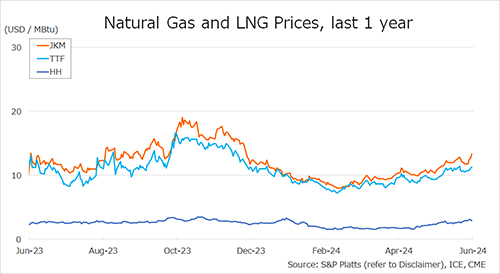

The Northeast Asian assessed spot LNG price JKM for last week (10 June – 14 June) rose to high-USD 12s on 14 June from high-USD 11s the previous weekend (7 June).

The price rose to middle-USD 13s on June 13 due to supply concerns from the shutdown of the Wheatstone gas facility in Australia and higher summer demand but fell to high-USD 12s due to daily price increases.

METI announced on 12 June that Japan’s LNG inventories for power generation as of 9 June stood at 2.10 million tonnes, down 0.13 million tonnes from the previous week.

The European gas price TTF for last week rose to USD 11.1/MBtu on 14 June from USD 10.6/MBtu the previous weekend (7 June).

It rose to USD 11.4/MBtu midweek on the back of higher JKM prices and forecasts for cooler temperatures in Europe but fell to USD 11.1/MBtu on weak fundamentals due to firm inventory levels and below-average seasonal temperature forecasts.

According to AGSI+, the EU-wide underground gas storage increased to 72.9% as of 14 June from 71.3% the previous weekend.

The U.S. gas price HH for last week almost unchanged at USD 2.9/MBtu on 14 June from USD 2.6/MBtu the previous weekend (7 June). The price rose to USD 3.1/MBtu on June 11 on the back of higher demand for natural gas for power generation but fell to USD 2.9/MBtu on June 14 on the back of firm inventory levels indicated by the EIA.

The EIA Weekly Natural Gas Storage Report released on 13 June showed U.S. natural gas inventories as of 7 June at 2,974 Bcf, up 74 Bcf from the previous week, up 13.9% from the same period last year, and 23.9% increase over the five-year average.

Updated: June 17

Source: JOGMEC