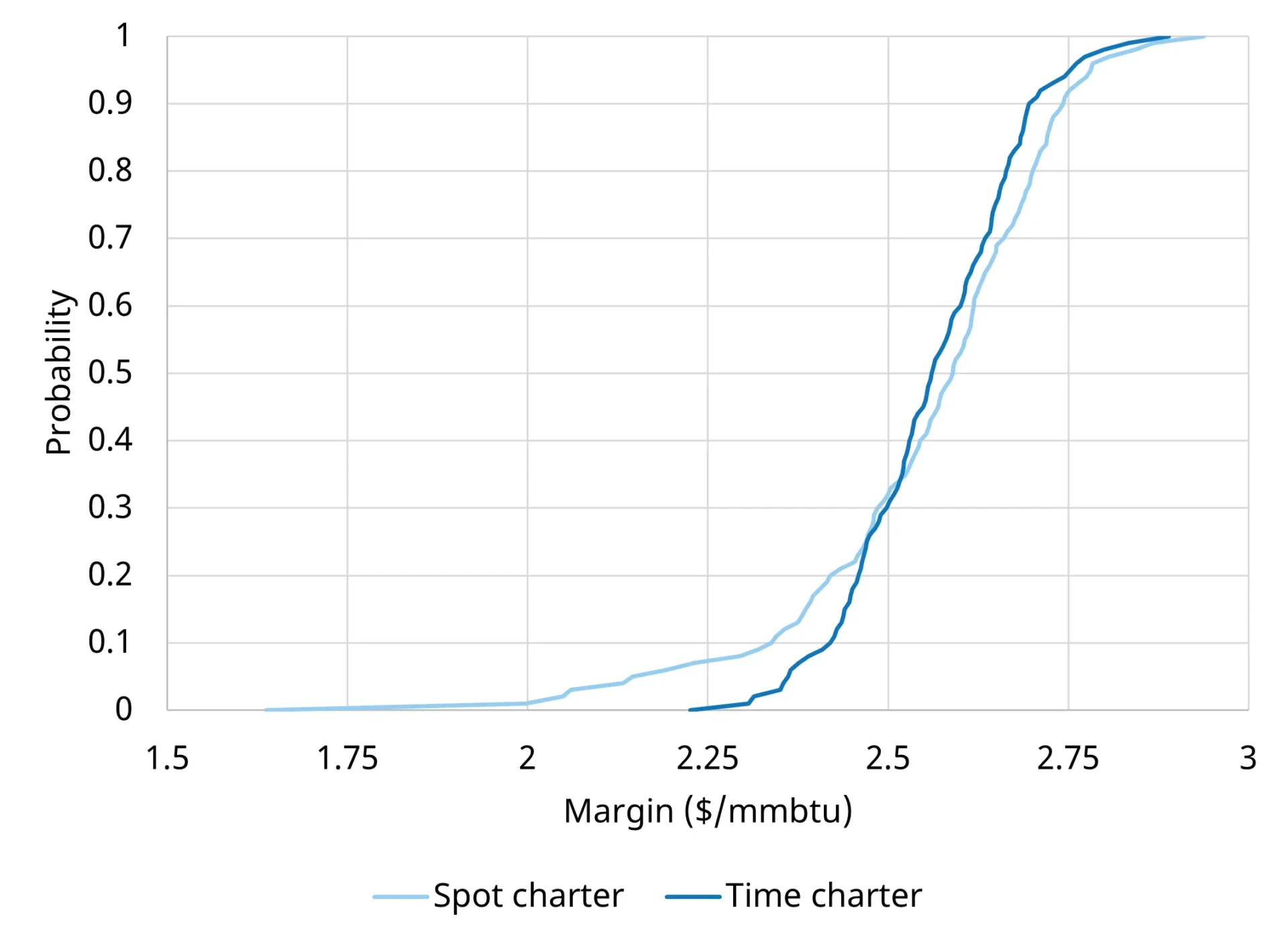

They also show, via a portfolio case study, how fixing a time charter tightens margin variance and protects downside versus full spot exposure.

Freight is currently a value lever: in a weak spot market, locking in a time charter can reduce downside risk—at the cost of some expected value—before tightening later this decade as voyage lengths rise and new LNG volumes absorb spare tonnage

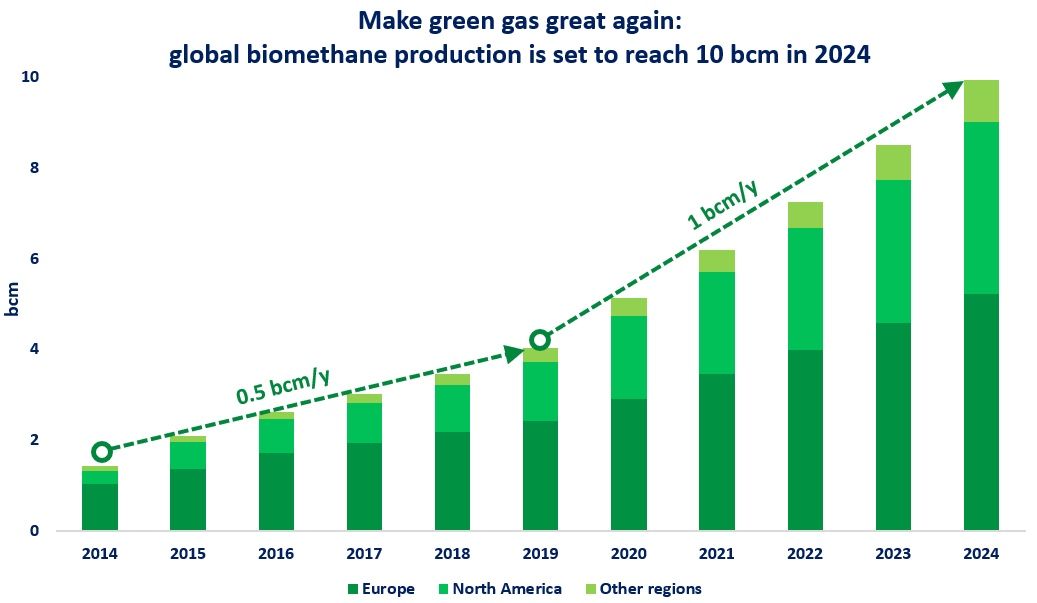

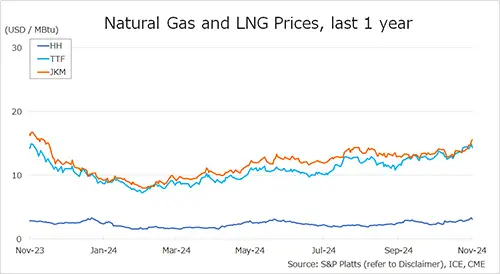

Chart 1: Atlantic charter rates vs fleet abundance

Chart source: Timera Energy, Spark Commodities, LNG Unlimited

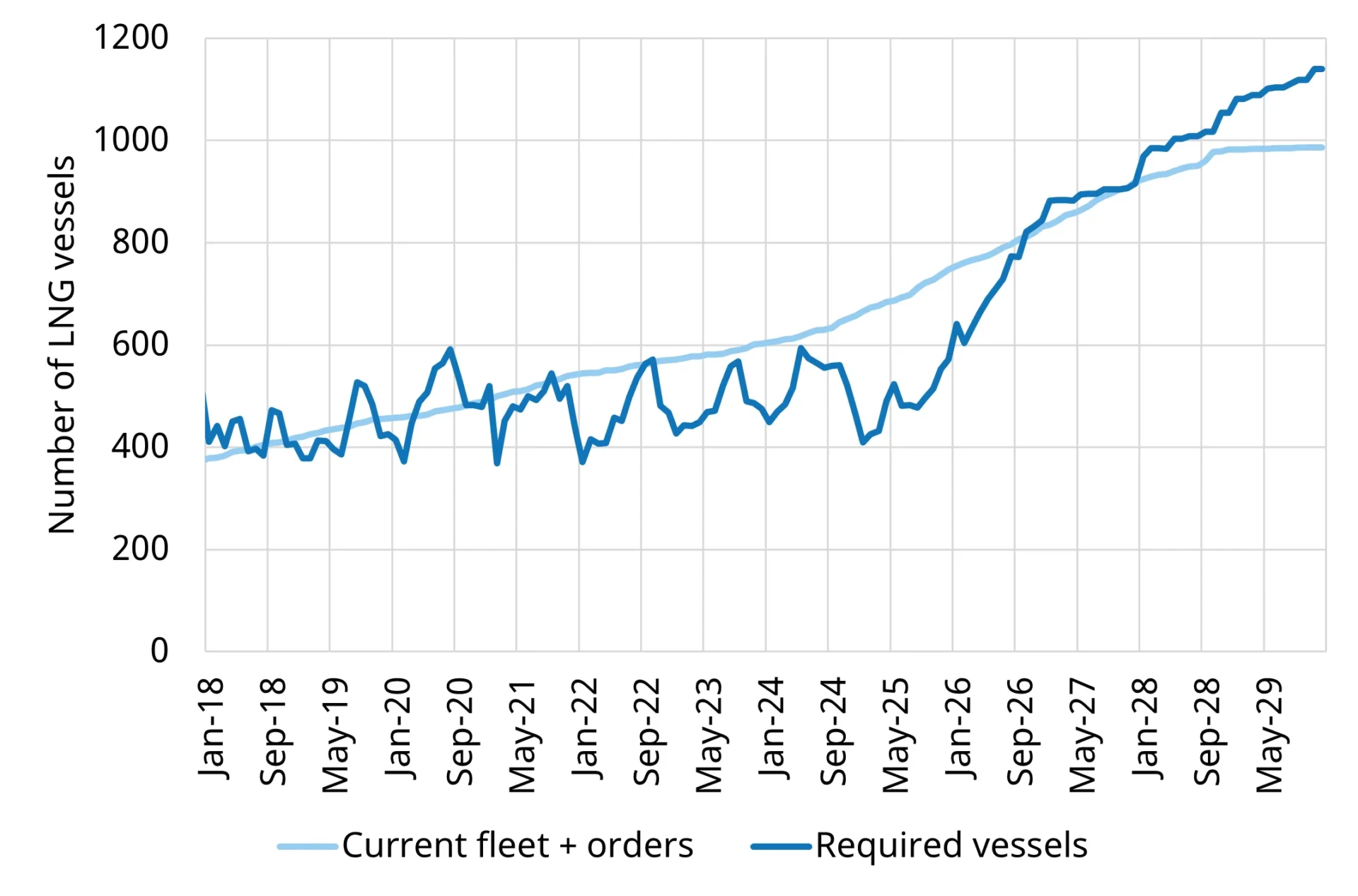

Chart 2: LNG shipping balance — fleet vs required vessels

Chart source: Timera Energy, LNG Unlimited

Chart 3: Portfolio margin distributions — spot exposure vs term charter

Chart source: LNG Bridge portfolio valuation model

Read the full analysis for charts on fleet abundance vs. rates and a simulated margin distribution at Timera Energy