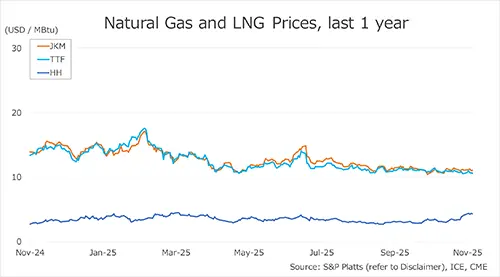

Spot LNG and gas benchmarks showed mixed movements over the week of 3–7 November, with Northeast Asian JKM largely unchanged, European TTF nudging higher and U.S. Henry Hub extending its recent gains.

In Northeast Asia, the JKM spot LNG marker for December delivery held in the low USD 11s/MBtu range, ending 7 November at roughly the same level as the previous weekend. Ample supply and a sluggish start to winter demand kept buying interest muted. JKM posted small increases for three consecutive sessions between 3 and 5 November as temperatures dipped, but spot demand failed to strengthen and the price retraced on 6 November, returning to its earlier level. Japan’s Ministry of Economy, Trade and Industry (METI) reported that LNG inventories for power generation stood at 1.98 million tonnes as of 2 November, up 0.02 million tonnes week-on-week.

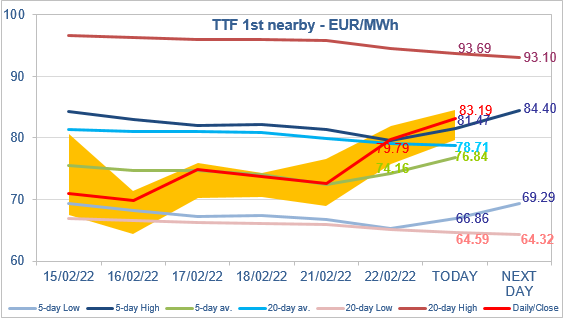

In Europe, the TTF December contract edged higher to around USD 10.6/MBtu on 7 November, compared with USD 10.5/MBtu on 31 October. Prices briefly touched USD 11.0/MBtu on 4 November on expectations of lower wind power generation, but the rally faded and TTF traded in a narrow band later in the week amid warm weather forecasts and stable Norwegian pipeline flows. According to AGSI+, EU underground gas storage was 82.7% full on 7 November, slightly down from 82.8% a week earlier, 12.5% below the same period last year and 9.2% below the five-year average.

In the United States, Henry Hub December futures rose to around USD 4.3/MBtu on 7 November from USD 4.1/MBtu at the previous weekend. Prices climbed to roughly USD 4.3/MBtu on 4 November on the back of cooler weather forecasts and higher feed-gas flows into LNG export terminals, and moved towards USD 4.4/MBtu by 6 November. The EIA’s Weekly Natural Gas Storage Report showed U.S. working gas inventories at 3,915 Bcf as of 31 October, an increase of 33 Bcf on the week, 0.2% below the year-earlier level and 4.3% above the five-year average.

Updated: 10 November 2025

Source: JOGMEC