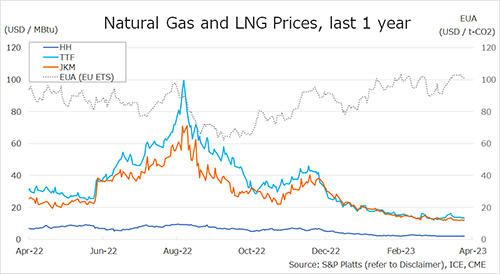

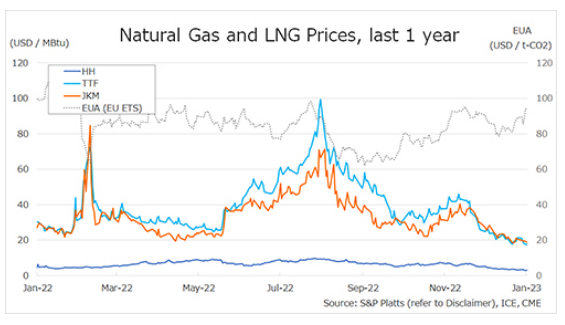

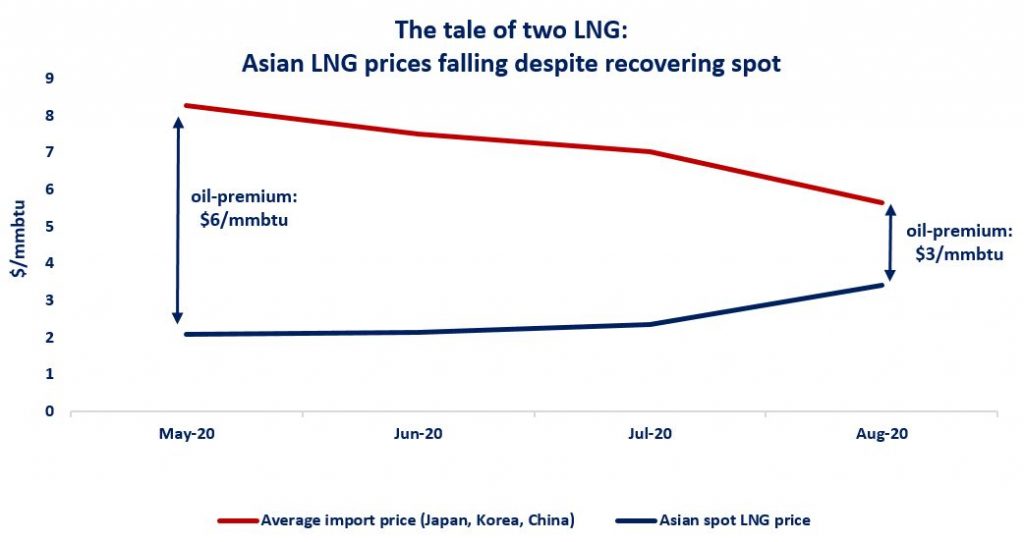

(Greg Molnar) Despite JKM recovering by 40% in August, the average Asian LNG import price fell by almost 20% month-on-month, as the lower crude prices continue to filter through the price structure of LTCs.

This highlights at least two points:

(1) the prevalence of oil-indexation in Asian LNG import contracts;

(2) the growing tension between market fundamentals (driving JKM) and the regime of oil-indexation.

Taking into consideration the current forward curve, the oil-premium could fall from an astonishing $5/mmbtu through this year to $1/mmbtu this winter.

This does not overwrite the second issue point: oil-indexation is increasingly failing to reflect market fundamentals and hinders the right market reaction and the right time.

What is your view?

Will the current price environment favour oil-indexation? What will be the impact on spot this winter? Could TTF and JKM emerge as an alternative?

Connect with Greg & see original post on LinkedIn