LNG liquefaction capacity additions are set to dry up in the coming years, just at a time when Europe eyes for boosting its LNG imports to diversify away of Russia.

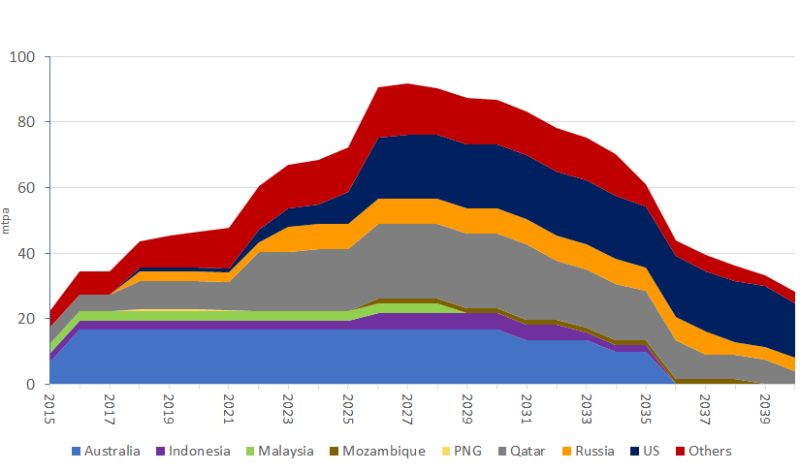

LNG liquefaction capacity additions averaged at ~40 bcm/y between 2016 and 2020, largely supported by Australia, the US and the YAMAL LNG project in Russia.

Altogether close to 200 bcm of liquefaction capacity has been added over this period, providing strong downward pressure on gas prices both in Europe and northeast Asia.

But LNG projects are now drying up: to an average of just 15 bcm/y between 2021 and 2024, with some

significant downside risks, especially when Russia’s Arctic LNG 2 project is considered.

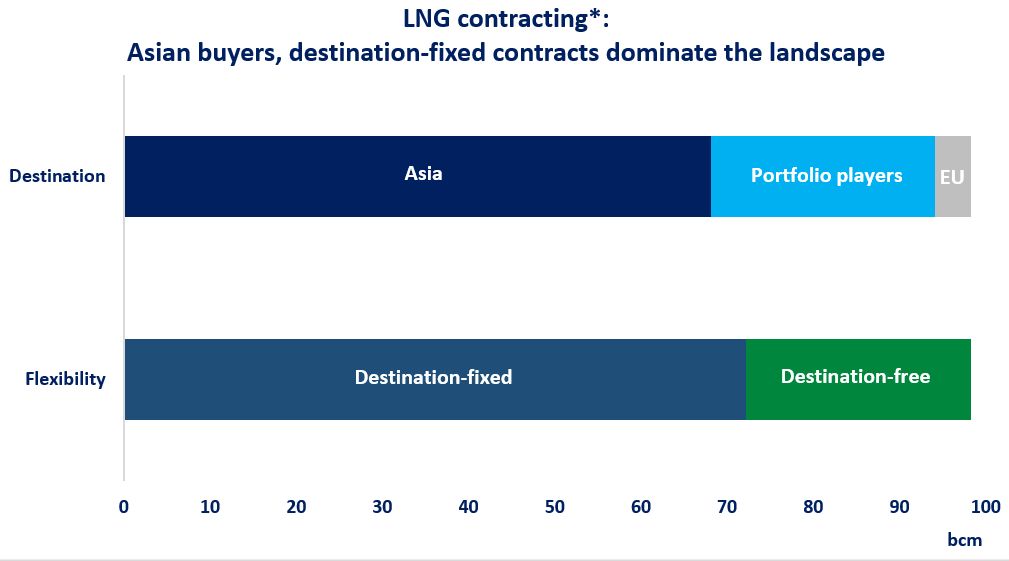

Add to this picture the uncertainty around Russian gas supply and Europe’s strong drive to ramp-up its LNG imports.

The result is likely a prolonged period of market tightness and fierce competition for each and every drop of LNG.

The good news is, that LNG supply additions are not necessarily equal to LNG capacity additions: higher utilisation rates could be reached at a number of plants by debottlenecking infrastructure, solving upstream supply issues and have a better utilisation of natural gas (via reducing gas flaring/methane leaks).

It won’t solve alone the issue of market tightness, but would bring some relief to the market while waiting for Qatar and the next LNG mega-wave starting in 2025/26.

What is your view? What is the outlook for LNG and gas markets in the coming years? Will Europe emerge as a premium market? What are the short-term options to scale-up LNG availability?

Source: Greg Molnar (LinkedIn)