Natural gas prices came back late in the day yesterday as they fought to resist a further collapse.

The February contract is testing the $2.50- mark again today in a 2.25% decrease to $2.485/MMBtu, and it will be important to watch where the front month ends the trading day to determine if it can avoid a clean break through this psychological support. Further out in 2021, contracts in late summer and early fall have backfilled a gap that was left by traders as prices surged into the new year. So far, these levels are providing a backstop and preventing a crash back to late December’s lows.

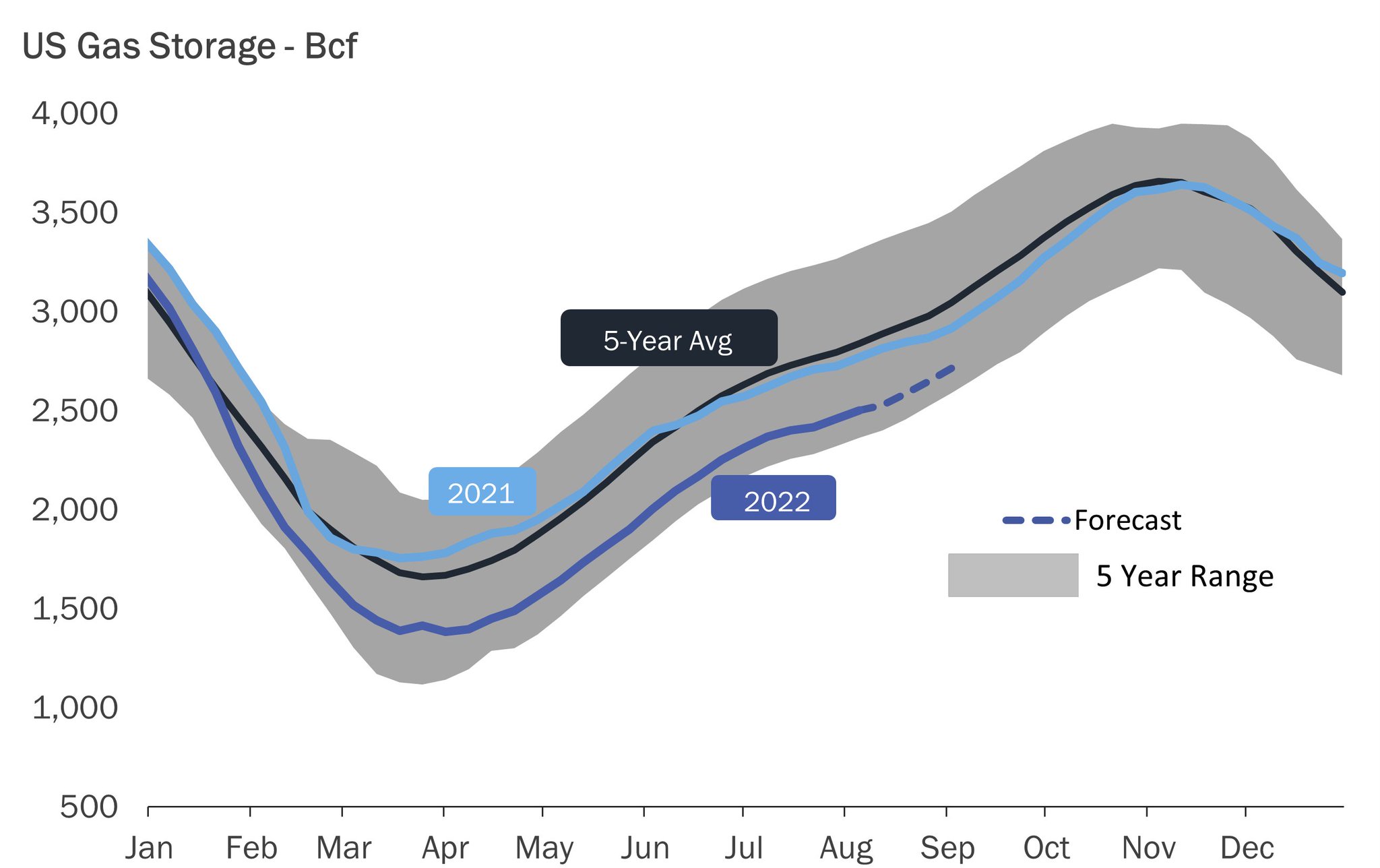

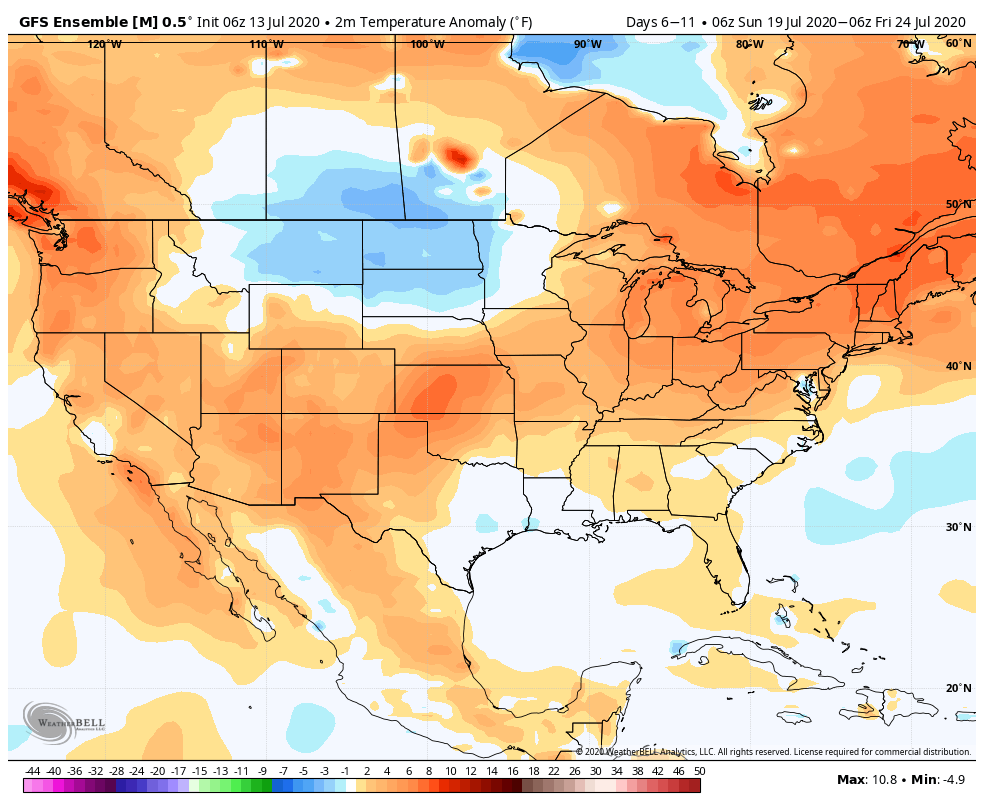

This week’s EIA storage report will come out tomorrow due to Monday’s holiday and may provide the market some brief positivity if it can deliver a larger than average withdrawal as expected. However, mild weather in the current week has hindered demand and will be evident in a much smaller withdrawal by next week’s report. Additionally, weather models continue to confirm the outlook for a warmer than normal start to February, centered in the middle of the country and extending to the east.

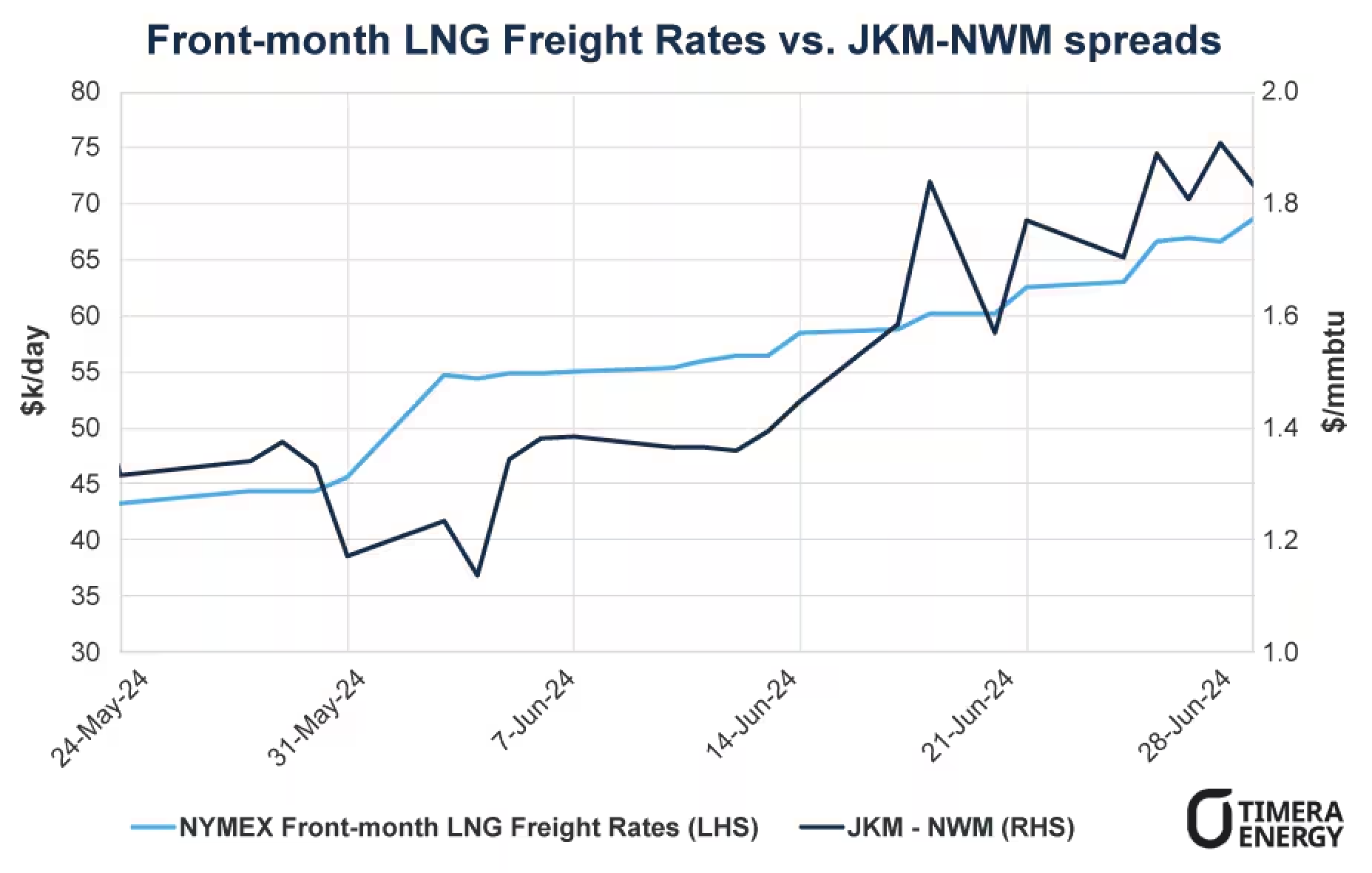

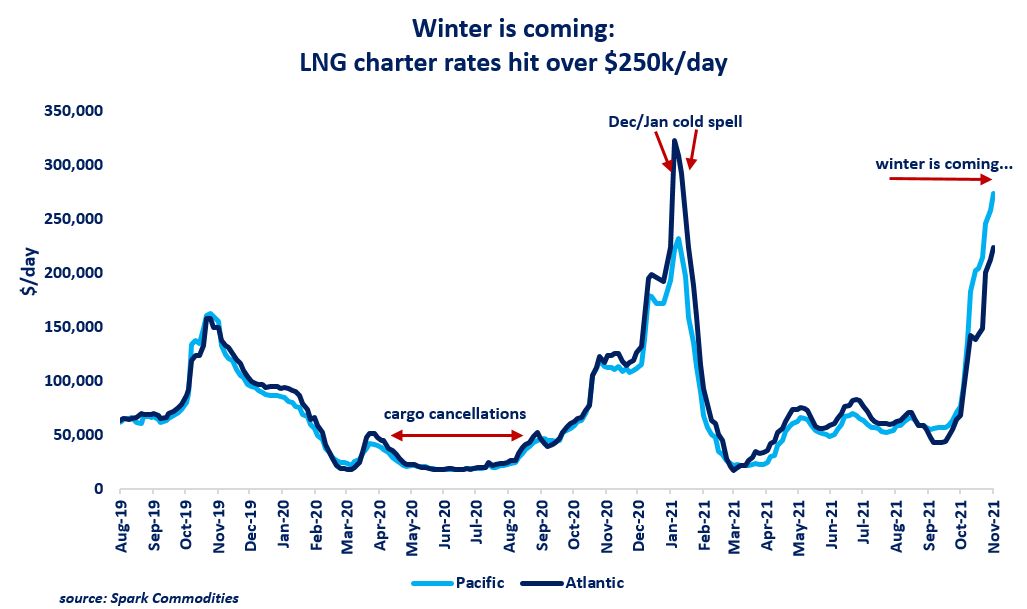

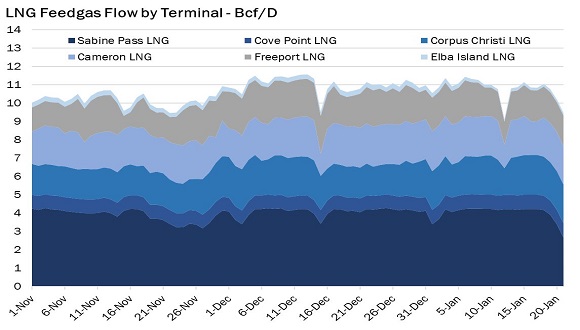

On the fundamental side, LNG feedgas flows have fallen off in recent days and are estimated near 9.5 Bcf today, mainly on a drop at Sabine Pass. It is unclear what is causing this decrease, but reports of dense sea fog along the Gulf Coast and maintenance at nearby compressor stations have been suggested by various sources.

Source: Gelber & Associates

Follow on Twitter:

[tfws username=”GelberCorp” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]